Another Week of Stock Gains and Mixed Data Reports

Market Overview

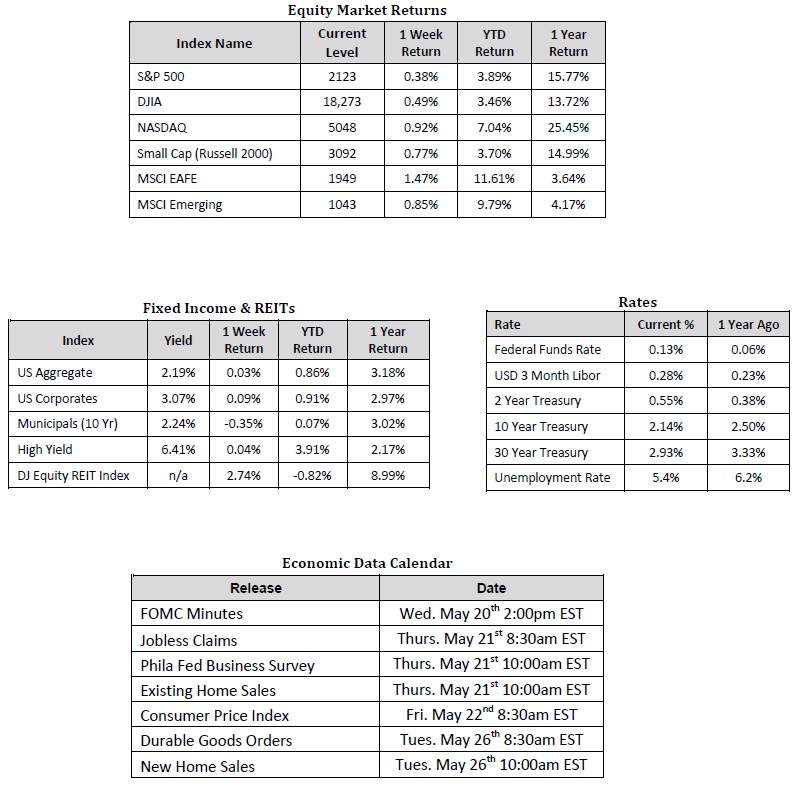

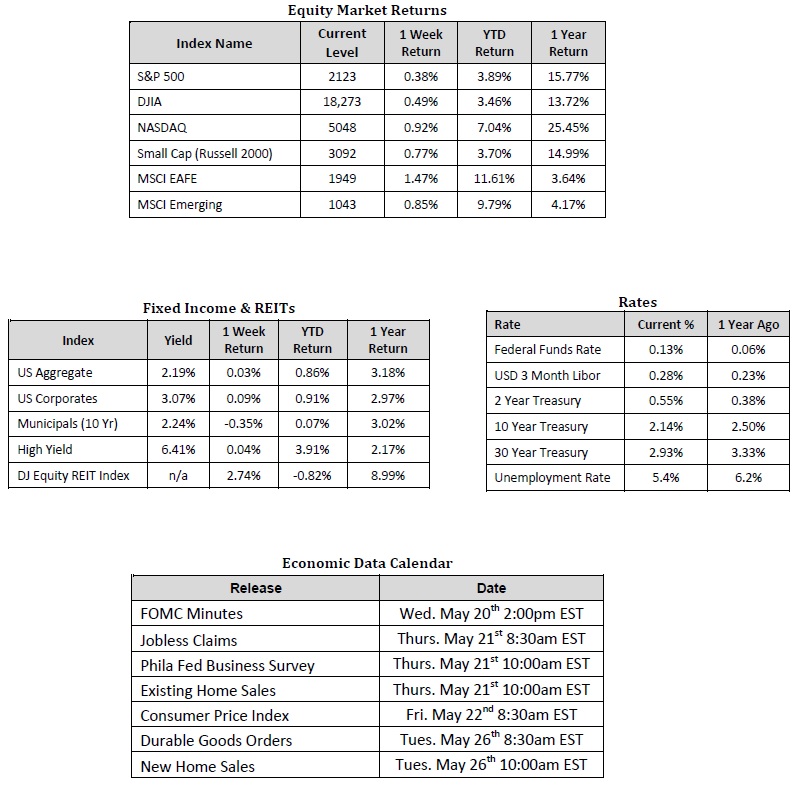

Sources: Equity Market, Fixed Income and REIT returns from JP Morgan as of 5/15/15. Rates and Economic Calendar Data from Bloomberg as of 5/18/15.

Happening Now

Another Week of Stock Gains and Mixed Data Reports

A flurry of economic data released last week painted a mixed picture of the health of the U.S. Economy and has kept domestic markets range bound. Major U.S. stock market indexes (the S&P 500 Index, S&P 400 Mid Cap Index and Russell 2000 Index) all posted a second consecutive week of gains and third positive weekly return in the last four weeks. Over the last month*, however, markets have delivered mixed results with Large cap gaining 0.8%, Mid-cap losing -0.4% and Small cap selling off -2.5% based on the returns of the indexes listed above. This type of return pattern is often associated with declining economic growth expectations. Considering that last week alone Retail Sales, Inflation (PPI), Industrial Production, and Chinese Industrial and Retail numbers all disappointed, we are not very surprised to see that growth sensitive stocks took a slight step back.

