2025 Market Recap

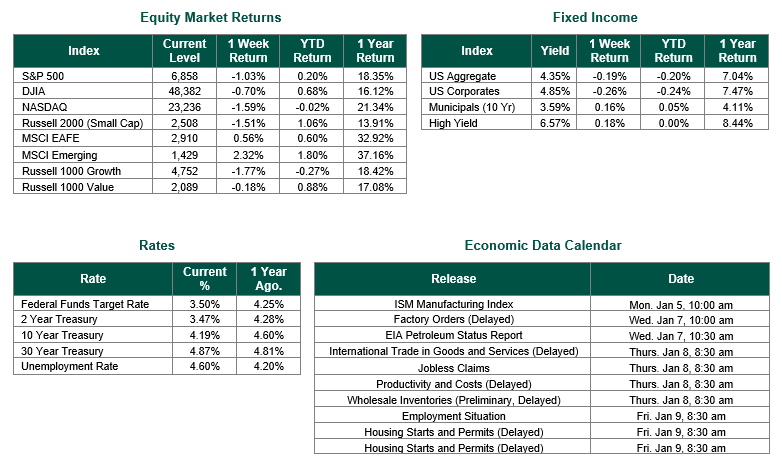

Global equity markets finished higher for the week. In the U.S., the S&P 500 Index closed the week at a level of 6858, representing a decrease of 1.03%, while the Russell Midcap Index moved -0.35% last week. Meanwhile, the Russell 2000 Index, a measure of the Nation’s smallest publicly traded firms, returned -1.51% over the week. As developed international equity performance and emerging markets were positive, returning 0.56% and 2.32%, respectively. Finally, the 10-year U.S. Treasury yield ended the week higher, closing at 4.19%.

Global equity markets finished higher for the week. In the U.S., the S&P 500 Index closed the week at a level of 6858, representing a decrease of 1.03%, while the Russell Midcap Index moved -0.35% last week. Meanwhile, the Russell 2000 Index, a measure of the Nation’s smallest publicly traded firms, returned -1.51% over the week. As developed international equity performance and emerging markets were positive, returning 0.56% and 2.32%, respectively. Finally, the 10-year U.S. Treasury yield ended the week higher, closing at 4.19%.

2025 was a year marked by persistent uncertainty and resilience in global markets and economies, shaped by U.S. trade policies, technological advancements in artificial intelligence (AI), geopolitical tensions, and shifts in monetary policy. Tariff announcements created uncertainty, while investments in AI infrastructure provided support. Markets demonstrated adaptability amid these challenges. Let’s take a look at some of the more noteworthy monthly highlights from the year that was 2025:

January: The year began with the inauguration of Donald Trump as President on January 20, marking the start of his second term in office. Markets responded positively initially. The launch of DeepSeek, a low-cost Chinese AI model, later triggered a sharp sell-off in tech stocks, particularly impacting Nvidia and broader AI-related equities.

February: Tariff policies started to take shape, with initial duties imposed on imports from key trading partners, raising concerns about trade relations.

March: Investments in semiconductor production and tech acquisitions highlighted the ongoing focus on domestic manufacturing and cybersecurity.

April: Tariffs escalated significantly with the announcement of “Liberation Day” measures, including broad-based duties on imports. The announced tariffs led to sharp market declines, with oil prices weakening, gold prices rallying, and certain currencies depreciating against the U.S. dollar. Inflation expectations rose amid the trade disruptions.

May: Leadership transitions in major companies and large-scale international investment pledges to the U.S. dominated headlines, alongside ongoing policy developments.

June: Geopolitical events, including conflicts in Ukraine and the Middle East, increased global uncertainty. Central bank actions in Europe signaled monetary easing, while U.S. economic data showed signs of contraction.

July: Interest rates remained elevated as central banks prioritized inflation control, leading markets to favor companies with strong fundamentals.

August: Slowing growth in major economies, such as Europe and China, raised concerns about global demand, pressuring export-oriented sectors.

September: The Federal Reserve initiated rate cuts, providing support to equities and contributing to declines in Treasury yields. Gold prices advanced amid the easing environment.

October: Cooling inflation supported hopes for further monetary relief. A prolonged U.S. government shutdown introduced additional volatility in financial markets.

November: Policy uncertainties and the resolution of the government shutdown influenced cautious market sentiment.

December: Markets stabilized as major events were absorbed, with focus shifting toward the upcoming year. Continued rate adjustments reinforced positive moves in equities and commodities.

In summary, 2025 tested global markets through trade policies and geopolitical risks, but also showcased strength from technological innovation and policy adaptations. As we head into 2026, new challenges will certainly play their role in investors’ portfolios. The new year is a time to revisit your financial situation and help ensure that your portfolio is positioned in a way that satisfies your goals and objectives. You are also welcome to read our Top 10 Investment Themes for 2026 as published on Forbes and posted on our website.

Equity and Fixed Income Index returns sourced from Bloomberg on 1/2/26. Calendar Data from Econoday as of 1/5/26. International developed markets are measured by the MSCI EAFE Index, emerging markets are measured by the MSCI EM Index, and U.S. Large Caps are defined by the S&P 500 Index. Sector performance is measured using the GICS methodology.

Disclosures: Past performance does not guarantee future results. We have taken this information from sources that we believe to be reliable and accurate. Hennion and Walsh cannot guarantee the accuracy of said information and cannot be held liable. You cannot invest directly in an index. Diversification can help mitigate the risk and volatility in your portfolio but does not ensure a profit or guarantee against a loss.