Top 10 Investment Themes for 2026

Happy New Year, everyone! As you may recall, our overall macro theme for 2025 was “Growth Opportunities Ahead.” The theme ultimately proved to be accurate, as the current bull market run celebrated its 3-year anniversary in October 2025 and the breadth of the rally extended beyond the “Magnificent 7” stocks (Nvidia, Apple, Microsoft, Amazon.com, Alphabet, Tesla, and Meta Platforms). As a point of reference, the “Magnificent 7” accounted for 62% of the total return of the S&P 500 index in 2023, 54% in 2024, and “just” 44% in 2025 as of December 9, 2025. Yes, these stocks still play an important leadership role within the stock market and have a significant impact on the psyche of investors, but thematic areas such as artificial intelligence (AI) infrastructure investment, power, aerospace & defense, healthcare (notably biotech), and international equities (both developed and emerging) delivered even more impressive returns to their investors. As it relates to those fearful that the current bull market run is a little “long in the tooth” and due for a pullback, we provide this historical perspective. According to research from Creative Planning, looking back over the past 50 years, the five previous bull markets that reached their third anniversary all continued to climb, with the shortest lasting 5 years, the average lasting 8 years, and two bull market runs lasting double-digit years. Of course, past performance is not indicative of future results, and this time could be different.

While the stock market, as measured by the S&P 500 index, provided strong double-digit returns in 2025 (the third year of double-digit returns), it did not start out looking so promising, largely due to the “tariffs tantrum” that resulted from President Trump’s initial tariffs announcement in April, which caught many investors by surprise in terms of their severity and reach. However, the tantrum was short-lived. Consider that, as of April 8, the S&P 500 was down 14.99% year-to-date; however, it has since rebounded by 38.45% from April 8 to December 9, 2025. Let this time period in 2025 serve yet another example of the potential dangers of trying to time the market and how time in the market, consistent with one’s risk tolerance, investment timeframe, and objectives, is often most important over the long term.

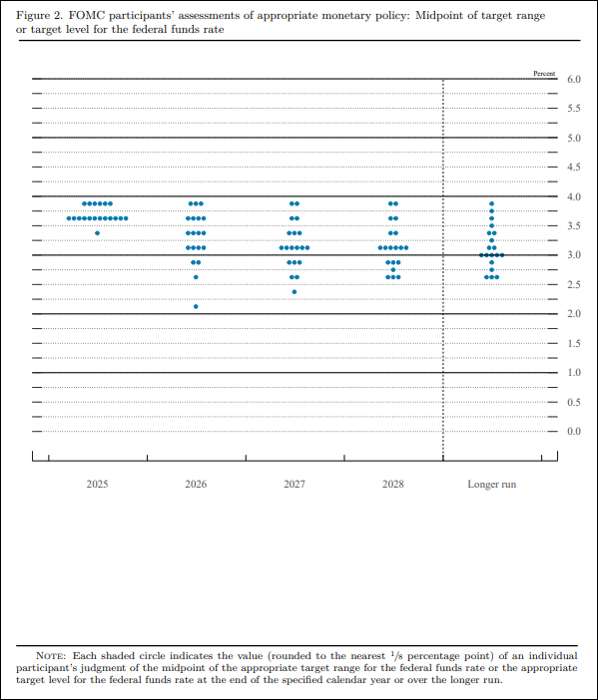

The Federal Reserve (“Fed”) was also on the minds of many investors in 2025. On December 10, as widely expected, the Fed cut interest rates by 25 Bp by a vote of 10-3, the third such cut of 2025, bringing the Federal Funds Target Rate within a range of 3.50%-3.75%. The Federal Reserve’s new Dot Plot chart, released on December 10, also indicated one additional 25-basis-point cut in 2026 and one more 25-basis-point cut in 2027, which, when combined, would bring the Fed Funds Target Rate to its stated neutral rate of 3%. Commentary from current Fed Chair Jay Powell after the December meeting was in line with the “hawkish cut” narrative that dominated the headlines leading into the final FOMC meeting of the year, as Powell stated, “We haven’t made any decisions about January,” and “we are well positioned to wait and see how the economy evolves.” However, it should be noted that Chair Powell’s tenure as Fed Chair is coming to an end in May 2026, and the new President Trump-appointed Fed Chair will likely be more dovish and in favor of additional rate cuts.

As we look ahead to the new year, we believe that the bull market will also celebrate its four-year anniversary. However, there will likely be more short-term bouts of volatility, and certain areas of the market associated with large, anticipated spending amounts are likely to provide better performance. In contrast, other areas of the market that are more overvalued are likely to experience more downside pressure. As a result, we see the theme for 2026 as “Follow the Money”

Here are our “Top 10 Investment Themes for 2026” for your review and consideration.

