Equities Soar as Government Shutdown Continues

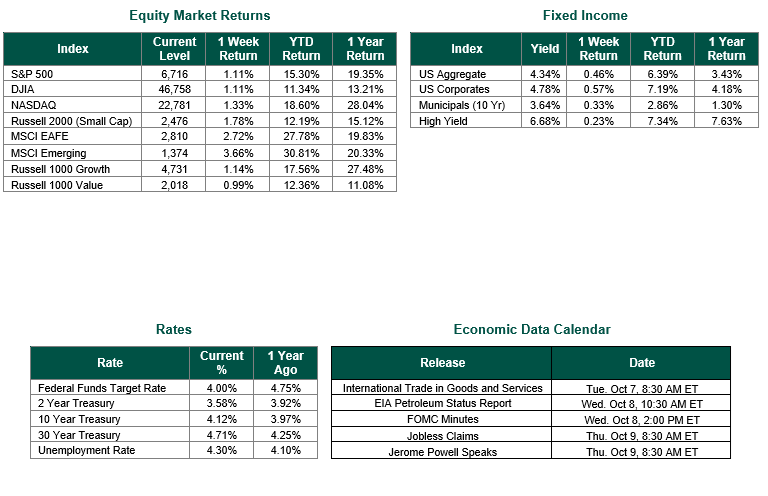

Global equity markets finished higher for the week. In the U.S., the S&P 500 Index closed the week at a level of 6,716, representing a gain of 1.11%, while the Russell Midcap Index moved 0.77% higher last week, closing near 3,713. Meanwhile, the Russell 2000 Index, a measure of the nation’s smallest publicly traded firms, returned 1.78% over the week. Developed international equities were strong, with the MSCI EAFE Index returning 2.72%, while emerging markets outperformed, as the MSCI Emerging Markets Index gained 3.66%. Finally, the 10-year U.S. Treasury yield moved higher, closing the week at 4.12%.

Last week, several notable economic data releases and developments shaped investor sentiment and policy discussions. Most significantly, the federal government officially shut down at midnight on October 1, after Congress failed to pass a funding bill amid partisan disagreements over spending levels and health care subsidies. This conclusion marked the first shutdown in six years and resulted in roughly 900,000 federal employees being furloughed, another 700,000 federal employees working without pay, and uncertainty for upcoming economic report releases.

On the employment front, the ADP report released last Wednesday indicated the private sector shed 32,000 jobs in September, painting a picture of a cooling labor market. However, the more comprehensive government jobs report, scheduled for release on Friday, was delayed due to the previously mentioned shutdown, depriving policymakers and investors of critical data needed for timely assessments of labor market health. The Job Openings and Labor Turnover Survey (JOLTS) showed hiring and job separations remained nearly unchanged, with hiring rates stuck at decade-long lows, although firings remained rare.

Consumer confidence also declined in September, reaching its lowest level since April, as measured by The Conference Board, reinforcing worries about waning momentum in consumer demand. With both employment and confidence data suggesting a loss of steam, the government shutdown further clouded economic visibility, at least for the time being.

These disruptions and underlying data trends may have implications for monetary policy and the Federal Reserve. The lack of new federal economic data complicates the Fed’s ability to make well-informed decisions ahead of its next scheduled meeting at the end of October, where another interest rate cut of 25 bps (0.25%) is widely anticipated. Ultimately, the cooling of the labor market and the drop in consumer confidence, alongside policy uncertainty associated with the government shutdown, increase the probability of a near-term rate cut in our opinion.

Despite the disruptions caused by the shutdown and the delayed government economic data, the equity markets reached record levels during the week, with both the Dow Jones Industrial Average and S&P 500 index hitting all-time highs. This stock market resilience can be attributed to strong corporate earnings, excitement about advancements in artificial intelligence, optimistic expectations of future Federal Reserve interest rate cuts, and the historical tendency of stock markets to remain stable or even perform well during government shutdowns.

Best wishes for the week ahead!

Equity and Fixed Income Index returns sourced from Bloomberg on 10/3/25. ADP Employment Data was sourced from Automatic Data Processing Inc. The Job Openings and Labor Turnover Survey (JOLTS) Data was sourced from the Bureau of Labor Statistics. Consumer Confidence Data was sourced from The Conference Board. Economic Calendar Data from Econoday as of 10/3/25. International developed markets are measured by the MSCI EAFE Index, emerging markets are measured by the MSCI EM Index, and U.S. Large Caps are defined by the S&P 500 Index. Sector performance is measured using the GICS methodology.

Disclosures: Past performance does not guarantee future results. We have taken this information from sources that we believe to be reliable and accurate. Hennion and Walsh cannot guarantee the accuracy of said information and cannot be held liable. You cannot invest directly in an index. Diversification can help mitigate the risk and volatility in your portfolio but does not ensure a profit or guarantee against a loss.