A Choppy September Could Lead into a Strong 4th Quarter

Coming off of a volatile month of August, where the S&P 500 index fell by over 6% on a total return basis, many stock market investors are looking for indications of what lies ahead for the final four months of 2015. To this end, it is often said that September is one of the most, if not THE most, difficult months each year for stock market investors. While every market cycle is different, and past performance is not a guarantee of future results, we thought it would be appropriate to look at the recent performance history of the stock market, as measured by the S&P 500 index, to see if this long held contention has some validity.

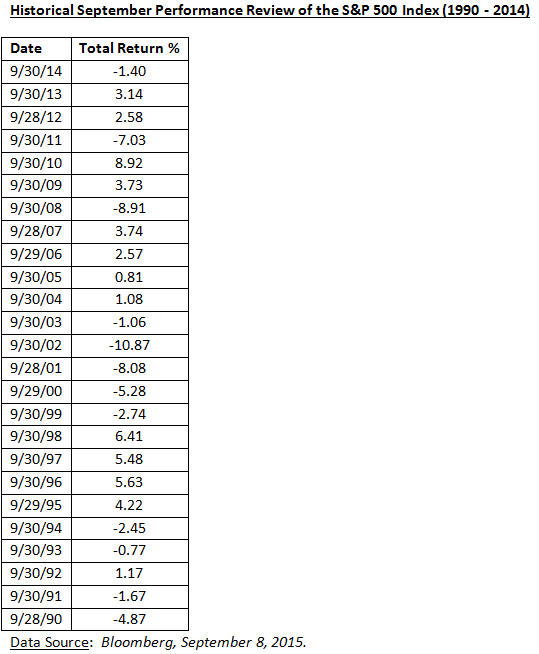

Looking at market data provided by Bloomberg, we found that over the course of the last 25 years, there have been 12 times when the market finished lower, on a total return basis, for the month of September (i.e. approximately 48% of the time). In our view, September of 2015 also is shaping up to potentially be another volatile month with downside pressures resulting from uncertainties around Federal Reserve interest rate activity, China and the depth of this particular market correction.

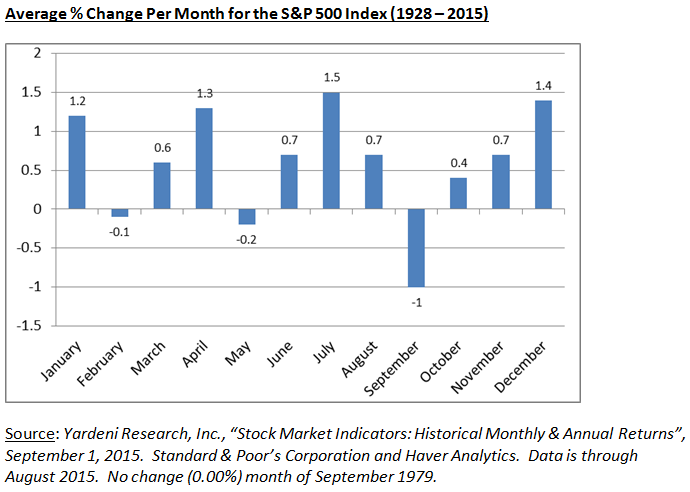

Going back even further to 1928 would show the month of September as being the most difficult month, on average, for stock market investors over the course of each year.

This does not necessarily mean that this September will be as difficult or that the market cannot rebound coming out of a difficult September and finish the year on a high note. There is even some historical precedent for such strong calendar year finishes, regardless of the performance of the stock market during the month of September. According to a MFS “By the Numbers” piece on September 8, 2015, over the course of the last 25 years, the S&P 500 index has gained more on a total return basis during the 4th quarter; which includes the months of October, November and December, of the year than the index has gained during the other 3 quarters – combined. Since 1990, the final 3 months of the year have gained +253.1% on a total return basis versus a gain of +181.3% for the first 9 months of the year.

These two historical trends bode well for both our short-term “nearlook” for a likely volatile month of September in the markets and our longer-term “outlook” for a strong 4th quarter and continuation of this secular bull market cycle ahead. However, this does not necessarily mean that investors should be trying to now time the market as it has long been our contention at SmartTrust that moving a portfolio from fully invested to cash or from cash to being fully invested (i.e. traditional attempts at market timing behavior) is often an inefficient and costly way to manage an investment portfolio.

These past examples, however, should help to reinforce the importance of asset allocation and the need to have the flexibility to make tactical adjustments to asset allocation strategies as needed. These asset allocation strategies, and any ensuing tactical changes, should always be considered in accordance with an investor’s investment objectives, investment timeframe and tolerance for risk. While past performance cannot guarantee future results, and asset allocation cannot ensure a profit or protect against a loss, applying a historical perspective and maintaining an appropriate strategic asset allocation can help provide comfort and direction to investors during periods of great volatility.

Please note: This post is for informational purposes only and should not be considered as a solicitation to purchase or sell any of the themes discussed. Past performance is not an indication of future results. The S&P 500 index consists of 500 stocks chosen for market size, liquidity and industry group representation. It is a market value weighted index with each stock’s weight in the index proportionate to its market value. You cannot invest directly in an index.

Disclosure: Hennion & Walsh is the sponsor of SmartTrust® Unit Investment Trusts (UITs). For more information on SmartTrust® UITs, please visit www.smarttrustuit.com. The overview above is for informational purposes and is not an offer to sell or a solicitation of an offer to buy any SmartTrust® UITs. Investors should consider the Trust’s investment objective, risks, charges and expenses carefully before investing. The prospectus contains this and other information relevant to an investment in the Trust and investors should read the prospectus carefully before they invest.