Last Week’s Markets in Review: Asset Classes That Can Help Hedge Inflation

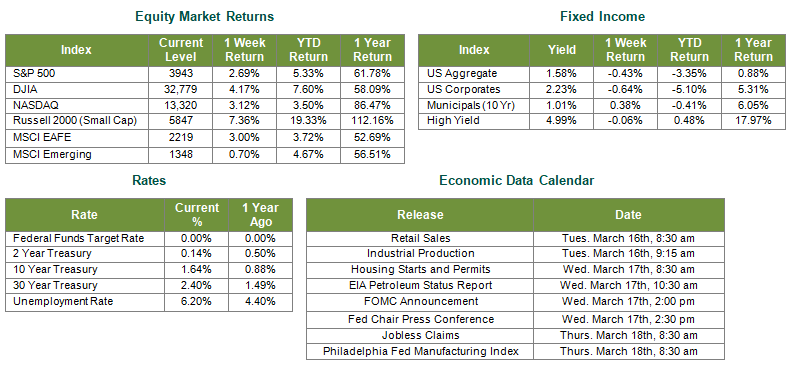

Global equity markets roared higher on the week, with U.S. equities slightly trailing international equities. In the U.S., the S&P 500 Index rose to a level of 3,943, representing a 2.69% gain, while the Russell Midcap Index followed suit, appreciating 3.81%. Meanwhile, the Russell 2000 Index, a measure of the Nation’s smallest publicly traded firms, moved an astonishing 7.36% higher over the week. Moreover, developed and emerging international markets returned 3.00% and 0.70%, respectively. Finally, the 10-year U.S. Treasury moved to 1.64%, eight basis point higher than the prior week.

In a previous issue written approximately nine months ago, which can be found here, we argued that deflationary pressures were abundant at that particular point in time, which would likely keep a lid on near-term inflation, despite the unprecedented volume of low-cost money that had been pumped into the financial system. Those assumptions were correct at the time, but with an additional $1.9 trillion in U.S. Dollars set to enter the financial system, the possibility of an upshot in inflation has once again caught investors’ attention. In an inflationary environment, we argued that Precious Metals, Real Estate Investment Trusts (REITs), and U.S. Large Cap equities might serve as an appropriate hedge, depending, of course, on an investor’s specific tolerance for risk and investment objective. With inflation expectations elevated once again, we thought it might be useful to examine what underlying dynamics, unique to each, allow these particular asset classes to help hedge the corrosive effects of inflation.

Precious Metals

Most investors inherently understand the value that precious metals like Gold or Silver offer during periods of elevated inflation. As collective faith in currencies like the Dollar and the Euro wain and inflation expectations rise, many turn to one of the oldest and most trusted mediums of exchange, gold. Now, the caveat here is that gold carries a high degree of volatility and has suffered long stretches of negative returns. Furthermore, gold is an income- less asset, which is highly problematic for those investors unable to hold the position at a depressed value for an extended time.

Real Estate Investment Trusts (REITs)

Those investors concerned about inflation but require near-term cash flows may be better suited to consider REITs or U.S. Large Cap equities. REITs are required by law to distribute 90% of their net operating income. Therefore, as an investor, the majority of your return from a REIT investment is attributable to consistent income rather than capital appreciation. This feature can be paramount in hedging inflation as the source of these cash flows are generally renters. Landlords often negotiate rental agreements with their tenants annually, and these agreements are typically staggered amongst tenants. In other words, all tenants don’t move into the building on the same day and pay the same level of rent. There is a constant renegotiation process going on behind the scenes that allow the income generated by REITs to typically reflect the prevailing market rate at a given time continually.

U.S. Large Cap Stocks

The rationale for using stocks, specifically U.S. Large Cap stocks, to hedge rising inflation runs parallel to the argument for investing in REITs, without the focus on returning the lion’s share of cash-flows to investors. We’ve written previously about the importance of earnings in driving the growth of company’s market capitalization. The bottom line is that companies that consistently and steadily grow their profitability tend to see their share price appreciate accordingly. So, how does this condition hedge against inflation? Public companies are required by law to disclose earnings data quarterly and are tasked with making performance projections for the upcoming quarter. The only way to consistently meet these self-imposed projections is to maintain an intimate understanding of consumer pricing dynamics and to adjust pricing to match the prevailing market rate quickly. This means that quarterly earnings reflect near-term pricing, and since earnings help drive share appreciation, an inflation premium is inherently embedded in the stock’s return.

