Equities Reach All-Time Highs Despite Economic Uncertainty

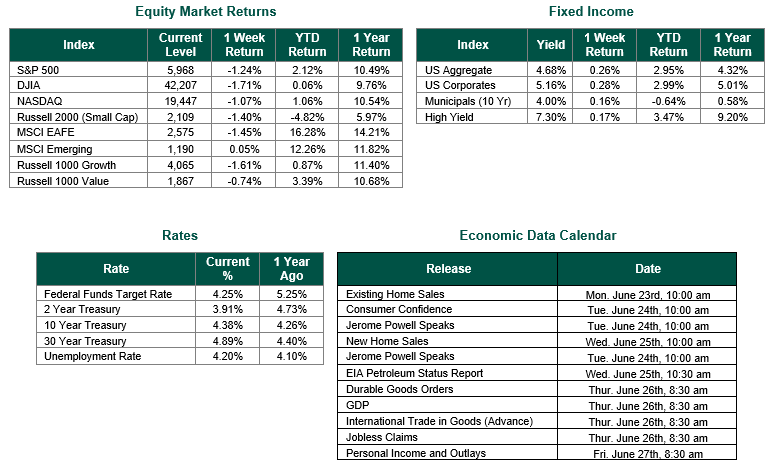

Global equity markets finished mixed for the week. In the U.S., the S&P 500 Index closed the week at a level of 6,173, representing a gain of 3.45%, while the Russell Midcap Index moved -1.10% last week. Meanwhile, the Russell 2000 Index, a measure of the Nation’s smallest publicly traded firms, returned 3.01% over the week. As developed international equity performance and emerging markets were positive, returning 3.11% and 3.35%, respectively. Finally, the 10-year U.S. Treasury yield moved lower, closing the week at 4.28%.

Last week, U.S. economic data painted a mixed picture of resilience and emerging headwinds. Durable goods orders surged in May by an impressive 16.4%, driven largely by a rebound in transportation equipment, particularly a 231% spike in non-defense aircraft orders. Even excluding transportation, orders rose by a modest 0.5%, suggesting underlying strength in manufacturing despite ongoing tariff uncertainties. The third estimate of U.S. GDP for Q1 2025, released on June 26, showed the economy contracted at an annualized rate of -0.5%, a sharper decline than earlier estimates of -0.2% and -0.3%. This downward revision was primarily due to weaker consumer spending and exports, which more than offset gains in investment and services output. However, continuing claims rose to 1.974 million, the highest since late 2021, indicating that laid-off workers are finding it harder to secure new employment. Personal income data for May showed a 0.4% decline, while disposable personal income dropped 0.6%. Personal consumption expenditures also edged down 0.1%, reflecting cautious consumer behavior amid economic uncertainty. Altogether, the week’s data suggested a cooling economy with pockets of strength, as businesses and households navigate a complex landscape shaped by trade policy, inflationary pressures, and shifting labor dynamics.

Irrespective of a possible cooling economy, the S&P 500 and Nasdaq Composite surged to all-time highs during the final week of June, propelled by a confluence of market-friendly developments. Investor sentiment was buoyed by renewed optimism over global trade negotiations, particularly after Canada scrapped its digital services tax on U.S. tech firms, signaling progress in talks with the United States. This move, coupled with expectations of deeper Federal Reserve interest rate cuts amid soft economic data, helped fuel a rally in rate-sensitive and growth-oriented sectors like technology. Major tech players posted notable gains, while enthusiasm around artificial intelligence continued to drive bullish momentum. Additionally, strong company earnings and positive results from the Fed’s annual bank stress tests reinforced confidence in corporate resilience. Despite lingering geopolitical tensions and tariff uncertainties, the market’s rebound from its spring lows reflected a broader belief that policy risks were easing and that the economic backdrop, while mixed, remained supportive of equity valuations.

Best wishes for the week ahead, and please enjoy the celebration of the birth of our great Nation!

Equity and Fixed Income Index returns sourced from Bloomberg on 6/27/25. The Durable Goods Data sourced from the U.S. Census Bureau. GDP and Personal Income data sourced from the Bureau of Economic Analysis. Weekly Jobless Claims sourced from the U.S. Department of Labor. Economic Calendar Data from Econoday as of 6/27/25. International developed markets are measured by the MSCI EAFE Index, emerging markets are measured by the MSCI EM Index, and U.S. Large Caps are defined by the S&P 500 Index. Sector performance is measured using the GICS methodology.

Disclosures: Past performance does not guarantee future results. We have taken this information from sources that we believe to be reliable and accurate. Hennion and Walsh cannot guarantee the accuracy of said information and cannot be held liable. You cannot invest directly in an index. Diversification can help mitigate the risk and volatility in your portfolio but does not ensure a profit or guarantee against a loss.