Front and Center: Greece and the Fed

Market Overview

Happening Now

Front and Center: Greece and the Fed

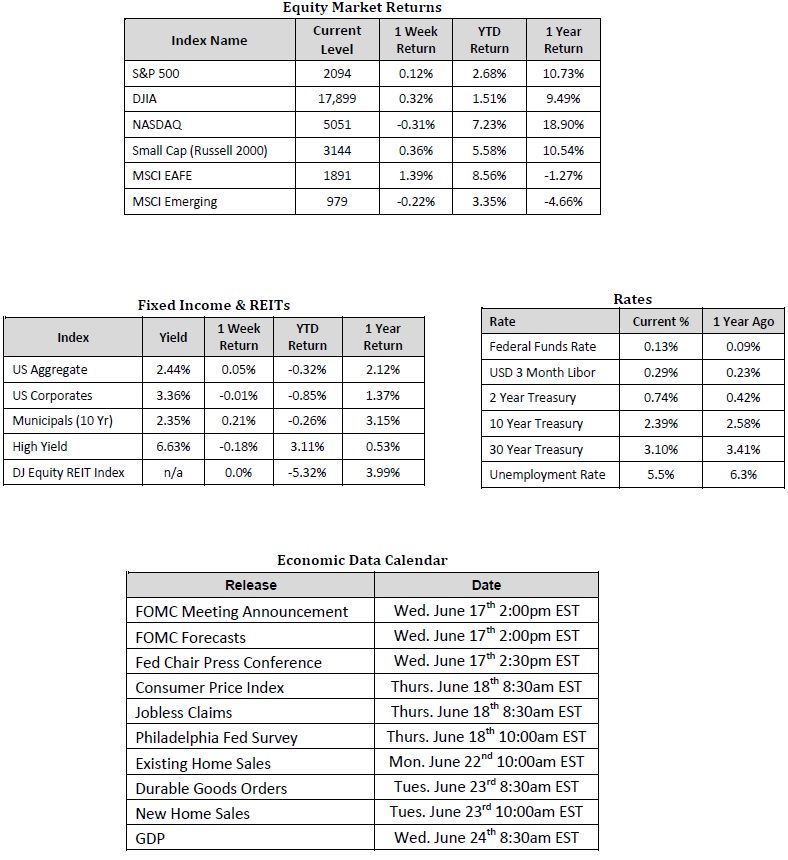

Market participants await the results of this week’s Federal Open Markets Committee (FOMC) meeting while jitters surrounding the potential Greek exit from the Euro weigh on risk assets. Last week, markets were relatively stable with the S&P 500 index gaining 0.12%, the NASDAQ index falling 0.31% and developed international markets, as measured by the MSCI EAFE index, putting together a 1.32% gain thanks to large moves to the upside on Wednesday, 6/10 and Thursday, 6/11. This week, however, following unproductive Greek discussions over the weekend and ahead of the Fed’s fourth statement in 2015, trading appears more defensive with German and U.S. government bond prices increasing and equity indexes producing mixed results on Monday and Tuesday.

Investors appear to be pricing in a higher probability of a Greek exit from the Euro and we believe that any sell offs in European stocks, specifically those of the stronger more developed countries, like Germany and France, will prove to be short term in nature and may present opportunities for attractive entry points. Our analysis of the economic improvements seen in the Eurozone, along with the expansionary monetary policies in place, supports long term growth potential for equities. However, we recognize the potential for volatility over the short term and caution investors to take a diversified approach when considering investments in international developed (and emerging) stock markets.

Here in the U.S., the long awaited June 2015 Fed meeting is set to begin Tuesday, June 16 and culminate with Fed Chair Janet Yellen’s press conference on Wednesday, June 17 following their second day of talks and the release of their latest decision. During most of 2014, this June meeting was seen as the most likely time for the first Fed Fund’s rate hike since June of 2006. With the lack of wage growth, decline in oil prices and no meaningful economic growth in the first quarter, most “fed forecasters” are now suggesting September is when we will get the hotly anticipated, 25 bps increase in the target rate.