1. Heightened Demand for Power Solutions – According to Pew Research, U.S. data centers consumed 183 terawatt hours (TWh) of electricity, accounting for approximately 4% of total U.S. electricity use in 2024, roughly equivalent to the annual electricity demand of the entire nation of Pakistan. However, U.S. data center energy consumption is forecasted to increase by 133% to 426 TWh by 2030. Electricity is already stretched in the U.S., and the U.S. electricity grid is antiquated and unreliable. As a result, the data centers that serve as the nervous system of the AI ecosystem will need to look beyond traditional energy sources to alternative sources, such as natural gas and nuclear energy, to help provide the massive amount of power they require. Regarding natural gas, S&P Global Ratings estimates that the increasing energy demands of U.S. data centers will result in additional gas demand of between 3 billion and 6 billion cubic feet per day by 2030. In relation to nuclear energy, Goldman Sachs believes that the U.S. and globally are in the early stages of a nuclear renaissance, driven by data center power demand, particularly in the form of small modular reactors (SMRs) and larger-scale nuclear power plants, and Deloitte suggests that new nuclear capacity could fulfill approximately 10% of the projected increase in data center demand by 2035. Companies that provide products or services in these areas stand to benefit from the anticipated demand and associated spending on viable power solutions.

2. AI Infrastructure Boom Continues In terms of where we are in the timeline of the artificial intelligence (AI) revolution, I contend that we are still merely in batting practice of a double-header with so much more planned infrastructure development spending to take place during batting practice before the transformative applications of AI ultimately take place in later years during the double-header of games. In this regard, Nvidia CEO Jensen Huang stated on August 28, 2025, that “A new industrial revolution has started. The AI race is on,” and “We see $3 trillion to $4 trillion in AI infrastructure spend by the end of the decade.” AI infrastructure investment opportunities associated with this spending can be found in other areas within the AI ecosystem, beyond semiconductors/chips, including, but not limited to, data center construction, electrical connectivity, power, and cooling solutions.

3. Global Defense and Security Upgrades – In the evolving new world order, countries and regions across the globe, including the United States, are committing to spending billions of dollars to replenish, upgrade, and modernize their respective national defense and security abilities. For example, NATO allies agreed at the 2025 Hague Summit to invest 5% of their gross domestic product (GDP) annually in defense and security by 2035, split into 3.5% for core military needs and 1.5% for other related security areas, such as cyber and infrastructure. Within the U.S., the current defense spending plan for Fiscal Year 2026 totals a record potential authorization of more than $900 billion, focused on areas such as nuclear modernization, conventional and hypersonic munitions, AI, space, and autonomous systems, including drones. Companies that play a pivotal role in areas such as enhancing military readiness, advancing missile defense systems, and driving technological innovation in autonomous and defense technologies stand to benefit from the increases in investment and spending in these areas.

4. Small Cap Biotech M&A Tailwinds – Johnson & Johnson kicked off 2025 M&A activity with its high-profile $14.6 billion acquisition of neuro company Intra-Cellular Therapies in January. M&A activity then slowed until mid-year, when the pace of acquisitions accelerated. According to AlphaSense, the cumulative year-to-date value of biotech deals in 2025, as of October 10th, has already surpassed the total from all of 2024. We believe that the momentum in biotech M&A activity will continue into 2026. Large-cap pharmaceutical companies face multiple headwinds as they continue to have their profit margins pressured by Washington, D.C. ‘s push to lower drug prices and possess larger revenue-producing drugs that have come off patent or are scheduled to lose patent protection and be challenged by lower generic drug prices. With respect to the looming patent cliff, over 200 drugs are set to lose their patent protection in the coming years, including at least 69 blockbuster drugs with annual sales exceeding $1 billion each, with a cumulative overall loss in sales projected to exceed $300 billion, according to AlphaSense.

One answer to the revenue quandary of large cap pharmaceutical companies can be found in the innovative healthcare solutions being developed by smaller-cap biotech firms. These innovative healthcare solutions, which are now enhanced by artificial intelligence developments in certain cases, include, but are not limited to, gene therapies, RNA therapeutics, precision and targeted oncology treatments, and obesity drugs such as GLP-1. Investors thus need to find those smaller-cap biotech companies (which may also help those investors looking to add small-cap exposure in 2026) with existing breakthroughs or innovative drugs in the FDA approval pipeline that large-cap pharmaceutical companies desire to add to their platforms, thereby having the greatest chance of being acquired. Identifying companies with related drugs in Phase II or Phase III of the FDA approval process is a good starting point for finding potential investment opportunities.

