Earnings Season Will Help Illustrate the Impact of COVID-19 on Various Sectors

Market Overview

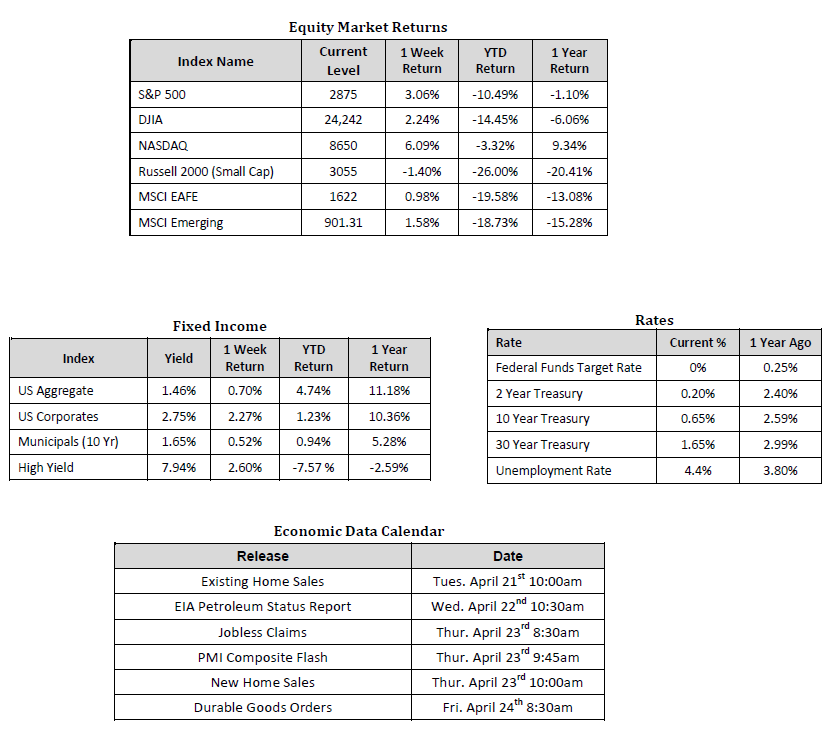

Sources: Sources for data in tables: Equity Market and Fixed Income returns are from JP Morgan as of 04/17/2020. Rates and Economic Calendar Data from Bloomberg as of 04/17/2020. International developed markets measured by the MSCI EAFE Index, emerging markets measured by the MSCI EM Index. Sector performance is measured using GICS methodology.

Happening Now

Global equity markets posted a second consecutive week of gains. Sentiment was lifted by reported progress on a treatment for the coronavirus as well as the potential for the easing of lockdown restrictions across the world. In the U.S., the S&P 500 Index rose to a level of 2,875, representing a 3.06% gain for the week while the Russell Midcap Index advanced 0.96%. Small-cap companies, which are often more sensitive to economic growth rates, were the exception to last week’s rally evidenced by the Russell 2000 Index returning -1.40% over the week. On the international equities front, both developed and emerging markets also finished in the green, returning 0.98% and 1.58%, respectively. Finally, the 10-year U.S. Treasury yield settled in at 0.65% to end the week.

Earnings will remain in focus this week, with nearly 20% of S&P 500 companies scheduled to report first-quarter 2020 results. We understand that forward guidance, which is a major driver of valuations, is highly unreliable during our current quandary and that the pronounced dispersion in company earnings estimates from analysts indicates a high level of uncertainty and weak visibility. However, keeping a keen eye on actual results in the first quarter will be important when preparing for the coming months of continued market and economic turbulence. We expect earnings revisions to continue at the current negative rate until more information surfaces and companies can get a better handle on operations.

Drilling down into sector-specific insights, industry earnings will vary greatly. Financials, banks specifically, kicked off this earnings season with significant quarterly losses. Some of the biggest banks reported greater than 40% drops in earnings. Market volatility helped some firm’s trading divisions, however, the necessary buildup of reserves set aside for potential, future loan defaults took a toll on many of their bottom lines. Energy companies will also feel the pain, which should come as no surprise due to the historic drop in oil prices driven by oversupply and a slash in demand. In fact, certain crude oil futures contracts even dipped below $0/barrel on Monday. Finally, Industrials are also set to disappoint. To provide a better picture of the sector, we can break it down further into Transportation, Capital Goods, and Commercial & Professional Services. All areas have been significantly influenced by coronavirus related disruption.

On the other hand, expect Information Technology and Communication Services to be among the leaders this earnings season on a relative basis. These two sectors, in particular, may have varying results within the category (consider a hardware company hurt by a supply disruption while a software company may be experiencing increased demand) but on the aggregate should fare relatively well. In addition, some of the more defensive sectors such as Health Care and Utilities are likely to fall into the leader’s category.

