Fed Cuts Rates for the 1st Time in 2025

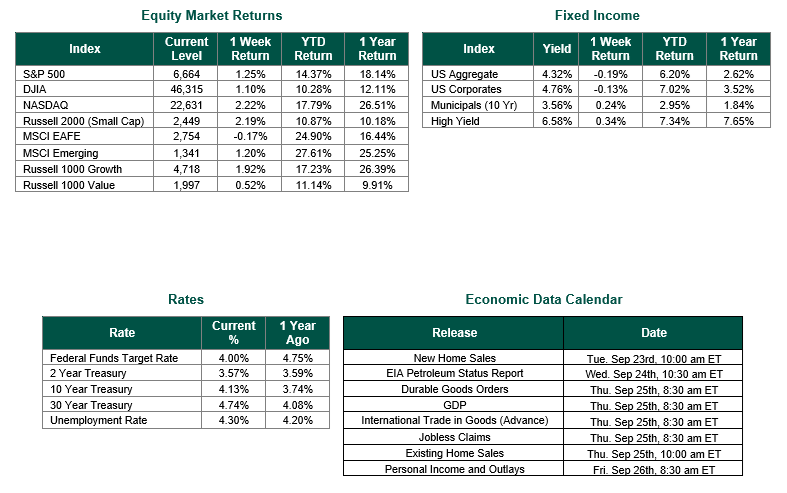

Global equity markets finished higher for the week. In the U.S., the S&P 500 Index closed the week at a level of 6,664, representing a gain of 1.25%, while the Russell Midcap Index moved -0.37% last week. Meanwhile, the Russell 2000 Index, a measure of the Nation’s smallest publicly traded firms, returned 2.19% over the week. As developed international equity performance and emerging markets were mixed, returning -0.17% and 1.20%, respectively. Finally, the 10-year U.S. Treasury yield moved higher, closing the week at 4.13%.

Retail sales data released last Tuesday showed stronger-than-expected consumer activity for August, with overall sales rising by 0.6%, surpassing the consensus forecast of 0.2%. July’s figures were also revised upward to a 0.6% gain from the previously reported 0.5%. Despite trade tensions and a softening labor market, consumer spending remained resilient, signaling continued economic momentum heading into the final quarter of the year.

The Federal Reserve, as widely anticipated, implemented a 25 basis point interest rate cut on Wednesday by a vote of 11-1, marking the first such move in 2025 and bringing the Federal Funds Target Rate to a range of 4.00%–4.25%. Notably, the sole dissenter was newly appointed Governor Stephen Miran, who advocated for a more aggressive 50 basis point cut. In addition to the rate change, the Fed revised its forecast to include three total rate cuts totaling 75 basis points for 2025, up from the two cuts totaling 50 basis points projected in June. This adjustment, reflected in the updated Dot Plot chart, implies that further 25 basis point reductions are now expected at each of the final two FOMC meetings of the year.

Looking ahead, the Fed maintained its June rate projections for 2026 and 2027, forecasting one 25 basis point cut in each year. Collectively, these anticipated cuts would bring the Federal Funds Target Rate closer to the Fed’s stated neutral rate of 3% by 2027. On the balance sheet front, the Fed confirmed it will continue reducing its holdings of Treasury securities, agency debt, and agency mortgage-backed securities. The monthly redemption cap on Treasury securities, which was lowered from $25 billion to $5 billion in April, remains unchanged, as does the $35 billion cap on agency-related securities.

From a critical standpoint, if the Fed truly operates in a “data dependent” manner, its June forecasts would have justified a 25 basis point cut earlier—perhaps in either June or July. In our view, the Fed is once again behind the curve, albeit for different reasons this time. Their updated Summary of Economic Projections shows unemployment ending 2025 at 4.5% (unchanged from June), dipping slightly to 4.4% in 2026, and remaining above 4.2% through 2028. Inflation, measured by Core PCE, is expected to end 2025 at 3.1% (also unchanged), fall to 2.6% in 2026 (up from 2.4% in June), and reach the 2% target by 2028. Real GDP growth is now projected to end 2025 at 1.6% (up from 1.4%) and rise to 1.8% in 2026 (up from 1.6%), though it is expected to stay below 2% through 2028.

Given the recent slowdown in job growth and the Bureau of Labor Statistics’ revision showing 911,000 fewer jobs created over the past year than initially reported, it’s surprising, in our view, that the Fed did not revise its unemployment forecasts. Nevertheless, barring a resurgence in inflation, it appears the Fed is now placing greater emphasis on the employment side of its dual mandate. Chair Powell acknowledged in his post-meeting remarks that “the downside risks to employment have risen” and that “moderate economic (GDP) growth was largely a result of a slowdown in consumer spending.”

Ultimately, it’s important to remember that only the views of voting FOMC members truly influence policy, and attempting to predict their moves often proves futile and can lead to short-term market volatility throughout the remainder of 2025 and into early 2026. That said, based on the Fed’s own projections and commentary, interest rates, yields, and inflation are expected to trend lower, while economic growth should remain relatively stable. This outlook presents promising opportunities for selective investments in both equities and fixed income over the next two years.

While the Fed’s actions and projections indicate a gradual path toward easing monetary policy, the interplay between slowing labor market conditions, persistent though moderating inflation, and resilient consumer spending will remain the key drivers of market sentiment. Investors should expect periodic bouts of volatility as data releases and Fed communications shape expectations, but the broader trend points to a more accommodative policy stance over time. For long-term investors, this environment underscores the importance of staying disciplined, patient, and selective in positioning across asset classes, with particular attention to sectors and strategies that can benefit from declining rates and stable economic growth.

Best wishes for the week ahead!

Equity and Fixed Income Index returns sourced from Bloomberg on 9/19/25. Retail Sales Data for August 2025 was sourced from the Commerce Department. The Federal Reserve is the source for FOMC data. Economic Calendar Data from Econoday as of 9/5/25. International developed markets are measured by the MSCI EAFE Index, emerging markets are measured by the MSCI EM Index, and U.S. Large Caps are defined by the S&P 500 Index. Sector performance is measured using the GICS methodology.

Disclosures: Past performance does not guarantee future results. We have taken this information from sources that we believe to be reliable and accurate. Hennion and Walsh cannot guarantee the accuracy of said information and cannot be held liable. You cannot invest directly in an index. Diversification can help mitigate the risk and volatility in your portfolio but does not ensure a profit or guarantee against a loss.