Dow 50,000, AI Concerns, and Sector Rotation

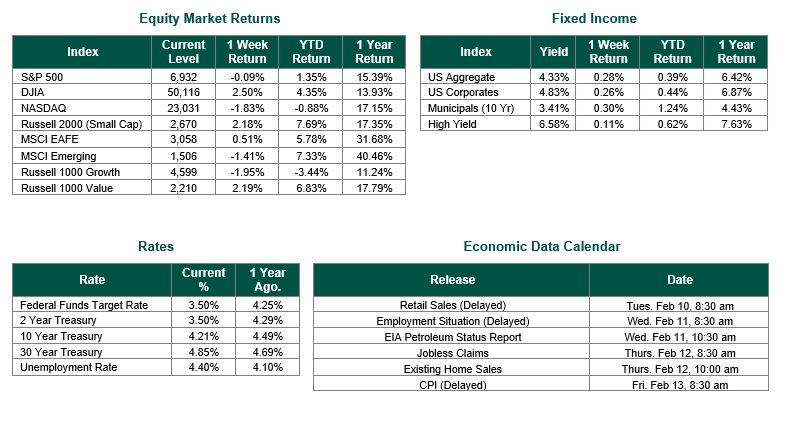

Global equity markets finished mixed for the week. In the U.S., the S&P 500 Index closed the week at a level of 6932, representing a decrease of 0.09%, while the Russell Midcap Index moved +1.98% last week. Meanwhile, the Russell 2000 Index, a measure of the Nation’s smallest publicly traded firms, returned 2.18% over the week. As developed international equity performance and emerging markets were mixed, returning 0.51% and -1.41%, respectively. Finally, the 10-year U.S. Treasury yield moved lower, closing the week at 4.21%.

Last week proved to be one of significant turbulence and transition for equity markets, as investors grappled with fundamental questions about the impact of artificial intelligence (AI) on corporate America. Rather than a simple down week, we witnessed a pronounced market rotation that reveals where investor concerns and opportunities may lie ahead. Given the significant rebound last Friday, when the Dow Jones Industrial Average topped 50,000 for the first time, last week can also serve as yet another reminder of the dangers of trying to time the market.

The week’s dominant narrative centered on growing anxiety that artificial intelligence may be disrupting the very software companies many investors thought would benefit most from it. Anthropic’s release of specialized plugins for its Claude Cowork tool, designed to automate tasks across legal, finance, sales, and marketing, triggered a sharp reaction. The announcement sparked a $285 billion rout in stocks across the software, financial services, and asset management sectors.

Adding to investor unease were eye-popping AI infrastructure budgets. Alphabet reported stellar results but guided full-year 2026 capital expenditure to $175-185 billion, well above the $115 billion analysts had expected. This news triggered fresh concerns about return on investment—a question intensified by earlier disruptions, such as last year’s fears about the cost-efficient models of Chinese AI startup DeepSeek. We believe, however, that these current AI spending concerns, while warranted, are currently overblown and remind investors that the AI revolution is a long and winding road, likely filled with many potholes along the way.

Beneath the headline volatility, an important shift appears to be developing in market leadership. Industrials, materials, energy, and consumer staples hit fresh all-time highs, and the S&P Equal Weight index traded at a fresh all-time high. After years of returns concentrated in mega-cap technology, this rotation toward cyclicals, real assets, and smaller companies represents a meaningful change in market character, and one can be viewed as healthy for the longer-term sustainability of the current bull market.

Best wishes for the week ahead!

Equity and Fixed Income Index returns sourced from Bloomberg on 2/6/26. Alphabet earnings data was sourced for Fact Set. Calendar Data from Econoday as of 2/9/26. International developed markets are measured by the MSCI EAFE Index, emerging markets are measured by the MSCI EM Index, and U.S. Large Caps are defined by the S&P 500 Index. Sector performance is measured using the GICS methodology.

Disclosures: Past performance does not guarantee future results. We have taken this information from sources that we believe to be reliable and accurate. Hennion and Walsh cannot guarantee the accuracy of said information and cannot be held liable. You cannot invest directly in an index. Diversification can help mitigate the risk and volatility in your portfolio, but does not ensure a profit or guarantee against a loss.