Last Week’s Markets in Review: Chair Powell Reaffirms Inflation Fight

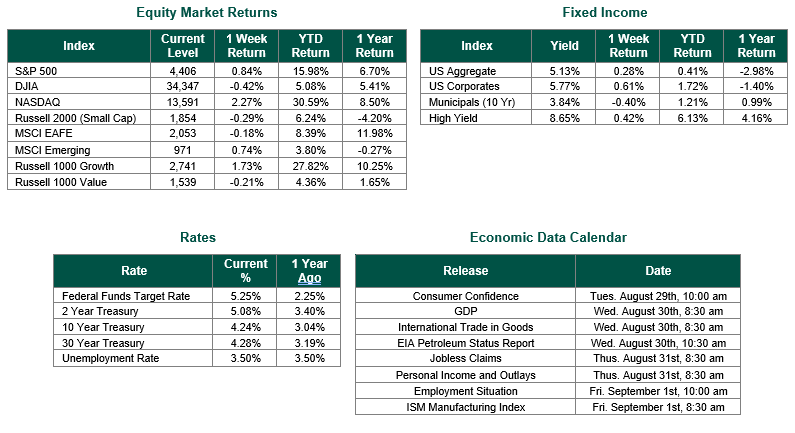

Global equity markets finished mixed for the week. In the U.S., the S&P 500 Index closed the week at a level of 4406, representing an increase of 0.84%, while the Russell Midcap Index moved 0.00% last week. Meanwhile, the Russell 2000 Index, a measure of the Nation’s smallest publicly traded firms, returned -0.29% over the week. As developed international equity performance and emerging markets were mixed, returning -0.18% and 0.74%, respectively. Finally, the 10-year U.S. Treasury yield moved lower, closing the week at 4.24%.

Last week, market strategists were focused on a speech that Federal Reserve Chairman Powell gave at the Jackson Hole Economic Symposium. Jackson Hole is an annual event sponsored by the Federal Reserve Bank of Kansas City and often offers timely economic views on monetary policy and other important topics that help shape policy for global central banks. Powell spoke on Friday, so any economic data released before the speech was factored into the ongoing debate concerning the Fed’s next potential policy action.

On Wednesday, August’s S&P Global Flash Composite PMI (Purchasing Managers’ Index) was released. The composite is broken down into the categories of Manufacturing and Services and registered a total value of 50.4. Both components were lower than the consensus estimates. Manufacturing was 47.0 for the current report, well below the consensus of 48.8. Likewise, the Services Index was 51.0, and the consensus was 52.0. Markets viewed these results as signs that inflation is easing.

On Thursday, weekly Jobless Claims changed this previous day’s view on inflation. Jobless Claims for the week ending 8/19/23 were 230,000, below the prior week’s (240,000) and consensus (241,000). Market participants are still waiting for the lagged and variable effects of the Fed’s monetary policy to affect the labor market meaningfully.

Chairman Powell’s comments from Jackson Hole on Friday continued his previous stance concerning inflation. Powell noted that the economy has been growing faster than expected and that consumers have kept spending briskly — trends that could keep certain inflation pressures high. He reiterated the Fed’s determination to keep its benchmark rate elevated until inflation is reduced to its 2% target. Powell stated, “We are attentive to signs that the economy may not be cooling as expected,” and “We are prepared to raise rates further if appropriate and intend to hold policy at a restrictive level until we are confident that inflation is moving sustainably down toward our objective.”

Surprisingly, the major equity indexes digested Powell’s hawkish comments and finished higher for the day. However, Powell’s comments affected the market’s outlook concerning the probability of a further rate hike at the next Federal Open Market Committee (FOMC) meeting on September 20th. According to the CME Group’s FedWatch Tool, the probability of a 25 Bp increase to the Federal Funds Target Rate rose to 19.5% after the Jackson Hole speech, an increase of 5.5%. Still, the overwhelming probability (i.e., 80.5%) is that the Fed will pause (potentially stop raising rates altogether) in September.

We hope everyone has a productive week and an enjoyable Labor Day weekend!

PMI Composite Flash data was sourced from S&P Global. Employment data was sourced from the U.S. Department of Labor. Information related to The FedWatch Tool was sourced from the CME Group. Equity Market, Fixed Income returns, and rates are from Bloomberg as of 8/25/23. Economic Calendar Data from Econoday as of 8/25/23. International developed markets are measured by the MSCI EAFE Index, emerging markets are measured by the MSCI EM Index, and U.S. Large Caps are defined by the S&P 500 Index. Sector performance is measured using the GICS methodology.

Disclosures: Past performance does not guarantee future results. We have taken this information from sources that we believe to be reliable and accurate. Hennion and Walsh cannot guarantee the accuracy of said information and cannot be held liable. You cannot invest directly in an index. Diversification can help mitigate the risk and volatility in your portfolio but does not ensure a profit or guarantee against a loss.