Fed Keeps Rates Steady

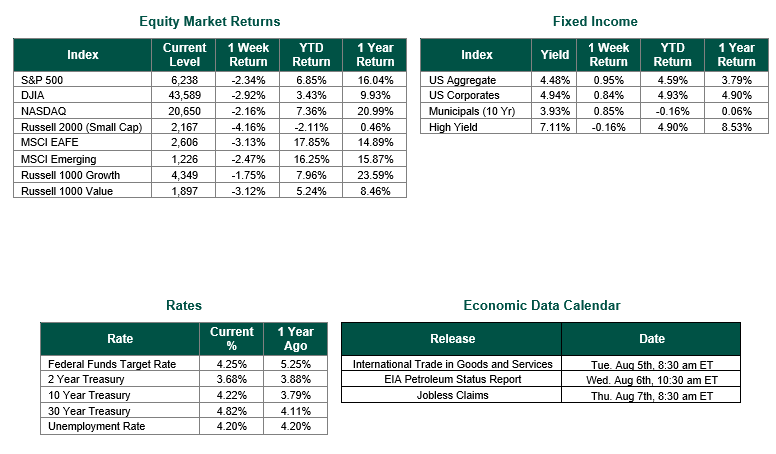

Global equity markets finished higher for the week. In the U.S., the S&P 500 Index closed the week at a level of 6,238, representing a weekly gain of –2.34%, while the Russell Midcap Index moved approximately +1.4% last week. Meanwhile, the Russell 2000 Index, a measure of the Nation’s smallest publicly traded firms, returned –4.16% over the week. As developed, international equity performance and emerging markets were positive, returning –3.13% and –2.47%, respectively. Finally, the 10-year U.S. Treasury yield moved higher, closing the week at 4.22%.

Last week was highlighted by a mixed picture of economic data, corporate earnings, and trade negotiations. The July jobs report added only 73,000 non-farm payrolls, missing the 100,000 forecast, with unemployment rising to 4.2%. Prior months’ job figures were revised down by 250,000, signaling labor market weakness. Retail sales grew 0.4%, beating expectations of 0.3%, showing consumer resilience. The ISM manufacturing PMI dropped to 48% from 49%, indicating ongoing sector contraction due to declines in employment and supplier deliveries.

Corporate earnings, however, were a bright spot, with 82% of S&P 500 companies reporting Q2 results exceeding EPS estimates, surpassing the five-year average of 78%. The blended earnings growth rate reached 10.3%, up from 4.9% at quarter-end, with revenue growth at 5.9% year-over-year, beating June projections of 4.2%, according to FactSet.

Trade developments heavily influenced markets over the course of the week as President Trump’s August 1 deadline for new trade deals saw agreements with the EU, Japan, and South Korea, setting tariffs at 15% for most exports to the U.S., lower than the initially feared 30%. Mexico received a 90-day negotiation extension, while Canada faced a 35% tariff on non-exempt goods, effective August 7. A 90-day extension for U.S.-China talks signaled ongoing challenges, contributing to a late-week sell-off. The U.S. dollar strengthened, while Treasury yields fell, with the 10-year note dropping to 4.27% after the jobs data, as markets priced in an 85% chance of a September Fed rate cut, up from 63% pre-report, according to CME Group.

As expected, the Federal Reserve maintained rates at 4.25%–4.5% in its July meeting, with Chair Jerome Powell emphasizing a data-dependent approach amid tariff-related inflation uncertainties. Two dissenting governors favored an immediate 25-basis-point cut, and markets now anticipate 1–2 cuts in 2025’s second half, potentially easing to a neutral rate of 3%–3.5% by 2026. Investors should expect volatility as trade negotiations and economic data unfold. Diversified portfolios remain essential to balance risks and capitalize on earnings-driven opportunities.

Best wishes for the Week ahead.

Equity and Fixed Income Index returns sourced from Bloomberg on 8/1/25. Corporate Earnings Data sourced from FactSet. Jobs data sourced from the Bureau of Labor Statistics on 8/1/25. Economic Calendar Data from Econoday as of 8/4/25. International developed markets are measured by the MSCI EAFE Index, emerging markets are measured by the MSCI EM Index, and U.S. Large Caps are defined by the S&P 500 Index. Sector performance is measured using the GICS methodology.

Disclosures: Past performance does not guarantee future results. We have taken this information from sources that we believe to be reliable and accurate. Hennion and Walsh cannot guarantee the accuracy of said information and cannot be held liable. You cannot invest directly in an index. Diversification can help mitigate the risk and volatility in your portfolio but does not ensure a profit or guarantee against a loss.