Last Week’s Markets in Review: Bank Earnings Dampen Inflation Report

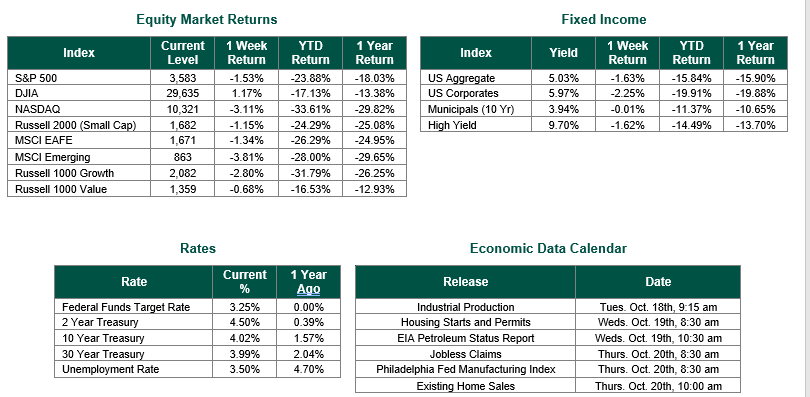

Global equity markets finished lower for the week. In the U.S., the S&P 500 index closed the week at a level of 3,583, representing a decrease of 1.53%, while the Russell Midcap Index moved 2.94% lower last week. Meanwhile, the Russell 2000 Index, a measure of the Nation’s smallest publicly traded firms, returned -1.15% over the week. As developed, international equity performance and emerging markets were lower, returning -1.34% and -3.81%, respectively. Finally, the 10-year U.S. Treasury yield moved higher, closing the week at 4.02%.

Markets continued their volatile swings throughout this past week. The anticipation surrounding consumer price data dominated trading as the S&P 500 index started the week where it had left off, dropping 1.73% between Monday and Wednesday. The six consecutive days of negative trading would match the yearly high of such activity that occurred last month between September 20th and the 27th. Thursday’s Consumer Price Index (CPI) data would ultimately disappoint, increasing on a year-over-year basis by 8.2% in September versus consensus expectation of 8.1%. Excluding food and energy, the index increased 6.6% year-over-year and 0.6% month-over-month. Both results were above consensus expectations. After initially dropping 2.46%, the S&P 500 Index rallied 5.06% before the day closed. This activity represented the largest intra-day swing in 2022 and the fifth largest in the index’s history.

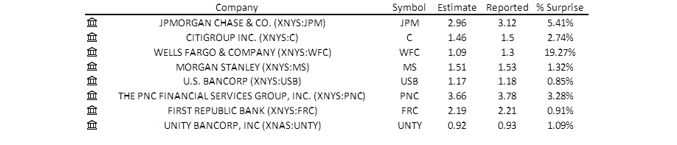

On Friday, headlines would put inflation aside (at least for a moment) as U.S. bank earnings rolled in and stole the spotlight. Major banks would positively kickstart the season despite a bleak outlook for the Q3 earnings season. Earnings for the reported institutions all beat consensus estimates, according to Zacks (see below), with the largest surprises being reported by Wells Fargo and JP Morgan. Despite major losses within their securities, trading, and investment banking business lines, banks were supported by surges in net interest income thanks to higher interest rates on the loans in their portfolios.

While bank stocks are typically a strong indicator of what to expect during earnings season, other corporations will not benefit from rising interest rates like these banks. Throughout this earnings season, it will be of great interest to examine how corporations within different sectors are affected by various economic pressures. Accordingly, the Q3 earnings season will help to answer the following questions:

• Will margins compress, revenues suppress, or earnings deteriorate?

• Will balance sheets weaken, and credit follow suit?

• Will there be guidance, either positive or negative?

Perhaps we will observe a different view of the U.S. economy compared to our recent discussions on macroeconomic data. Stay tuned for more of our analysis on this earnings season in future releases of our weekly update!

Investors should consider all the information discussed within this market update and many other factors when managing their investment portfolios. However, with so much data and so little time to digest, we encourage investors to work with experienced financial professionals to help process all this information to build and manage the asset allocations within their portfolios consistent with their objectives, timeframe, and tolerance for risk.

Best wishes for the week ahead!

Consumer Price Index data was sourced from the Bureau of Labor Statistics on 10/13/22. Earnings data sourced from Zacks on 10/14/2022. Equity Market and Fixed Income returns are from JP Morgan as of 10/14/22. Rates and Economic Calendar Data from Bloomberg as of 10/14/22. International developed markets are measured by the MSCI EAFE Index, emerging markets are measured by the MSCI EM Index, and U.S. Large Caps are defined by the S&P 500 Index. Sector performance is measured using the GICS methodology.

Disclosures: Past performance does not guarantee future results. We have taken this information from sources that we believe to be reliable and accurate. Hennion and Walsh cannot guarantee the accuracy of said information and cannot be held liable. You cannot invest directly in an index. Diversification can help mitigate the risk and volatility in your portfolio but does not ensure a profit or guarantee against a loss.