Cooling Jobs, a Narrowing Trade Gap, and New Market Highs

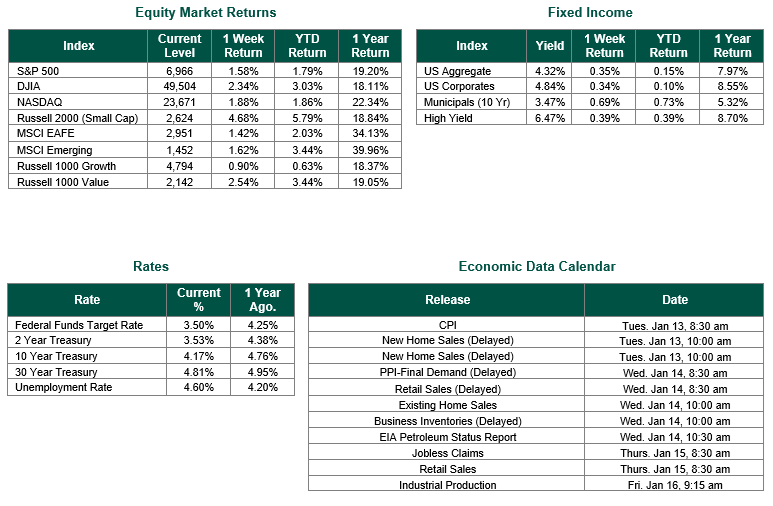

Global equity markets finished higher for the week. In the U.S., the S&P 500 Index closed the week at a level of 6966, representing an increase of 1.58%, while the Russell Midcap Index moved +0.94% last week. Meanwhile, the Russell 2000 Index, a measure of the Nation’s smallest publicly traded firms, returned 4.68% over the week. As developed international equity performance and emerging markets were positive, returning 1.42% and 1.62%, respectively. Finally, the 10-year U.S. Treasury yield moved higher, closing the week at 4.19%.

A heavy slate of early-January data offered a nuanced snapshot of the late-2025 U.S. economy, revealing a labor market that is cooling but still fundamentally intact alongside shifting dynamics in trade. As it relates to the labor market, we learned the following:

- JOLTS (Job Openings and Labor Turnover Survey) data for December, released last Wednesday, suggested some cooling in job openings from prior months but continued turnover dynamics, with hires and quits exhibiting mixed patterns depending on sector and region. The JOLTS framework often shows openings remaining elevated relative to historical norms, even as hiring slows in certain periods, which can impact wages and consumer confidence.

- On Thursday, weekly initial claims for unemployment pointed to a still-resilient labor market, with claims hovering near historically low ranges or modest increases around year-end adjustments, indicating continued job stability for many workers.

- The Employment Situation report released on January 9, 2026, showed that the U.S. labor market ended 2025 in a markedly slower gear, with nonfarm payrolls rising by only 50,000 jobs in December and prior months revised lower, leaving annual job gains at about 584,000, the weakest year of growth outside a recession in more than two decades. However, the U-3 unemployment rate edged down to 4.4% as the household survey recorded a larger increase in employment and a slight dip in labor force participation. In addition, the broader U-6 unemployment rate fell to 8.4%, partly due to fewer people working part-time for economic reasons. Job growth was concentrated in services—especially restaurants and bars, health care, and social assistance—while retail continued to shed jobs. Policymakers and strategists will likely continue to assess how much further the labor market may cool in 2026.

The U.S. trade deficit six months into President Donald Trump’s tariffs tumbled to its lowest level since mid-2009, with the Commerce Department reporting that, as exports rose. Imports fell, and the trade shortfall narrowed to just $29.4 billion for October, a 39% decline from the prior month, as exports increased by 2.6%. Imports slipped 3.2%, bringing the deficit to its smallest level since the second quarter of 2009, when the U.S. was emerging from the financial crisis and Great Recession. The figures capture trade activity following the launch of Trump’s “liberation day” tariffs in April 2025, which many economists and policymakers initially feared would backfire by provoking retaliation and slowing global flows of goods and services.

These economic reports portray an economy in transition, with a labor market that remains fundamentally resilient but is losing momentum, while trade and external demand are exhibiting signs of relative strength.

Best wishes for the week ahead!

Equity and Fixed Income Index returns sourced from Bloomberg on 1/9/26. The JOLTS and Employment Situation reports were sourced from the Bureau of Labor Statistics. Weekly Jobless Claims were sourced from the U.S. Department of Labor. Trade deficit data was sourced from the Commerce Department. Calendar Data from Econoday as of 1/9/26. International developed markets are measured by the MSCI EAFE Index, emerging markets are measured by the MSCI EM Index, and U.S. Large Caps are defined by the S&P 500 Index. Sector performance is measured using the GICS methodology.

Disclosures: Past performance does not guarantee future results. We have taken this information from sources that we believe to be reliable and accurate. Hennion and Walsh cannot guarantee the accuracy of said information and cannot be held liable. You cannot invest directly in an index. Diversification can help mitigate the risk and volatility in your portfolio but does not ensure a profit or guarantee against a loss.