Another Rate Cut and Strong Earnings Drive Markets

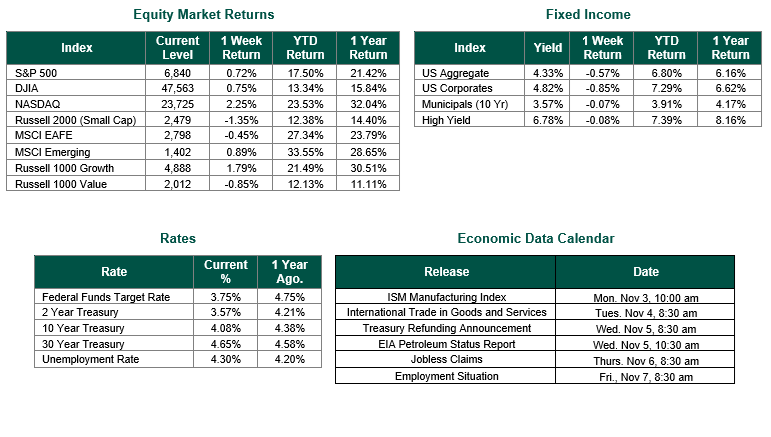

Global equity markets finished up for the week. In the U.S., the S&P 500 Index closed the week at a level of 6840, representing a gain of 0.72%, while the Russell Midcap Index moved -1.94% last week. Meanwhile, the Russell 2000 Index, a measure of the Nation’s smallest publicly traded firms, returned -1.35% over the week. As developed international equity performance and emerging markets were mixed, returning -0.45% and 0.89%, respectively. Finally, the 10-year U.S. Treasury yield moved higher, closing the week at 4.08%.

As 2025 enters its final months, financial markets are navigating a complex mix of monetary policy shifts, corporate earnings momentum, and macroeconomic uncertainty. The Federal Reserve’s evolving stance on interest rates, coupled with a robust third-quarter earnings season, has shaped investor sentiment and market direction in recent weeks.

The Federal Reserve announced its second rate cut of 2025, reducing interest rates by 25 basis points to a range of 3.75%–4.00%, in a 10–2 vote. Of the two dissenting members, one favored a larger 50-point cut while the other supported leaving rates unchanged. In addition, the Fed said it will halt the reduction of its bond holdings starting December 1, ending its quantitative tightening program. This shift toward maintaining, rather than reducing, its balance sheet represents a modestly accommodative stance. Although the Fed updated its September guidance to include three total rate cuts this year instead of the two previously projected, Chair Powell emphasized during his press conference that another cut in December is “not a foregone conclusion,” citing differing views within the committee. His remarks surprised markets, which had priced in an 85% chance of another 25-point reduction. The Fed also voiced increased concern about weakening employment trends, suggesting a heightened focus on the labor side of its dual mandate. Still, with the federal government’s shutdown limiting access to key economic data, December’s rate decision carries additional uncertainty. As always, only the votes of the Federal Open Market Committee will determine the outcome, and market speculation about future Fed actions could continue to drive volatility through late 2025 and into early 2026.

Additionally, during the past week, the third-quarter corporate earnings season yielded significant results from major technology companies, including tech giants such as Apple, Microsoft, Amazon, Alphabet, and Meta. These earnings reports were part of a strong overall performance trend, with analysts estimating a year-over-year earnings growth rate of about 10.5% for S&P 500 companies for the third quarter. When excluding the energy sector, this growth rate rises to approximately 11.4%. Third-quarter earnings continue to highlight the ongoing positive momentum in corporate profitability, contributing to overall market confidence.

Looking ahead, investors are likely to weigh the Federal Reserve’s cautious policy stance against the strength of corporate fundamentals as they position for the year’s end. While uncertainty surrounding future rate decisions, labor trends, and geopolitical risks may keep volatility elevated, the resilience evident in corporate earnings provides a counterbalance to those concerns. The coming months will test whether steady business performance can sustain market optimism in the face of persistent economic crosscurrents and shifting expectations for 2026.

Best wishes for the week ahead!

Equity and Fixed Income Index returns sourced from Bloomberg on 10/31/25. Interest Rate Data is sourced from The Federal Reserve. Corporate Earnings Data was sourced from FactSet. Economic Calendar Data from Econoday as of 10/31/25. International developed markets are measured by the MSCI EAFE Index, emerging markets are measured by the MSCI EM Index, and U.S. Large Caps are defined by the S&P 500 Index. Sector performance is measured using the GICS methodology.

Disclosures: Past performance does not guarantee future results. We have taken this information from sources that we believe to be reliable and accurate. Hennion and Walsh cannot guarantee the accuracy of said information and cannot be held liable. You cannot invest directly in an index. Diversification can help mitigate the risk and volatility in your portfolio but does not ensure a profit or guarantee against a loss.