5. Position for Modest Rate Cuts and Modest Economic Growth – As widely expected, the Federal Reserve cut interest rates by 25 Bp in December, the third such cut of 2025, bringing the Federal Funds Target Rate within a range of 3.50%-3.75%. According to their updated Dot Plot chart (see below), the Fed is currently forecasting just one 25-basis-point rate cut in 2026 and another 25-basis-point rate cut in 2027, which, when combined, would bring the Fed Funds Target Rate to its stated neutral rate of 3%. In its Summary of Economic Projections, released on December 10, the Federal Reserve also updated its forecast for real GDP growth to 2.3% in 2026. Hence, investors should not be looking to the Fed for answers in 2026 or expect too many additional rate cuts. Investors should also consider positioning their portfolios for modest economic growth, though not stellar, associated with moderating inflationary pressures. These areas may include, but are not limited to, certain sectors of equities, such as Health Care, Information Technology, Financials, Communication Services, and Consumer Discretionary, as well as bonds of different credit qualities, with an overweighting towards investment-grade.

Source: Federal Reserve, December 10, 2025

6. Expect More Short-Term Bouts of Volatility in 2026 – in 2025, as of December 12, there were only 35 days where the S&P 500 Index moved by more than 1.5% in a given trading day – and 20 of those 35 days were positive moves! This amount translates to just 6% of the trading days involving a downside move of 1.5% or more, marking the second consecutive year of low overall volatility. The S&P 500 also experienced 40 record closes in 2025, as of December 12, following 57 such record closes in 2024. As a result, certain valuations with the stock market are stretched, and smaller-scale corrections and increased volatility are both possible in the months ahead. The expiration of the temporary government funding stopgap measure, mid-term elections, a new Federal Reserve Chair, tariffs uncertainties, and lingering “AI/technology bubble” concerns are all potential catalysts for heightened levels of volatility. However, the potential for more volatility in 2026 does not mean that investors should try to time the market, as timing the market is often an exercise in futility, and “staying on the sidelines” for too long can have a negative impact on achieving longer-term financial goals. Rather, a more balanced approach towards stock market positioning, perhaps through equal-weighted strategies, covered calls, or more defensive stocks, may be worthy of consideration for certain investors and/or portions of their overall portfolios.

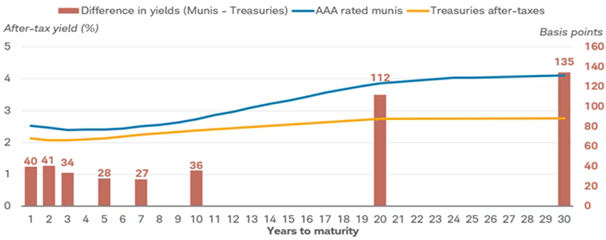

7. Municipal Bond Strength Despite Expected Record Issuance – Tax free income is always attractive to income-oriented investors, particularly investors in higher tax brackets. We anticipate this level of attraction, and the associated demand for municipal bonds, to continue through 2026, as investors seek attractive tax-adjusted yields and solid credit quality. Continued demand will be critical, as municipal bond issuance is expected to remain high, potentially exceeding $600 billion, according to Bloomberg, as issuers fund ongoing infrastructure projects and address higher costs. As it relates to yields, while short-term yields are forecasted to move lower (as previously discussed), longer-term yields are not expected to move significantly, making longer-duration bonds more appealing. Currently, the difference in yields between longer-term municipal bonds and U.S. Treasuries after taxes is higher for longer-term municipal bonds than it is for short-term municipal bonds. For example, based on the chart below, an index of two-year AAA-rated municipal bond yields 42 basis points more than a two-year Treasury after factoring in taxes. This difference in yields increases to 112 basis points for 20-year municipal bonds and is even greater for 30-year municipal bonds, according to the Charles Schwab “2026 Outlook: Municipal Bonds” report published on December 4, 2025. Lower short-term interest rates should also generally benefit municipal closed-end fund (CEF) strategies that employ leverage, many of which are still trading at a discount to their net asset values (NAVs).

Source: Bloomberg, as of 11/28/2025. Charles Schwab, “2026 Outlook: Municipal Bonds,” December 4, 2025.

Municipal bonds are represented by the Bloomberg BVAL Muni AAA Yield Curve. Treasuries assume a 37% tax rate and 3.8% NIIT. For illustrative purposes only. Past performance is not a guarantee of future results.The BVAL Muni AAA Yield Curve is the baseline curve for BVAL tax-exempt munis. It is populated with high quality U.S. municipal bonds with an average rating of AAA from Moody’s and S&P. The yield curve is built using a non-parametric fit of market data obtained from the Municipal Securities Rulemaking Board, new issues calendars, and other proprietary contributed prices. Represents 5% couponing.

