Fed Pauses and Earnings Growth Continues

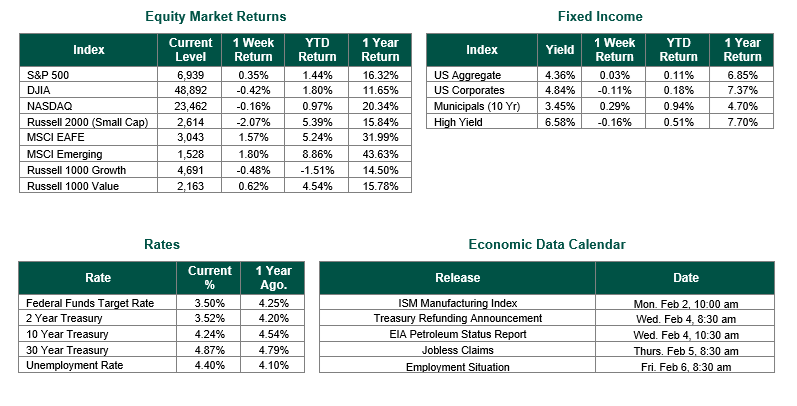

Global equity markets finished mixed for the week. In the U.S., the S&P 500 Index closed the week at a level of 6939, representing an increase of 0.35%, while the Russell Midcap Index moved -1.27% last week. Meanwhile, the Russell 2000 Index, a measure of the Nation’s smallest publicly traded firms, returned -2.07% over the week. As developed international equity performance and emerging markets were positive, returning 1.57% and 1.80%, respectively. Finally, the 10-year U.S. Treasury yield moved higher, closing the week at 4.24%.

Last week’s economic developments painted a picture of resilience amid some inflationary pressures and robust corporate earnings. Throughout this update, we will provide our insights into this busy week of market information.

The January FOMC meeting concluded with the Federal Reserve voting 10–2 to maintain the Federal Funds Target Rate at 3.50%–3.75%, in line with expectations. Dissenting members Miran and Waller supported a 25-basis-point rate cut. In its statement, the Fed noted that economic activity continues to expand solidly, job gains remain modest, and inflation remains somewhat elevated. As a reminder, the Fed’s December 2025 Dot Plot projected two 25-basis-point cuts—one each in 2026 and 2027—that would lower the rate to its neutral level of 3%. Updated economic projections from the Fed in December forecast real GDP growth of 2.3% by the end of 2026, unemployment steady at 4.4%, and core PCE inflation easing to 2.5%, not reaching the 2% target until 2028. The Fed also resumed Treasury purchases in December, signaling a modest shift toward accommodation that could affect longer-term yields. Although predicting the Fed’s next moves is uncertain, current guidance suggests limited easing this year—possibly two small rate cuts, with the first no earlier than May—unless labor market conditions worsen or inflation declines more sharply.

The Producer Price Index (PPI) data for December 2025, released by the Bureau of Labor Statistics (BLS) on Friday, showed a sharper-than-expected increase, with the final demand PPI rising 0.5% month-over-month—more than double the consensus forecast of 0.2%—marking the largest gain in five months. Year-over-year, producer prices climbed 3.0%, an improvement from 3.5% in 2024, driven primarily by a 0.7% surge in services prices (including a 1.7% jump in trade margins for machinery and equipment wholesaling), while goods prices held steady at 0% monthly amid declines in food (-0.3%) and energy (-1.4%). Core PPI, excluding food and energy, also accelerated to 0.7% monthly and stood at 3.3% annually, signaling potential pass-through of higher input costs from tariffs and raising concerns about consumer inflationary pressures ahead. However, several analysts noted that the jump was concentrated and unlikely to persist, given volatile components such as margins.

Fourth quarter 2025 earnings continued to show a generally strong reporting season for S&P 500 companies, with results coming in ahead of expectations on both earnings and revenue, according to FactSet. The blended year-over-year earnings growth rate for the index improved to about 11.9% as more companies reported, up from roughly 8% the prior week and at the end of the quarter, reflecting the impact of widespread positive earnings surprises. Sectors such as Industrials, Information Technology, and Communication Services were key drivers of this improvement, helped by notably strong reports from large constituents including Apple, Microsoft, Meta Platforms, Boeing, and GE Vernova, many of which beat consensus EPS and revenue estimates by meaningful margins. In aggregate, companies were reporting earnings roughly 9% above analyst expectations, a surprise rate above recent 1-, 5-, and 10-year averages, while revenue growth for the quarter also accelerated as more firms topped sales estimates. Looking ahead, FactSet data showed analysts expecting double-digit earnings growth to continue through 2026, with full-year S&P 500 earnings projected to rise in the mid-teens and the forward 12-month price-to-earnings (P/E) ratio remaining elevated versus its 5- and 10-year historical averages, underscoring resilient corporate profitability but also a market that is already pricing in a favorable earnings outlook.

In case that wasn’t enough activity, President Trump selected former Fed Governor Kevin Warsh as his nominee to be Jerome Powell’s successor on Friday. Warsh, once the youngest-ever Fed governor, now faces Senate confirmation.

Best wishes for the week ahead!

Equity and Fixed Income Index returns sourced from Bloomberg on 1/30/26. FOMC data was sourced from the Federal Reserve. The Producer Price Index was sourced from the Bureau of Labor Statistics. Fourth quarter earnings data was sourced for Fact Set. Calendar Data from Econoday as of 1/30/26. International developed markets are measured by the MSCI EAFE Index, emerging markets are measured by the MSCI EM Index, and U.S. Large Caps are defined by the S&P 500 Index. Sector performance is measured using the GICS methodology.

Disclosures: Past performance does not guarantee future results. We have taken this information from sources that we believe to be reliable and accurate. Hennion and Walsh cannot guarantee the accuracy of said information and cannot be held liable. You cannot invest directly in an index. Diversification can help mitigate the risk and volatility in your portfolio, but does not ensure a profit or guarantee against a loss.