It’s hard for us to envision how, in the long term, a three month delay in raising rates by just 25 bps will actually help the economy. After keeping rates at near zero since 2008, we believe that the terminal rate the fed will allow its target to rise to, along with the pace and duration of the tightening, is more important than when the initial rate hike actually occurs. Nonetheless, investors have to play the hand they are dealt and we are optimistic that when the rate hike does occur it will signal long awaited confidence in the economy from the most influential, and perhaps well-equipped, group of economists in the U.S..

Now is certainly the time to consider how your portfolio is invested to help ensure that you understand both the upside and downside risks inherent in your current lineup of investments.

Sources: Equity Market, Fixed Income and REIT returns from JP Morgan as of 6/12/15. Rates and Economic Calendar Data from Bloomberg as of 6/15/15.

Important Information and Disclaimers

Disclosures: Past performance does not guarantee future results. We have taken this information from sources that we believe to be reliable and accurate. Hennion and Walsh cannot guarantee the accuracy of said information and cannot be held liable.

Investing in foreign securities presents certain risks not associated with domestic investments, such as currency fluctuation, political and economic instability, and different accounting standards. This may result in greater share price volatility. These risks are heightened in emerging markets.

There are special risks associated with an investment in real estate, including credit risk, interest rate fluctuations and the impact of varied economic conditions. Distributions from REIT investments are taxed at the owner’s tax bracket.

The prices of small company and mid cap stocks are generally more volatile than large company stocks. They often involve higher risks because smaller companies may lack the management expertise, financial resources, product diversification and competitive strengths to endure adverse economic conditions.

Investing in commodities is not suitable for all investors. Exposure to the commodities markets may subject an investment to greater share price volatility than an investment in traditional equity or debt securities. Investments in commodities may be affected by changes in overall market movements, commodity index volatility, changes in interest rates or factors affecting a particular industry or commodity.

Products that invest in commodities may employ more complex strategies which may expose investors to additional risks.

Investing in fixed income securities involves certain risks such as market risk if sold prior to maturity and credit risk especially if investing in high yield bonds, which have lower ratings and are subject to greater volatility. All fixed income investments may be worth less than original cost upon redemption or maturity. Bond Prices fluctuate inversely to changes in interest rates. Therefore, a general rise in interest rates can result in the decline of the value of your investment.

Definitions

MSCI- EAFE: The Morgan Stanley Capital International Europe, Australasia and Far East Index, a free float-adjusted market capitalization index that is designed to measure developed-market equity performance, excluding the United States and Canada.

MSCI-Emerging Markets: The Morgan Stanley Capital International Emerging Market Index, is a free float-adjusted market capitalization index that is designed to measure the performance of global emerging markets of about 25 emerging economies.

Russell 3000: The Russell 3000 measures the performance of the 3000 largest US companies based on total market capitalization and represents about 98% of the investible US Equity market.

ML BOFA US Corp Mstr [Merill Lynch US Corporate Master]: The Merrill Lynch Corporate Master Market Index is a statistical composite tracking the performance of the entire US corporate bond market over time.

ML Muni Master [Merill Lynch US Corporate Master]: The Merrill Lynch Municipal Bond Master Index is a broad measure of the municipal fixed income market.

Investors cannot directly purchase any index.

LIBOR, London Interbank Offered Rate, is the rate of interest at which banks offer to lend money to one another in the wholesale money markets in London.

The Dow Jones Industrial Average is an unweighted index of 30 “blue-chip” industrial U.S. stocks.

The S&P Midcap 400 Index is a capitalization-weighted index measuring the performance of the mid-range sector of the U.S. stock market, and represents approximately 7% of the total market value of U.S. equities. Companies in the Index fall between S&P 500 Index and the S&P SmallCap 600 Index in size: between $1-4 billion.

DJ Equity REIT Index represents all publicly traded real estate investment trusts in the Dow Jones U.S. stock universe classified as Equity REITs according to the S&P Dow Jones Indices REIT Industry Classification Hierarchy. These companies are REITSs that primarily own and operate income-producing real estate