Economic Resilience Shines Through Trade Uncertainty

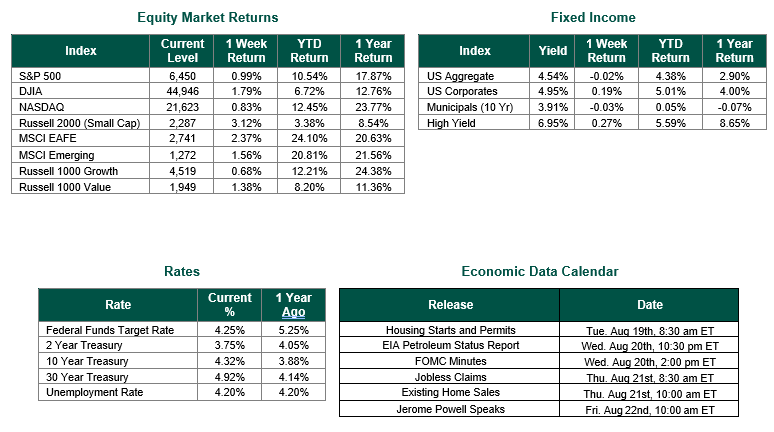

Global equity markets finished higher for the week. In the U.S., the S&P 500 Index closed the week at a level of 6,450, representing a gain of 0.99%, while the Russell Midcap Index moved 1.79% last week. Meanwhile, the Russell 2000 Index, a measure of the Nation’s smallest publicly traded firms, returned 3.12% over the week. Developed international equity performance and emerging markets were also positive, returning 2.37% and 1.56%, respectively. Finally, the 10-year U.S. Treasury yield moved higher, closing the week at 4.32%.

Markets navigated a volatile week with cautious optimism, driven by key economic releases and trade developments. The Consumer Price Index (CPI) for July rose 0.2% month-over-month and 2.8% year-over-year, slightly above the expected 2.7%. Shelter costs (+0.2%) and food prices (+0.3%) were key drivers, while energy prices fell 1.1%. Core CPI, excluding food and energy, increased 0.3% monthly and 3.1% annually, exceeding forecasts, signaling persistent service-sector inflation. The Producer Price Index (PPI), meanwhile, climbed 0.2% month-over-month and 2.3% year-over-year, in line with estimates, with goods prices up 0.4% and services flat. Portfolio management fees rose 5.4%, representing the largest contributor to the indexes gains. Retail sales for July grew 0.5% month-over-month, matching expectations, with year-over-year growth at 3.9%, led by nonstore retailers (8.0%) and food services (5.6%), reflecting robust consumer spending despite tariff concerns.

Corporate earnings remained a bright spot, with 83% of S&P 500 companies reporting Q2 results surpassing EPS estimates, above the five-year average of 78%, according to FactSet. The blended earnings growth rate hit 10.8%, up from 4.9% at quarter-end, with revenue growth at 6.1%. Information Technology and Communication Services led gains, though some firms cautioned about tariff-related cost pressures.

Trade news ultimately drove market swings. President Trump’s faltering U.S.-China trade talks, announced midweek, sparked concerns over potential 25% tariffs, causing a Thursday dip. A 90-day tariff delay for Mexico, reported August 14, eased fears, boosting sentiment by Friday. Jobless claims for the week ending August 9, reported August 14, dropped to 224,000, down 3,000 from the prior week, underscoring labor market resilience. The 10-year Treasury yield fell to 4.25% after mixed economic signals, with markets pricing a 90% chance of a September rate cut, up from 42% two weeks ago.

Looking ahead, investors are focused on upcoming consumer sentiment and housing data to gauge economic momentum. Stable PPI and strong retail sales highlight resilience, but trade risks persist. Diversified portfolios are crucial to balance tariff-related volatility while capitalizing on earnings strength and consumer spending trends.

Best wishes for the week ahead!

Equity and Fixed Income Index returns sourced from Bloomberg on 8/15/25. CPI and PPI data sourced from the U.S. Bureau of Labor Statistics on 8/12/25 and 8/14/25, respectively. Retail Sales data sourced from the U.S. Jobs data sourced from the U.S. Department of Labor on 8/14/25. Census Bureau on 8/15/25. Economic Calendar Data from Econoday as of 8/18/25. International developed markets are measured by the MSCI EAFE Index, emerging markets are measured by the MSCI EM Index, and U.S. Large Caps are defined by the S&P 500 Index. Sector performance is measured using the GICS methodology.

Disclosures: Past performance does not guarantee future results. We have taken this information from sources that we believe to be reliable and accurate. Hennion and Walsh cannot guarantee the accuracy of said information and cannot be held liable. You cannot invest directly in an index. Diversification can help mitigate the risk and volatility in your portfolio but does not ensure a profit or guarantee against a loss.