Last Week’s Markets in Review: A Barbell Approach to Investing in Stocks

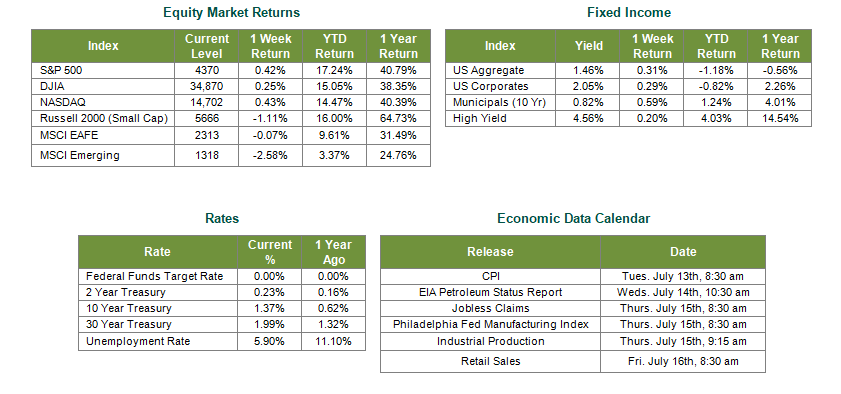

Global equity markets finished higher for the week. In the U.S., the S&P 500 Index reached record highs and closed the week at a level of 4,2334,370, representing a gain of 0.42%, while the Russell Midcap Index moved 0.21% lower last week. Meanwhile, the Russell 2000 Index, a measure of the Nation’s smallest publicly traded firms, returned -1.11% over the week. International equity performance was also negative as developed, and emerging markets returned -0.07% and -2.58%, respectively. Finally, the 10-year U.S. Treasury yield ticked lower, closing the week at 1.37%.

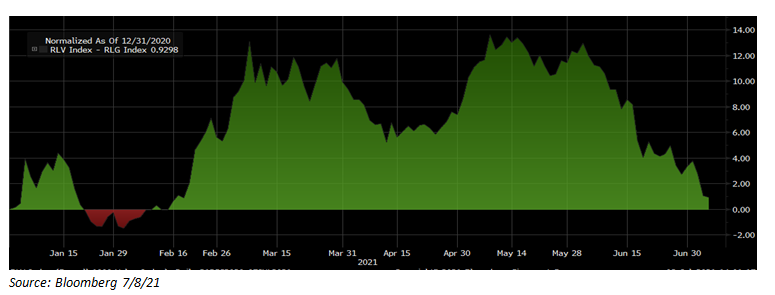

June marked a bounceback in growth-oriented stocks, which had previously taken a back seat in the growth to value rotation we’ve been tracking throughout the year. The chart below shows the relative price performance of the Russell 1000 Value (RLV) and Growth (RLG) Indexes for 2021 and depicts how the momentum has reversed course leaving the indexes nearly neck-and-neck year to date.

This resurgence has led many to question whether a lasting growth to value rotation will occur in 2021 and how to position portfolios accordingly. In the context of a strengthening U.S. economy with favorable growth prospects, we are bullish on equities overall at this stage of the economic cycle. As a result, certain investors may want to consider a more balanced, or barbell style, approach to allocating equity positions. Such an approach may include larger, relatively equal allocations to the growth and value styles and potentially a smaller allocation to dividend-paying defensive stocks settling in the middle of the barbell. Below we will discuss some of our rationale for this type of barbell equities strategy.

Growth

Interest rates have no doubt played a roll in the recent rebound of growth stocks. The 10 year U.S. Treasury yield sits at a meager 1.37%, down over 25% since March. While rising rates posed a risk to the high valuations of growth stocks early in the year, the same driver has reversed course of late and aided indexes such as the NASDAQ Composite back to new all-time highs. Even though these low levels of interest rates are unlikely to persist, we still see further upside potential in certain technology and related growth sectors. For example, we view companies and industries engaged in developing or effectively implementing innovative technologies or processes as attractive investment opportunities. The pandemic hardships acted as a catalyst for companies to adopt technology to improve efficiency, increase productivity, and cut costs. We view tis undertaking as part of a larger secular movement that will endure through a post-COVID world.

