Chairman Powell’s Dovish Comments Help Ignite Markets

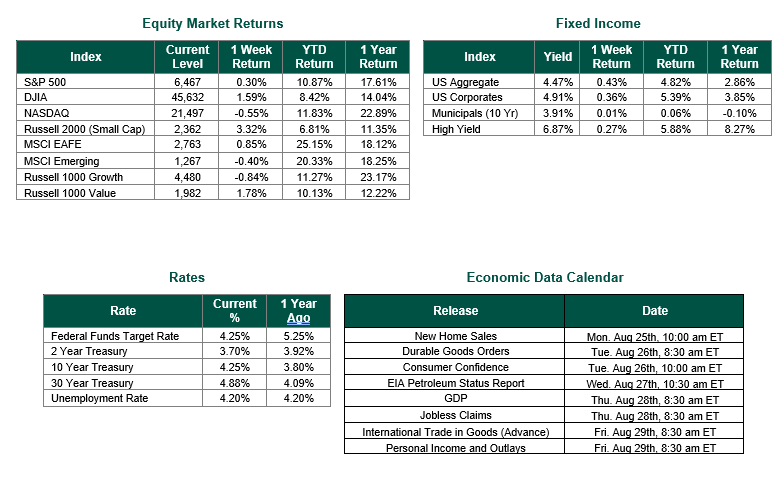

Global equity markets finished mixed for the week. In the U.S., the S&P 500 Index closed the week at a level of 6,467, representing a gain of 0.30%, while the Russell Midcap Index moved 1.78% last week. Meanwhile, the Russell 2000 Index, a measure of the Nation’s smallest publicly traded firms, returned 3.32% over the week. As developed international equity performance and emerging markets were 0.85% and -0.40%, respectively. Finally, the 10-year U.S. Treasury yield moved flat, closing the week at 4.25%.The global economic landscape was shaped by several major events this past week, including a revealing release of the FOMC minutes, Chairman Jerome Powell’s anticipated Jackson Hole speech, and significant international trade announcements affecting both North America and the European Union (EU).

The FOMC minutes, published on August 21, highlighted a rare and pronounced division within the Federal Reserve, where two senior governors dissented, advocating for an immediate 25-basis-point rate cut in response to recent tariff escalations and weakening employment data. Nevertheless, the majority opted to maintain the current policy rate at 4.25% to 4.50%, emphasizing persistent inflation risks over potential labor market deterioration, and underscoring the complexity introduced by the uncertain future of tariffs and trade policies.

Federal Reserve Chair Jerome Powell’s keynote speech from the Jackson Hole symposium acknowledged the economy’s resilience amid ongoing policy changes, but also signaled that while inflation had receded from post-pandemic peaks, upside risks remain and the labor market has softened, with unemployment moving up nearly a full percentage point—a shift not seen outside recessions in recent history. Powell reiterated the Fed’s commitment to a balanced approach and revealed the continued review of the Fed’s monetary policy framework, seeking to address both inflation containment and labor market support in light of evolving global and domestic challenges.

On the international trade front, Canada made headlines with an announcement that may impact goods flows across North America, while the United States and the European Union reached an updated trade agreement aimed at smoothing recent tariff tensions and reinforcing transatlantic cooperation. These developments come as flash PMI data and revised global inflation projections pointed to uneven recovery across regions, with manufacturing and services sectors responding differently to recent tariff changes and policy signals. Together, all of these events reflected a week marked by policy reassessment and uncertainty, as central banks and governments navigate shifting inflation, employment, and global trade patterns.

Major equity indexes posted strong performance last week, driven by renewed optimism about future interest rate cuts and positive investor sentiment on Wall Street. The Dow Jones Industrial Average surged 800 points, or 1.89%, reaching a record high of 45,631.74, marking its first such milestone for the year. The S&P 500 gained approximately 1.5%, closing just shy of an all-time high near 6,449, with monthly and yearly returns remaining robust at 0.92% and 14.81%, respectively. The Nasdaq Composite outperformed, rising 1.9% during the week and reflecting strong demand for technology shares, highlighted by investor anticipation ahead of Nvidia’s earnings release this coming week.

Best wishes for the week ahead, and for a safe and enjoyable Labor Day weekend!

Equity and Fixed Income Index returns sourced from Bloomberg on 8/22/25. Both the FOMC Minutes and Chairman Powell’s comments were sourced from the Federal Reserve. Economic Calendar Data from Econoday as of 8/22/25. International developed markets are measured by the MSCI EAFE Index, emerging markets are measured by the MSCI EM Index, and U.S. Large Caps are defined by the S&P 500 Index. Sector performance is measured using the GICS methodology.

Disclosures: Past performance does not guarantee future results. We have taken this information from sources that we believe to be reliable and accurate. Hennion and Walsh cannot guarantee the accuracy of said information and cannot be held liable. You cannot invest directly in an index. Diversification can help mitigate the risk and volatility in your portfolio but does not ensure a profit or guarantee against a loss.