Anticipating the Fed’s Next Move

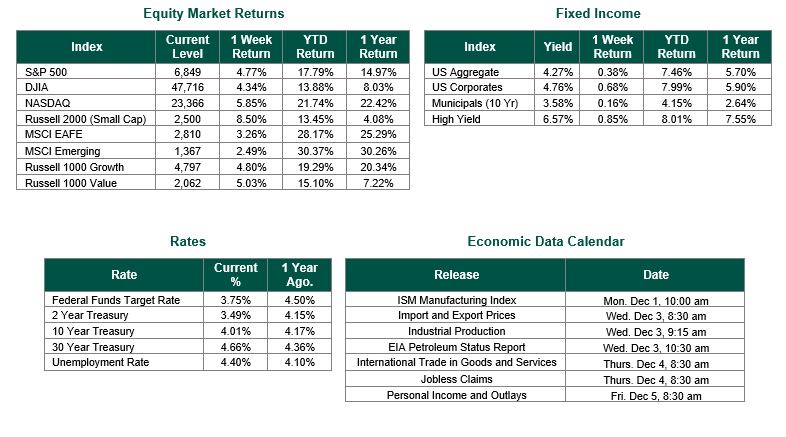

Global equity markets finished higher for the week. In the U.S., the S&P 500 Index closed the week at a level of 6849, representing an increase of 4.77%, while the Russell Midcap Index moved +2.32% last week. Meanwhile, the Russell 2000 Index, a measure of the Nation’s smallest publicly traded firms, returned 8.50% over the week. As developed international equity performance and emerging markets were positive, returning 3.26% and 2.49%, respectively. Finally, the 10-year U.S. Treasury yield moved lower, closing the week at 4.02%.

On Thanksgiving Day, many were reminded of the season’s deeper meaning, as it offered a chance to slow down, appreciate family and traditions, and reflect on what truly mattered most. We also wanted to emphasize how grateful we were for the trust our customers placed in us, valuing every conversation and each opportunity to help them pursue their financial goals.

Last week, market sentiment tilted clearly toward expecting another quarter‑point rate cut from the FOMC following its December 10 meeting, even though a cut was not viewed as absolutely guaranteed. Fed Funds futures pricing via tools like CME’s FedWatch showed the implied probability of a 25‑basis‑point cut (0.25%) rising into the roughly 80–90% range by the end of the week, up sharply from the more mixed “coin‑flip” odds seen earlier in November, reflecting investors’ belief that softer labor‑market signals and moderating inflation would push the Fed to ease again. Commentary from major banks and research houses reinforced this shift as several institutions publicly revised their calls to favor a December cut after previously leaning toward a later move in 2026, citing a cooling jobs backdrop, the absence of major new data before the meeting, and increasingly open‑minded remarks from Federal Reserve officials.

Economic data releases scheduled for last week were significantly affected by the recent federal government shutdown, causing several delays and postponements. The September retail sales data, which was originally scheduled for release much earlier, was rescheduled and expected to be published in early December instead. Similarly, the Producer Price Index (PPI), one of the key inflation gauges watched by many strategists, for September faced postponement, with no new numbers released last week. The Conference Board’s Consumer Confidence Index, however, was issued and reflected mixed sentiment as consumers weighed the impact of recent market volatility and economic uncertainty. Additionally, weekly initial jobless claims were released as scheduled, showing modest changes but remaining close to recent averages, indicating a softer labor market consistent with broader economic disruptions. As a result, while survey-based releases were mostly delayed, available sentiment and labor market indicators provided some ongoing insight into U.S. economic conditions during the holiday-shortened week.

Looking forward, in addition to reviewing the results from the big Black Friday and Cyber Monday holiday shopping days, financial markets will continue to be centered around the anticipation of the FOMC’s December 10 meeting, with investors closely watching for any signals about the path of interest rates and future policy.

We hope everyone enjoyed a relaxing Thanksgiving with family and friends, and wish you the best for the week ahead!

Equity and Fixed Income Index returns sourced from Bloomberg on 11/28/25. Fed funds futures was sourced from CME’s FedWatch. Consumer Confidence Index was sourced from the Conference Board. Employment Data was sourced from the Bureau of Labor Statistics. Calendar Data from Econoday as of 11/14/25. International developed markets are measured by the MSCI EAFE Index, emerging markets are measured by the MSCI EM Index, and U.S. Large Caps are defined by the S&P 500 Index. Sector performance is measured using the GICS methodology.

Disclosures: Past performance does not guarantee future results. We have taken this information from sources that we believe to be reliable and accurate. Hennion and Walsh cannot guarantee the accuracy of said information and cannot be held liable. You cannot invest directly in an index. Diversification can help mitigate the risk and volatility in your portfolio but does not ensure a profit or guarantee against a loss.