Value

Value stocks have enjoyed a nice ride for the better part of 2021. We have discussed the tailwinds for value stocks (early cycle investing, economic reopenings, lofty stock valuations, earnings rebound, etc.) in our updates this year and note that those supporting forces have not waned. As a result, allocations to value and cyclically sensitive stocks remain worthy of consideration from our perspective.

Defensive

Many investors are concerned that a stock market pullback is likely given excessive valuations, inflationary pressures, and geopolitical uncertainties. However, these same investors do not want to miss out on any additional upside equity movements that may take place during this bull market run. As a result, a defensive allocation to dividend-paying equities within their portfolios is worthy of consideration for these investors to help them maintain exposure to U.S. equities with some degree of downside protection.

Whether you favor overweighting any one of these three areas or adopting a barbell approach such as the one describe above this summer, we encourage investors to work with experienced financial professionals to help build and manage the asset allocations within their portfolios consistent with their objectives, timeframe, and tolerance for risk.

Best wishes for the week ahead!

Sources for data in tables: Equity Market and Fixed Income returns are from JP Morgan as of 7/9/21. Rates and Economic Calendar Data from Bloomberg as of 7/9/21. International developed markets measured by the MSCI EAFE Index, emerging markets measured by the MSCI EM Index, U.S. Large Cap defined by the S&P 500. Sector performance is measured using the GICS methodology.

Disclosures: Past performance does not guarantee future results. We have taken this information from sources that we believe to be reliable and accurate. Hennion and Walsh cannot guarantee the accuracy of said information and cannot be held liable. You cannot invest directly in an index. Diversification can help mitigate the risk and volatility in your portfolio but does not ensure a profit or guarantee against a loss.

Diversification can help mitigate the risk and volatility in your portfolio but does not ensure a profit or guarantee against loss.

Investing in commodities is not suitable for all investors. Exposure to the commodities markets may subject an investment to greater share price volatility than an investment in traditional equity or debt securities. Investments in commodities may be affected by changes in overall market movements, commodity index volatility, changes in interest rates or factors affecting a particular industry or commodity.

Products that invest in commodities may employ more complex strategies which may expose investors to additional risks.

Investing in fixed income securities involves certain risks such as market risk if sold prior to maturity and credit risk especially if investing in high yield bonds, which have lower ratings and are subject to greater volatility. All fixed income investments may be worth less than the original cost upon redemption or maturity. Bond Prices fluctuate inversely to changes in interest rates. Therefore, a general rise in interest rates can result in the decline of the value of your investment.

Definitions

MSCI- EAFE: The Morgan Stanley Capital International Europe, Australasia and Far East Index, a free float-adjusted market capitalization index that is designed to measure developed-market equity performance, excluding the United States and Canada.

MSCI-Emerging Markets: The Morgan Stanley Capital International Emerging Market Index, is a free float-adjusted market capitalization index that is designed to measure the performance of global emerging markets of about 25 emerging economies.

Russell 3000: The Russell 3000 measures the performance of the 3000 largest US companies based on total market capitalization and represents about 98% of the investible US Equity market.

ML BOFA US Corp Mstr [Merill Lynch US Corporate Master]: The Merrill Lynch Corporate Master Market Index is a statistical composite tracking the performance of the entire US corporate bond market over time.

ML Muni Master [Merill Lynch US Corporate Master]: The Merrill Lynch Municipal Bond Master Index is a broad measure of the municipal fixed income market.

Investors cannot directly purchase any index.

LIBOR, London Interbank Offered Rate, is the rate of interest at which banks offer to lend money to one another in the wholesale money markets in London.

The Dow Jones Industrial Average is an unweighted index of 30 “blue-chip” industrial U.S. stocks.

The S&P Midcap 400 Index is a capitalization-weighted index measuring the performance of the mid-range sector of the U.S. stock market, and represents approximately 7% of the total market value of U.S. equities. Companies in the Index fall between S&P 500 Index and the S&P SmallCap 600 Index in size: between $1-4 billion.

DJ Equity REIT Index represents all publicly traded real estate investment trusts in the Dow Jones U.S. stock universe classified as Equity REITs according to the S&P Dow Jones Indices REIT Industry Classification Hierarchy. These companies are REITs that primarily own and operate income-producing real estate.