Can Positive Earnings and Economic Data Reports Overcome Trade War Concerns?

Market Overview

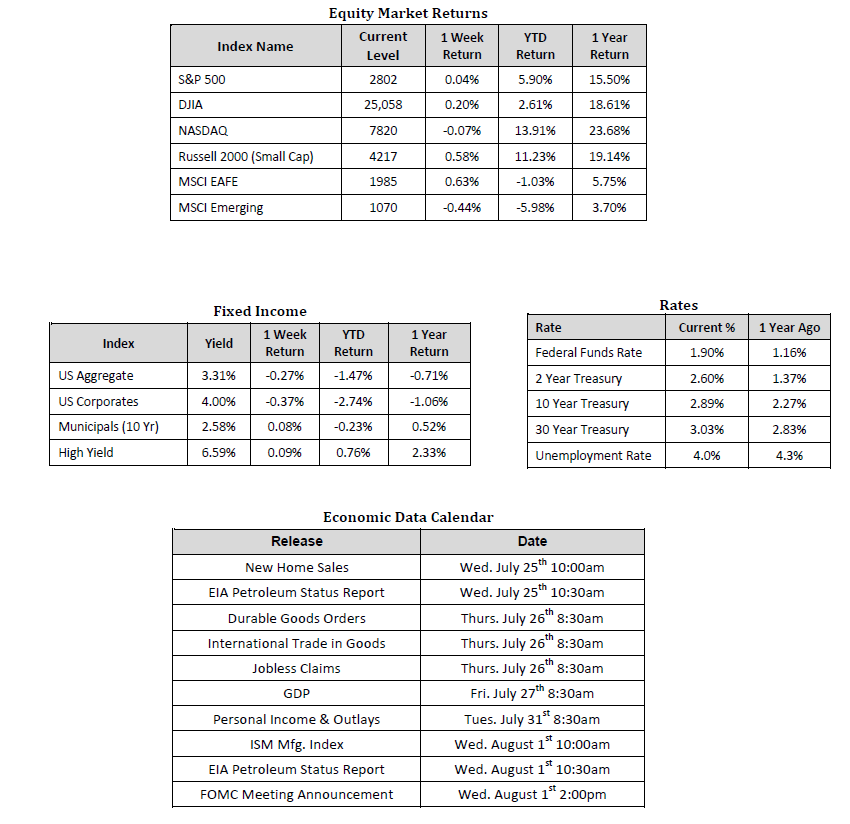

Sources: Sources for data in tables: Equity Market and Fixed Income returns are from JP Morgan as of 07/20/18. Rates and Economic Calendar Data from Bloomberg as of 07/23/18. International developed markets measured by the MSCI EAFE Index, emerging markets measured by the MSCI EM Index. Sector performance is measured using GICS methodology.

Sources: Sources for data in tables: Equity Market and Fixed Income returns are from JP Morgan as of 07/20/18. Rates and Economic Calendar Data from Bloomberg as of 07/23/18. International developed markets measured by the MSCI EAFE Index, emerging markets measured by the MSCI EM Index. Sector performance is measured using GICS methodology.

Happening Now

Global Capital Markets ended a turbulent week relatively flat, despite largely favorable economic readings, as concerns surrounding the potential impact of an escalating trade war began to intensify. The S&P 500 Index floundered to a level of 2,802, representing a meager increase of 0.04%, while the Russell Mid-cap Index gained 0.09%. The Russell 2000 Index, a measure of the Nation’s smallest publicly traded firms, outpaced its larger counterparts and returned 0.58% to investors. On the international equities front, developed markets produced the strongest performance of the week, rallying 0.63% higher, while emerging markets continued to give up ground losing 0.44%. Finally, the 10 year U.S. Treasury yield continued to trend upward settling at 2.89%, while the U.S. Dollar fell 0.25%.

Last week, Federal Reserve Chairman Jerome Powell took two days to deliver his semi-annual monetary policy testimony to the Senate Banking Committee and the House Financial Services Committee. These semi-annual meetings tend to be chock-full of political grandstanding, but they can, and should, provide investors with answers to key questions around the current mindset of the Federal Reserve. Throughout Mr. Powell’s multi-day testimony, he updated committee members on the current state of inflation, wage inflation, business investment, fiscal policy, retail sales, and industrial production amongst other economic data points.