In terms of international markets, just like the U.S. indices cited above, the MSCI EAFE index has posted 2 consecutive weekly gains and three positive weekly returns over the last four weeks. In terms of the performance of international stocks over the past month*, however, the return on MSCI EAFE index was 2.4%. The strong relative performance was delivered on the back of continued quantitative easing from the ECB and BOJ as well as improving economic conditions in Europe. In fact, it was revealed Tuesday that the ECB plans to inject even more liquidity into the markets by increasing the pace of their current $60B a month purchases. This accommodative extension of monetary policy coincides with the best GDP number in almost two years as the group of 19 nations that use the Euro grew by 0.4% during Q1 of 2015. While a 0.4% annualized rate might not be something to celebrate, especially when compared to the growth seen in some emerging markets, this is slightly above the 0.36% average growth rate in the Eurozone since 1995 according to tradingeconomics.com.

Despite domestic stocks being outpaced by certain international markets, we continue to remain optimistic for further growth in both the U.S. economy and stock market as a whole. On the international front, we expect monetary easing to help improve the Eurozone’s overall economic conditions but recognize the divergence across member countries and the persistence of geo-political risks. As noted in last week’s Stock Market Update, the flood of economic data releases can be daunting but with a clear understanding of how these types of data flow through into expected equity market returns, investors can help position themselves more strategically.

*As of 5/15/2015

Disclosures: Past performance does not guarantee future results. We have taken this information from sources that we believe to be reliable and accurate. Hennion & Walsh cannot guarantee the accuracy of said information and cannot be held liable.

Important Information and Disclaimers

Past Performance is not a guarantee of future performance.

Investing in foreign securities presents certain risks not associated with domestic investments, such as currency fluctuation, political and economic instability, and different accounting standards. This may result in greater share price volatility. These risks are heightened in emerging markets.

There are special risks associated with an investment in real estate, including credit risk, interest rate fluctuations and the impact of varied economic conditions. Distributions from REIT investments are taxed at the owner’s tax bracket.

The prices of small company and mid cap stocks are generally more volatile than large company stocks. They often involve higher risks because smaller companies may lack the management expertise, financial resources, product diversification and competitive strengths to endure adverse economic conditions.

Investing in commodities is not suitable for all investors. Exposure to the commodities markets may subject an investment to greater share price volatility than an investment in traditional equity or debt securities. Investments in commodities may be affected by changes in overall market movements, commodity index volatility, changes in interest rates or factors affecting a particular industry or commodity.

Products that invest in commodities may employ more complex strategies which may expose investors to additional risks.

Investing in fixed income securities involves certain risks such as market risk if sold prior to maturity and credit risk especially if investing in high yield bonds, which have lower ratings and are subject to greater volatility. All fixed income investments may be worth less than original cost upon redemption or maturity. Bond Prices fluctuate inversely to changes in interest rates. Therefore, a general rise in interest rates can result in the decline of the value of your investment.

Definitions

MSCI- EAFE: The Morgan Stanley Capital International Europe, Australasia and Far East Index, a free float-adjusted market capitalization index that is designed to measure developed-market equity performance, excluding the United States and Canada.

MSCI-Emerging Markets: The Morgan Stanley Capital International Emerging Market Index, is a free float-adjusted market capitalization index that is designed to measure the performance of global emerging markets of about 25 emerging economies.

Russell 3000: The Russell 3000 measures the performance of the 3000 largest US companies based on total market capitalization and represents about 98% of the investible US Equity market.

ML BOFA US Corp Mstr [Merill Lynch US Corporate Master]: The Merrill Lynch Corporate Master Market Index is a statistical composite tracking the performance of the entire US corporate bond market over time.

ML Muni Master [Merill Lynch US Corporate Master]: The Merrill Lynch Municipal Bond Master Index is a broad measure of the municipal fixed income market.

Investors cannot directly purchase any index.

LIBOR, London Interbank Offered Rate, is the rate of interest at which banks offer to lend money to one another in the wholesale money markets in London.

The Dow Jones Industrial Average is an unweighted index of 30 “blue-chip” industrial U.S. stocks.

The S&P Midcap 400 Index is a capitalization-weighted index measuring the performance of the mid-range sector of the U.S. stock market, and represents approximately 7% of the total market value of U.S. equities. Companies in the Index fall between S&P 500 Index and the S&P SmallCap 600 Index in size: between $1-4 billion.

DJ Equity REIT Index represents all publicly traded real estate investment trusts in the Dow Jones U.S. stock universe classified as Equity REITs according to the S&P Dow Jones Indices REIT Industry Classification Hierarchy. These companies are REITSs that primarily own and operate income-producing real estate.