UITs Continue to Surge Ahead in 2014 as Assets Exceed $100 Billion

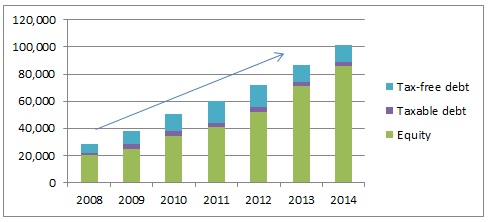

According to the Investment Company Institute (ICI), data on the market value of unit investment trusts (UITs) issued and outstanding as of year-end 2014 indicates a total of 5,381 trusts with a value of $101.14 billion. According to reports submitted by the major sponsors of UITs to ICI, at year-end 2014 there were:

- 2,287 tax-free bond trusts, with a market value of $12.11 billion

- 591 taxable bond trusts, with a market value of $3.06 billion

- 2,503 equity trusts, with a market value of $85.96 billion.

In December of 2014, total UIT deposits totaled $5.16 billion in December. For comparison purposes, total UIT deposits were $4.80 billion in November of 2014 and $4.87 billion in December in 2013. This represented a 6% year-over-year increase for the month of December and a 17% overall annual increase vs. 2013.

Total UIT Deposits by Trust Type (Thousands of dollars)

| December 2014 | November 2014 | December 2013 | |

| Equity | 5,046,543 | 4,730,066 | 4,743,716 |

| Taxable Debt | 49,717 | 36,005 | 43,893 |

| Tax-Free Debt | 63,044 | 33,529 | 83,161 |

| Total | 5,159,304 | 4,799,600 | 4,870,770 |

Further, there were 121 new trusts issuing shares in December. Of that total, 111 were equity trusts, four were taxable bond trusts, and six were tax-free bond trusts.

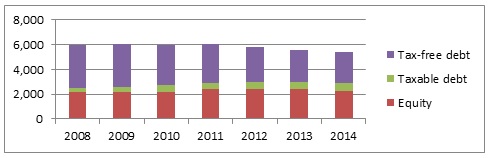

Over the last 6 years, while the number of UITs outstanding decreased by 10% from 5,984 to 5,381, total net assets invested in UITs have grown by more than 254%, starting at approximately $28 billion at the end of 2008 and finishing at the aforementioned $101 billion at the end of 2014.

Number of Unit Investment Trusts (UITs) (Year-End)

Source: Investment Company Institute, December 2014

Unit Investment Trust (UIT) Total Net Assets (Millions of Dollars, Year-End)

Source: Investment Company Institute, December 2014

Interestingly over this timeframe, the overall decline in the number of trusts outstanding can be attributed to tax-free debt products as the number of equity and taxable debt products have actually increased.

| Trust Category | Number of Trust % Increase/(Decrease) |

| Equity | 5% |

| Taxable Debt | 72% |

| Tax-Free Debt | (28%) |

| Total | (10%) |

The trends in assets tell a slightly different story as all product categories experienced increases in asset totals with the equity category leading the way with not only the largest % increase but also the largest amount of total net assets. It should be noted that as it stands now, the equity category within the ICI reporting system incorporates a wide range of different investment types whose underlying strategies most would not normally associate with equities (Ex. a Trust comprised of municipal bond closed-end funds). This may distort the categorization of the results, but it does not diminish the surging momentum as it relates to UIT assets.

| Trust Category | Total Net Assets % Increase/(Decrease) |

| Equity | 328% |

| Taxable Debt | 52% |

| Tax-Free Debt | 88% |

| Total | 254% |

For those that may not be familiar with Unit Investment Trusts, UITs are a fixed portfolio of securities issued with a fixed term. These types of portfolios allow investors to know what securities are held within a UIT as of the date of deposit, as well as the mandatory termination date of the trust. While it is not common, a trust may terminate early as described in the prospectus. UITs are a buy-and-hold investment strategy. In other words, the securities in the UIT portfolio normally do not change significantly during the life of the trust. For more information on UITs in general, please feel free to visit the SmartTrust® website by clicking here.

I believe that the popularity of UITs in recent years can be attributed to a number of factors, one of which is that many of the more popular UITs have primary investment objectives oriented towards current dividend income. These same UITs can invest in income producing securities that can tend to pay a higher level of current income when compared to more traditionally recognized income producing securities (i.e. bonds). Such income producing securities can include, but are not limited to, closed-end funds (that may or may not employ leverage), preferred stocks, real estate investment trusts (REITs), business development companies (BDCs), master limited partnerships (MLPs) and dividend paying equities. These strategies have been particularly appealing within an interest rate environment with persisting record low yields of fixed-income/debt securities – though that may begin to change towards the latter half of 2015.

UITs have also grown in popularity with many advisors in recent years as a result of the evolution of the product mechanics, the entry of some new UIT sponsors and the underlying investment strategies that UITs now employ. For example, in terms of mechanics, UITs now can be purchased using fee-based or standard CUSIPs to accommodate both fee-based advisors and commission-based advisors. In terms of underlying investment strategies, UITs can now be found with primary objectives of growth, income or total return. These strategies can be asset class (ex. US Large Cap), sector (Ex. Healthcare) or even theme (Ex. Rising Rate of Inflation Hedge) oriented. As a result, I believe that it is still fair to say that, “today’s UITs are not your father’s UITs.”

We encourage all investors to educate themselves on all aspects of UITs, including risks and expenses, in addition to understanding each UIT’s investment strategy in particular before considering an investment.

Disclosure: Hennion & Walsh is the sponsor of SmartTrust® Unit Investment Trusts (UITs). For more information on SmartTrust® UITs, please visit www.smarttrustuit.com. The overview above is for informational purposes and is not an offer to sell or a solicitation of an offer to buy any SmartTrust® UITs. Investors should consider the Trust’s investment objective, risks, charges and expenses carefully before investing. The prospectus contains this and other information relevant to an investment in the Trust and investors should read the prospectus carefully before they invest.