“Goldilocks” Economic Conditions

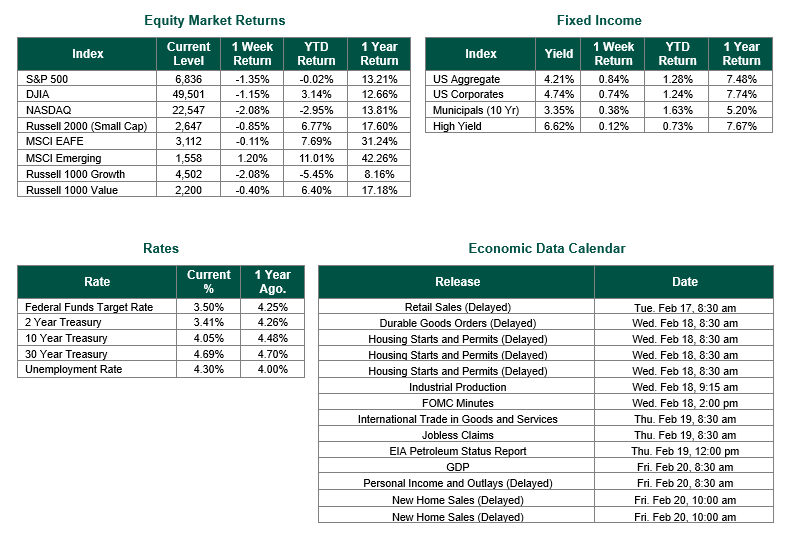

Global equity markets finished lower for the week. In the U.S., the S&P 500 Index closed the week at a level of 6836, representing a decrease of 1.35%, while the Russell Midcap Index moved -0.42% last week. Meanwhile, the Russell 2000 Index, a measure of the Nation’s smallest publicly traded firms, returned -0.85% over the week. As developed international equity performance and emerging markets were mixed, returning -0.11% and 1.20%, respectively. Finally, the 10-year U.S. Treasury yield moved lower, closing the week at 4.05%.

Economic data released over the past week painted a picture of a “Goldilocks” economy (i.e., not too hot and not too cold) that is slowing but still intact, as softer consumer spending and a stable labor market were partially offset by easing inflation and resilient corporate profitability.

Retail sales ended the year on a subdued note, with the Commerce Department reporting that overall retail and food services sales were essentially flat for December, missing expectations for 0.4% growth and marking the first monthly stall in retail sales since 2024. On a year-over-year basis, sales were up about 2.4%, a clear step down from November’s 3.3% gain, signaling that momentum in consumer spending faded as the holiday season ended despite what had been a reasonably solid performance earlier in 2025. Altogether, the report paints a picture of consumers turning more cautious under the weight of still-elevated prices, higher borrowing costs, and tariff-related distortions, capping a year in which total retail sales grew about 3.7% but leaving the economy with a slower spending backdrop heading into 2026.

The January 2026 Employment Situation report portrayed a labor market that is soft but clearly stabilizing, with total nonfarm payrolls rising by about 130,000 (versus expectations of just 55,000) and the unemployment rate edging down to 4.3%, better than forecasters had expected. Job growth was concentrated in health care and social assistance, which together added on the order of 120,000 positions, while construction also posted a solid gain of roughly 30,000 jobs. On the other hand, notable losses were recorded in federal government employment and financial activities, as earlier policy-driven downsizing and deferred resignations continued to appear in the data. The report also came with sizable downward revisions to 2025 payrolls, confirming that last year was much weaker than initially reported. Yet the recent three-month average of job gains has improved to around 100,000, suggesting the labor market may have already passed its trough. Wage growth remained moderate but steady, with average hourly earnings rising about 0.4% in the month and 3.7% over the year, a pace consistent with easing inflation but still supportive of consumer spending. Weekly jobless claims data through the February 12 release point in the same direction as filings remain relatively low by historical standards and have not shown the kind of sustained upward spike that would signal a new wave of layoffs.

The January CPI report showed a clear and encouraging step-down in U.S. inflation, with headline prices rising 2.4% over the past year and just 0.2% on the month, both slightly cooler than economists had expected. Core CPI, which strips out the more volatile food and energy prices, increased 2.5% year over year and about 0.3% month over month, marking its lowest annual pace in roughly five years and reinforcing the sense that underlying price pressures are steadily easing. The details of the report underscore a genuine, if gradual, normalization: shelter costs—long the stickiest part of the index—slowed to about a 3% annual rate with only a 0.2% monthly gain, food prices ticked up modestly by roughly 0.2%, and energy prices fell, helping to pull the overall rate of inflation down. Goods inflation continued to soften as used vehicle prices fell, and new vehicle prices rose only slightly. Taken together, the data paint a picture of an economy that has largely moved past the tariff and supply-chain shocks of 2025, giving the Federal Reserve more confidence that it is closing in on its 2% inflation target (using its preferred inflation gaugge of core PCE) and strengthening market expectations for rate cuts later in 2026, even as policymakers remain wary of rekindling inflation or undershooting growth.

Finally, fourth-quarter earnings for the S&P 500 are running solidly positive, with FactSet reporting that companies are on track for high single-digit year-over-year profit growth, alongside healthy mid-single-digit to high single-digit revenue gains as the earnings season progresses. FactSet notes that analysts revised EPS estimates slightly higher during the quarter as results have generally come in better than feared, led by particular strength in information technology, financials, and energy, even as more cyclical and rate-sensitive areas, such as some industrials and consumer names, lag. A majority of reporting companies are beating consensus on both earnings and sales, and FactSet’s blended growth measures show that Q4 2025 is extending the earnings rebound that began earlier in 2025, helping support elevated equity valuations and encouraging expectations for double-digit earnings growth for full‑year 2025 and further potential gains into 2026.

Best wishes for the week ahead!

Equity and Fixed Income Index returns sourced from Bloomberg on 2/13/26. Retail Sales data was sourced from the Commerce Department. Employment Data and the Consumer Price Index (CPI) was sourced from the Bureau of Labor Statistics. Weekly Jobless Claims are sourced from the U.S> Department of Labor. Fourth quarter earnings data was sourced for Fact Set. Calendar Data from Econoday as of 2/13/26. International developed markets are measured by the MSCI EAFE Index, emerging markets are measured by the MSCI EM Index, and U.S. Large Caps are defined by the S&P 500 Index. Sector performance is measured using the GICS methodology.

Disclosures: Past performance does not guarantee future results. We have taken this information from sources that we believe to be reliable and accurate. Hennion and Walsh cannot guarantee the accuracy of said information and cannot be held liable. You cannot invest directly in an index. Diversification can help mitigate the risk and volatility in your portfolio but does not ensure a profit or guarantee against a loss.