Last Week’s Markets in Review: Chair Powell Sounds Hawkish on Capitol Hill

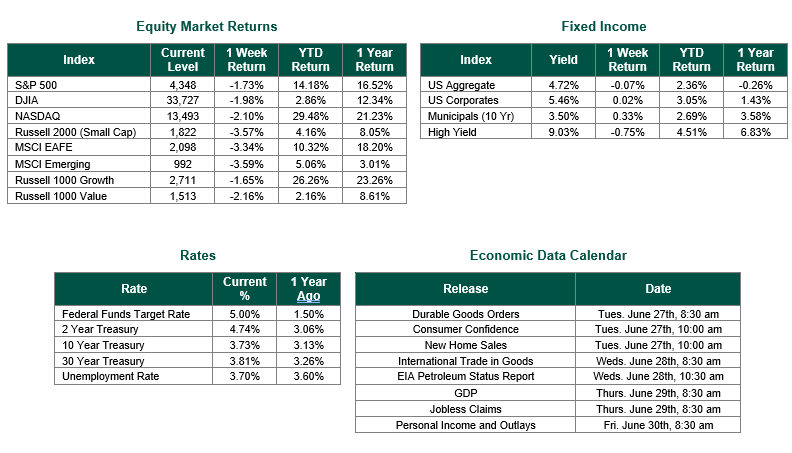

Global equity markets finished lower for the week. In the U.S., the S&P 500 Index closed the week at a level of 4,348, representing a decline of -1.73%, while the Russell Midcap Index moved -2.17% lower last week. Meanwhile, the Russell 2000 Index, a measure of the Nation’s smallest publicly traded firms, returned -3.57% over the week. As developed international equity performance and emerging markets were lower, returning -3.34% and -3.59%, respectively. Finally, the 10-year U.S. Treasury yield moved slightly lower, closing the week at 3.73%.

Monetary policy and Fed Chairman Powell continued to be at the top of the news cycle for a second week. Our readers will recall the greatly anticipated pause in rate hikes from the FOMC meeting two weeks ago. The hawkish remarks by the Chairman immediately after the meeting were much more of a surprise for the markets. The commentary that there may be an additional two 25 Bp (0.25%) rate hikes in 2023 slowed the ongoing rally in the major equity indices. This past week, Chairman Powell testified to the House of Representatives and the U.S. Senate during his semi-annual visit to Capitol Hill. As Powell’s tone stayed consistent throughout the two days on the Hill, equities continued to move lower for this past week.

Before Chairman Powell’s testimony, investors were updated on the state of the housing market. On Tuesday, the Census Bureau released both Housing Starts and New Building Permits for May. Housing Starts at an annual rate for May registered at 1.63 million. This result greatly exceeded the consensus estimate of 1.40 million and the revised prior month reading of 1.34 million. Additionally, New Permits for May were 1.42 million annually, exceeding the estimate and the previous month’s results. As investors digested this robust housing data, they were confronted by the idea that the Fed’s battle with inflation is an ongoing struggle that may last for many more months, if not years.

On Wednesday, Chairman Powell addressed the House Financial Services Committee. His hawkish tone was evident throughout his comments: “Inflation pressures continue to run high, and the process of getting inflation back down to 2% has a long way to go.” The Chairman also told Committee Members it was a “pretty good guess” that the FOMC would increase interest rates twice this year.

The U.S. Senate, specifically the Committee on Banking, Housing, and Urban Affairs, was the venue on Thursday for Chairman Powell. Significant comments from this testimony are as follows: “Inflation has moderated somewhat since the middle of last year.” Still, Powell stressed that “Inflation pressures continue to run high.” “Nearly all” Fed policymakers “expect that it will be appropriate to raise interest rates somewhat further by the end of this year.” Powell commented on the labor market, “Labor demand still substantially exceeds the supply of available workers.”

With a full month before the next policy meeting, we expect that “Fed Talk” will continue to be a primary driver of market activity. It should be noted that there are only four more FOMC meetings this year, with no meeting scheduled in August.

Investors should consider all the information discussed within this market update and many other factors when managing their investment portfolios. However, with so much data and so little time to digest, we encourage investors to work with experienced financial professionals to help process all this information to build and manage the asset allocations within their portfolios consistent with their objectives, timeframe, and tolerance for risk.

Best wishes for the week ahead!

Housing data is sourced from the Census Bureau. Equity Market, Fixed Income returns, and rates are from Bloomberg as of 6/23/23. Economic Calendar Data from Econoday as of 6/23/23. International developed markets are measured by the MSCI EAFE Index, emerging markets are measured by the MSCI EM Index, and U.S. Large Caps are defined by the S&P 500 Index. Sector performance is measured using the GICS methodology.

Disclosures: Past performance does not guarantee future results. We have taken this information from sources that we believe to be reliable and accurate. Hennion and Walsh cannot guarantee the accuracy of said information and cannot be held liable. You cannot invest directly in an index. Diversification can help mitigate the risk and volatility in your portfolio but does not ensure a profit or guarantee against a loss.