Mr. Powell asserted that the inflation picture looks promising, did not appear to pose a risk to the overall economy, and should remain around a comfortable 2.00% for several years. Moreover, wage inflation has increased moderately, but not to a level that would restrict economic growth or lead to a reduction in corporate earnings. In fact, business investment looks robust, and over 85% of S&P 500 companies that have reported earnings thus far for the 2nd quarter have reported figures that beat estimates. As it stands now, the blended earnings growth rate for S&P 500 companies is 20.8%. If this holds, it will mark the second highest earnings growth since Q3 2010. Additionally, industrial production and manufacturing, areas that had previously flashed signs of potential weakness, have firmed and are displaying strength globally. Finally, and potentially most impressive, were jobless claims falling to the lowest level seen since December 1969.

So why aren’t investors rejoicing this overabundance of positive economic news by pushing equity markets substantially higher? It looks as if the collective level of uncertainty regarding the ultimate end of on-going trade and tariff disputes has increased. In other words, too many investors are disregarding positive economic developments (perhaps temporarily) as they patiently wait for a resolution to this escalating trade dispute.

At SmartTrust® we understand downside risks and economic uncertainties are ever-present. As a result, portfolio diversification becomes increasingly important during times of heightened uncertainty, and we encourage investors to revisit the diversification that may, or may not, be in place within their existing portfolios.

Important Information and Disclaimers

Disclosures: Hennion & Walsh is the sponsor of SmartTrust® Unit Investment Trusts (UITs). For more information on SmartTrust® UITs, please visit www.smarttrustuit.com. The overview above is for informational purposes and is not an offer to sell or a solicitation of an offer to buy any SmartTrust® UITs. Investors should consider the Trust’s investment objective, risks, charges and expenses carefully before investing. The prospectus contains this and other information relevant to an investment in the Trust and investors should read the prospectus carefully before they invest.

Investing in foreign securities presents certain risks not associated with domestic investments, such as currency fluctuation, political and economic instability, and different accounting standards. This may result in greater share price volatility. These risks are heightened in emerging markets.

There are special risks associated with an investment in real estate, including credit risk, interest rate fluctuations and the impact of varied economic conditions. Distributions from REIT investments are taxed at the owner’s tax bracket.

The prices of small company and mid cap stocks are generally more volatile than large company stocks. They often involve higher risks because smaller companies may lack the management expertise, financial resources, product diversification and competitive strengths to endure adverse economic conditions.

Investing in commodities is not suitable for all investors. Exposure to the commodities markets may subject an investment to greater share price volatility than an investment in traditional equity or debt securities. Investments in commodities may be affected by changes in overall market movements, commodity index volatility, changes in interest rates or factors affecting a particular industry or commodity.

Products that invest in commodities may employ more complex strategies which may expose investors to additional risks.

Investing in fixed income securities involves certain risks such as market risk if sold prior to maturity and credit risk especially if investing in high yield bonds, which have lower ratings and are subject to greater volatility. All fixed income investments may be worth less than original cost upon redemption or maturity. Bond Prices fluctuate inversely to changes in interest rates. Therefore, a general rise in interest rates can result in the decline of the value of your investment.

Definitions

MSCI- EAFE: The Morgan Stanley Capital International Europe, Australasia and Far East Index, a free float-adjusted market capitalization index that is designed to measure developed-market equity performance, excluding the United States and Canada.

MSCI-Emerging Markets: The Morgan Stanley Capital International Emerging Market Index, is a free float-adjusted market capitalization index that is designed to measure the performance of global emerging markets of about 25 emerging economies.

Russell 3000: The Russell 3000 measures the performance of the 3000 largest US companies based on total market capitalization and represents about 98% of the investible US Equity market.

ML BOFA US Corp Mstr [Merill Lynch US Corporate Master]: The Merrill Lynch Corporate Master Market Index is a statistical composite tracking the performance of the entire US corporate bond market over time.

ML Muni Master [Merill Lynch US Corporate Master]: The Merrill Lynch Municipal Bond Master Index is a broad measure of the municipal fixed income market.

Investors cannot directly purchase any index.

LIBOR, London Interbank Offered Rate, is the rate of interest at which banks offer to lend money to one another in the wholesale money markets in London.

The Dow Jones Industrial Average is an unweighted index of 30 “blue-chip” industrial U.S. stocks.

The S&P Midcap 400 Index is a capitalization-weighted index measuring the performance of the mid-range sector of the U.S. stock market, and represents approximately 7% of the total market value of U.S. equities. Companies in the Index fall between S&P 500 Index and the S&P SmallCap 600 Index in size: between $1-4 billion.

DJ Equity REIT Index represents all publicly traded real estate investment trusts in the Dow Jones U.S. stock universe classified as Equity REITs according to the S&P Dow Jones Indices REIT Industry Classification Hierarchy. These companies are REITs that primarily own and operate income-producing real estate.