In our view, diversification should a strategic decision, not necessarily a tactical one. In other words, proper portfolio diversification is maintained by having constant allocations to various asset classes, sectors, and regions. However, sufficient portfolio diversification cannot be tactically applied at the first sign of trouble because, by that point, it’s often too late. While we’re not overly concerned about near-term inflation, we understand that some may be which is why we recommend taking a moment to evaluate your portfolio’s exposure to the asset classes discussed above. Moreover, we encourage investors to stay disciplined and work with experienced financial professionals to help manage their portfolios through various market cycles within an appropriately diversified framework consistent with their objectives, time-frame, and risk tolerance.

Sources for data in tables: Equity Market and Fixed Income returns are from JP Morgan as of 3/11/21. Rates and Economic Calendar Data from Bloomberg as of 3/11/21. International developed markets measured by the MSCI EAFE Index, emerging markets measured by the MSCI EM Index, U.S. Large Cap defined by the S&P 500. Sector performance is measured using GICS methodology.

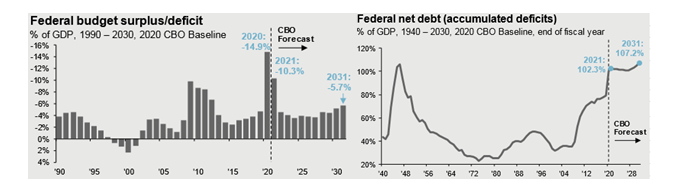

Sources for Charts: CBO, J.P. Morgan Asset Management; (Top and bottom right) BEA, Treasury Department. 2021 Federal Budget is based on the Congressional Budget Office (CBO) February 2021 Baseline Budget Forecast. CBO Baseline economic assumptions are based on the Congressional Budget Office (CBO) February 2021 Update to Economic Outlook.

Disclosures: Past performance does not guarantee future results. We have taken this information from sources that we believe to be reliable and accurate. Hennion and Walsh cannot guarantee the accuracy of said information and cannot be held liable. You cannot invest directly in an index. Diversification can help mitigate the risk and volatility in your portfolio but does not ensure a profit or guarantee against loss.

Diversification can help mitigate the risk and volatility in your portfolio but does not ensure a profit or guarantee against loss.

Investing in commodities is not suitable for all investors. Exposure to the commodities markets may subject an investment to greater share price volatility than an investment in traditional equity or debt securities. Investments in commodities may be affected by changes in overall market movements, commodity index volatility, changes in interest rates or factors affecting a particular industry or commodity.

Products that invest in commodities may employ more complex strategies which may expose investors to additional risks.

Investing in fixed income securities involves certain risks such as market risk if sold prior to maturity and credit risk especially if investing in high yield bonds, which have lower ratings and are subject to greater volatility. All fixed income investments may be worth less than the original cost upon redemption or maturity. Bond Prices fluctuate inversely to changes in interest rates. Therefore, a general rise in interest rates can result in the decline of the value of your investment.

Definitions

MSCI- EAFE: The Morgan Stanley Capital International Europe, Australasia and Far East Index, a free float-adjusted market capitalization index that is designed to measure developed-market equity performance, excluding the United States and Canada.

MSCI-Emerging Markets: The Morgan Stanley Capital International Emerging Market Index, is a free float-adjusted market capitalization index that is designed to measure the performance of global emerging markets of about 25 emerging economies.

Russell 3000: The Russell 3000 measures the performance of the 3000 largest US companies based on total market capitalization and represents about 98% of the investible US Equity market.

ML BOFA US Corp Mstr [Merill Lynch US Corporate Master]: The Merrill Lynch Corporate Master Market Index is a statistical composite tracking the performance of the entire US corporate bond market over time.

ML Muni Master [Merill Lynch US Corporate Master]: The Merrill Lynch Municipal Bond Master Index is a broad measure of the municipal fixed income market.

Investors cannot directly purchase any index.

LIBOR, London Interbank Offered Rate, is the rate of interest at which banks offer to lend money to one another in the wholesale money markets in London.

The Dow Jones Industrial Average is an unweighted index of 30 “blue-chip” industrial U.S. stocks.

The S&P Midcap 400 Index is a capitalization-weighted index measuring the performance of the mid-range sector of the U.S. stock market and represents approximately 7% of the total market value of U.S. equities. Companies in the Index fall between S&P 500 Index and the S&P SmallCap 600 Index in size: between $1-4 billion.

DJ Equity REIT Index represents all publicly traded real estate investment trusts in the Dow Jones U.S. stock universe classified as Equity REITs according to the S&P Dow Jones Indices REIT Industry Classification Hierarchy. These companies are REITs that primarily own and operate income-producing real estate.