GDP Surprises with Robust Results

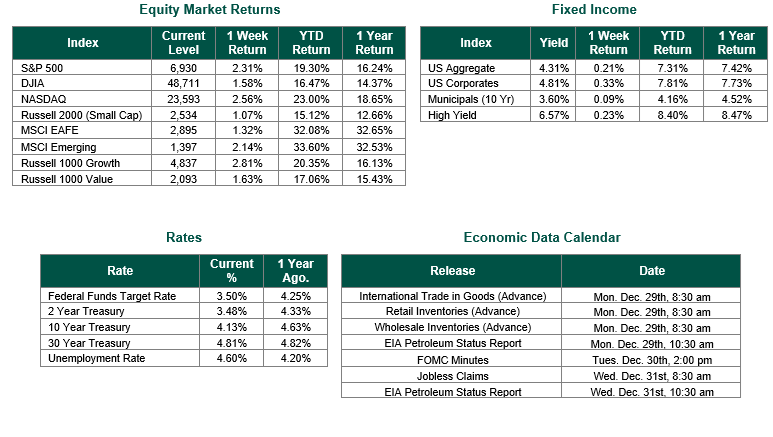

Global equity markets finished higher for the week. In the U.S., the S&P 500 Index closed the week at a level of 6930, representing an increase of 2.31%, while the Russell Midcap Index moved -0.11% last week. Meanwhile, the Russell 2000 Index, a measure of the Nation’s smallest publicly traded firms, returned +1.07% over the week. As developed international equity performance and emerging markets were positive, returning 1.32% and 2.14%, respectively. Finally, the 10-year U.S. Treasury yield moved lower, closing the week at 4.13%.

The shortened Christmas Week featured a mix of stronger headline GDP data alongside ongoing momentum in demand indicators, with several releases shaping the near-term outlook for growth, inflation, and labor markets.

The U.S. economy experienced robust growth in the third quarter of 2025, with Real GDP increasing by 4.3% (annualized rate), driven primarily by strong consumer spending on goods and services (especially healthcare and recreation) and a rebound in exports, despite a slowdown in investment. This significant uptick, reported in late December 2025, marked the strongest growth in two years and exceeded many forecasts. Imports decreased, further boosting the GDP figure, with government spending also contributing positively.

The U.S. Census Bureau reported last week (Dec. 23, 2025) that new durable goods orders for October 2025 fell by 2.2% to $307.4 billion, a larger drop than expected, driven mainly by a 6.5% decrease in transportation equipment orders (especially aircraft), though orders excluding transportation saw a slight 0.2% rise, signaling some underlying resilience in other manufacturing sectors.

The Conference Board Consumer Confidence Index fell to 89.1 in the latest report for December 2025, released on December 23, 2025, which was lower than the revised 92.9 in November. This marked the fifth consecutive month of decline amid deepening anxiety over jobs and income.

Weekly jobless claims remained in the low-to-mid 200,000 range, consistent with a labor market that was still tightening gradually but not deteriorating rapidly. The continuity of claims near this level suggested ongoing job creation and a reasonably contained pace of layoffs, reinforcing the view that the economy could sustain solid growth without a sharp uptick in unemployment.

Warmest wishes for a happy New Year and a prosperous 2026. Thank you for your continued trust, engagement, and support over the past year.

Equity and Fixed Income Index returns sourced from Bloomberg on 12/26/25. Gross Domestic Product (GDP) data was sourced from U.S. Bureau of Economic Analysis. Durable goods orders were sourced from The U.S. Census Bureau. Consumer Confidence Index supplied by the Conference Board. Weekly Jobless Claims is sourced from the U.S. Department of Labor. Calendar Data from Econoday as of 12/26/25. International developed markets are measured by the MSCI EAFE Index, emerging markets are measured by the MSCI EM Index, and U.S. Large Caps are defined by the S&P 500 Index. Sector performance is measured using the GICS methodology.

Disclosures: Past performance does not guarantee future results. We have taken this information from sources that we believe to be reliable and accurate. Hennion and Walsh cannot guarantee the accuracy of said information and cannot be held liable. You cannot invest directly in an index. Diversification can help mitigate the risk and volatility in your portfolio but does not ensure a profit or guarantee against a loss.