8. Favorable Environment for Regional Banks – Our outlook for regional banks (many of which are small caps), and the financials sector as a whole, in 2026 is favorable as net interest margins are improving, short-term interest rates have declined (and are forecasted to decline further), and the prospects for more economic growth and less regulation remain in 2026. An improved regulatory environment and market expansion could also lead to greater industry consolidation via an increase in mergers and acquisitions (M&A). To this end, Reed Smith indicated in its “U.S. Bank M&A Outlook for 2026 and Beyond” report on December 4, 2025, that bank M&A re-accelerated in 2025, with over 150 deals already announced, and October’s $21.4 billion total activity amount marked the highest monthly value since early 2019. We expect this momentum to continue into 2026, notably as acquiring banks look to address strategic scale needs through areas such as AI, digital payments, and geographic diversification.

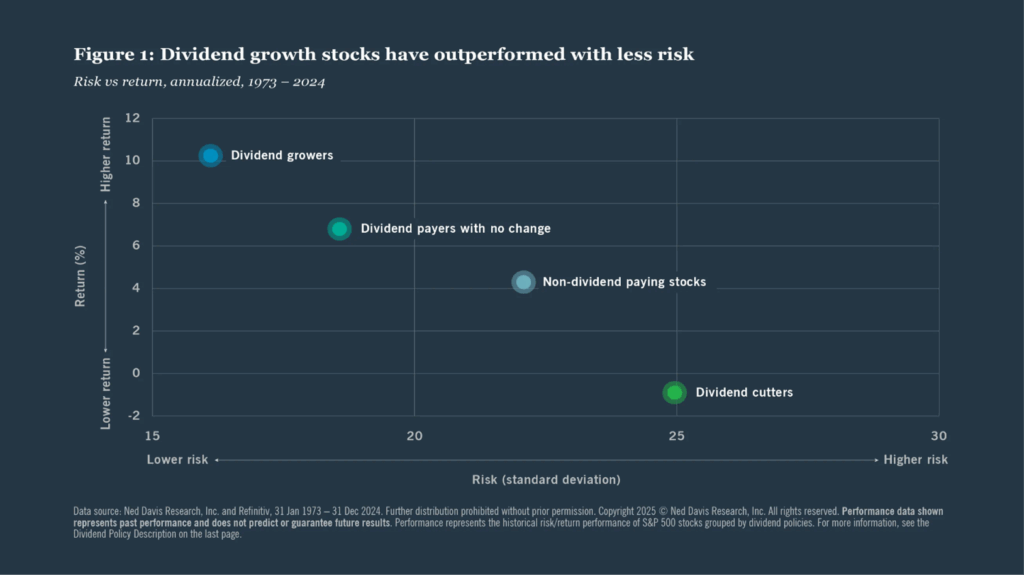

9. Consider Dividend Growers as Portfolio Growers – Companies that consistently grow their dividends typically have a reliable business model, strong balance sheets, stable free cash flows, management confidence, and a commitment to deliver shareholder returns through a combination of dividends and price increases. The stocks of these dividend-growing companies also tend to outperform those of companies that either do not have a history of dividend growth or do not pay a dividend at all. According to Nuveen in their February 2025 “Why Dividend Growth” paper, over the long term, dividend growers and initiators have generated higher returns with less risk, measured by standard deviation, than companies that maintained their dividends, paid no dividend, and reduced or eliminated their dividends (see chart below for more details). This type of outperformance may prove beneficial in a year (and a decade) when some investors may feel that stock market growth potential may be limited, and volatility may be more prevalent. It should also be noted that many dividend-paying stocks are value-oriented, which could be worthy of consideration for those investors looking for a growth to value rotation over the course of 2026, given the current valuations of both investment style categories.

10. Add Diversification Potential with International Equities – While the majority of Wall Street has not taken notice, international stocks significantly outperformed U.S. stocks in 2025, despite a strong year for U.S. stocks. Consider that as of December 12, 2025, international developed market stocks and international emerging market stocks have outperformed U.S. stocks by 12.77% and 15.32%, respectively. As a result, now may be the time to capitalize on this momentum, which could further accelerate in 2026, considering comparative valuations, expected earnings growth, and potential U.S. dollar weakness. However, we are not recommending abandoning U.S. equities, as we might suggest overweighting U.S. equities versus international equities overall in 2026, but rather suggest adding some degree of exposure to certain international companies across developed, emerging, and even frontier markets in the context of global diversification.

—————————————————————————————————————————————————————————————————————————————————————————————————————————————————————

Disclosures: This material is intended for general informational and educational purposes only. It is not intended to be a recommendation or investment advice, and it does not constitute a solicitation to buy, sell or hold a security or an investment strategy.

Hennion & Walsh Asset Management currently has allocations within its managed money program, and Hennion & Walsh currently has allocations within certain SmartTrust® Unit Investment Trusts (UITs) consistent with several of the portfolio management ideas for consideration cited above.

Investing involves risk, including loss of principal. To determine if a Trust is an appropriate investment for you, carefully consider the Trust’s investment objectives, risk factors, charges, and expenses before