So where do we go from here? Positive drug/vaccine developments and the eventual, gradual “re-opening” of America will help lift sentiment. Still, it’s important not to look past the facts and not to underestimate the historic economic blow the coronavirus has dealt to the global economy. We continue to favor quality companies, those that exhibit stable and robust balance sheets absent of excessive leverage, a consistent track record of increased and growing profitability, and a skillful and experienced management team in place to help weather the storm. In addition, keeping some cyclical exposure in quality companies may help portfolios participate in the upside once the market does stabilize and the days of whipsaw volatility are reduced.

It is also important to remember that history shows us that time in the market has a bigger impact on long-term performance than trying to time the market successfully. In this regard, we encourage investors to stay disciplined and work with experienced financial professionals to help manage their portfolios through various market cycles within an appropriately diversified framework that is consistent with their objectives, time-frame, and tolerance for risk.

Important Information and Disclaimers

Disclosures: Past performance does not guarantee future results. We have taken this information from sources that we believe to be reliable and accurate. Hennion and Walsh cannot guarantee the accuracy of said information and cannot be held liable. You cannot invest directly in an index. Diversification can help mitigate the risk and volatility in your portfolio but does not ensure a profit or guarantee against loss. Hennion & Walsh is the sponsor of SmartTrust® Unit Investment Trusts (UITs). For more information on SmartTrust® UITs, please visit www.smarttrustuit.com. The overview above is for informational purposes and is not an offer to sell or a solicitation of an offer to buy any SmartTrust® UITs. Investors should consider the Trust’s investment objective, risks, charges and expenses carefully before investing. The prospectus contains this and other information relevant to an investment in the Trust and investors should read the prospectus carefully before they invest.

Investing in foreign securities presents certain risks not associated with domestic investments, such as currency fluctuation, political and economic instability, and different accounting standards. This may result in greater share price volatility. These risks are heightened in emerging markets.

There are special risks associated with an investment in real estate, including credit risk, interest rate fluctuations and the impact of varied economic conditions. Distributions from REIT investments are taxed at the owner’s tax bracket.

The prices of small company and mid cap stocks are generally more volatile than large company stocks. They often involve higher risks because smaller companies may lack the management expertise, financial resources, product diversification and competitive strengths to endure adverse economic conditions.

Investing in commodities is not suitable for all investors. Exposure to the commodities markets may subject an investment to greater share price volatility than an investment in traditional equity or debt securities. Investments in commodities may be affected by changes in overall market movements, commodity index volatility, changes in interest rates or factors affecting a particular industry or commodity.

Products that invest in commodities may employ more complex strategies which may expose investors to additional risks.

Investing in fixed income securities involves certain risks such as market risk if sold prior to maturity and credit risk especially if investing in high yield bonds, which have lower ratings and are subject to greater volatility. All fixed income investments may be worth less than original cost upon redemption or maturity. Bond Prices fluctuate inversely to changes in interest rates. Therefore, a general rise in interest rates can result in the decline of the value of your investment.

Definitions

MSCI- EAFE: The Morgan Stanley Capital International Europe, Australasia and Far East Index, a free float-adjusted market capitalization index that is designed to measure developed-market equity performance, excluding the United States and Canada.

MSCI-Emerging Markets: The Morgan Stanley Capital International Emerging Market Index, is a free float-adjusted market capitalization index that is designed to measure the performance of global emerging markets of about 25 emerging economies.

Russell 3000: The Russell 3000 measures the performance of the 3000 largest US companies based on total market capitalization and represents about 98% of the investible US Equity market.

ML BOFA US Corp Mstr [Merill Lynch US Corporate Master]: The Merrill Lynch Corporate Master Market Index is a statistical composite tracking the performance of the entire US corporate bond market over time.

ML Muni Master [Merill Lynch US Corporate Master]: The Merrill Lynch Municipal Bond Master Index is a broad measure of the municipal fixed income market.

Investors cannot directly purchase any index.

LIBOR, London Interbank Offered Rate, is the rate of interest at which banks offer to lend money to one another in the wholesale money markets in London.

The Dow Jones Industrial Average is an unweighted index of 30 “blue-chip” industrial U.S. stocks.

The S&P Midcap 400 Index is a capitalization-weighted index measuring the performance of the mid-range sector of the U.S. stock market, and represents approximately 7% of the total market value of U.S. equities. Companies in the Index fall between S&P 500 Index and the S&P SmallCap 600 Index in size: between $1-4 billion.

DJ Equity REIT Index represents all publicly traded real estate investment trusts in the Dow Jones U.S. stock universe classified as Equity REITs according to the S&P Dow Jones Indices REIT Industry Classification Hierarchy. These companies are REITs that primarily own and operate income-producing real estate.