Last Week’s Markets in Review: Consumer Confidence & GDP Surprises

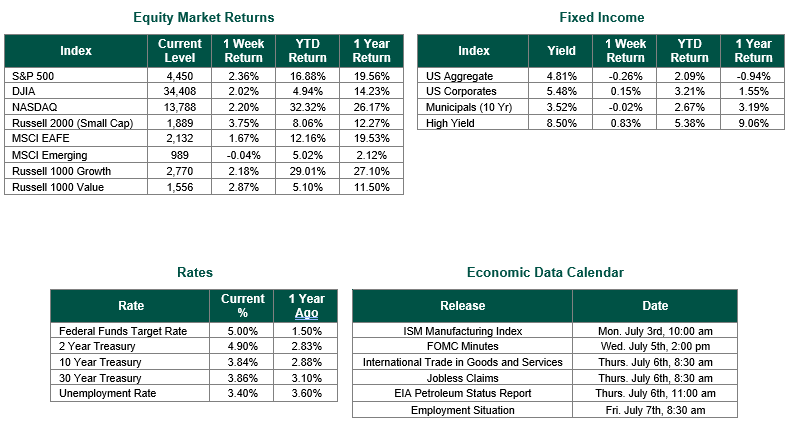

Global equity markets finished higher for the week. In the U.S., the S&P 500 Index closed the week at a level of 4,450, representing an increase of 2.36%, while the Russell Midcap Index moved 3.90% higher last week. Meanwhile, the Russell 2000 Index, a measure of the Nation’s smallest publicly traded firms, returned 3.75% over the week. As developed, international equity performance and emerging markets were higher, returning 1.67% and -0.04%, respectively. Finally, the 10-year U.S. Treasury yield moved higher, closing the week at 3.81%.

Consumer Confidence figures last week showed a rise in the index to 109.7 from 102.5 in May, its highest reading since January 2022. Although most economists expected the index to climb from its May reading, the June figure would defy the expectations of a slowing economy due to aggressive monetary policies. The latest consumer confidence report reveals a significant surge in positive sentiment among consumers, indicating a somewhat optimistic economic outlook. This increased confidence may translate into higher spending, benefiting businesses and stimulating economic growth. The report not only signifies a more resilient economy but also presents opportunities for businesses to expand and innovate in response to the favorable consumer environment – at least as it stands now.

The final revision to first-quarter gross domestic product (GDP) also surprised economists to the upside before the holiday weekend. The revision of 2.0% would be significantly greater than the prior estimate of just 1.3%. The results were attributed to greater-than-expected consumer spending and exports, which rose 4.2% and 7.8%, respectively. As measured by Core PCE, inflation was reported to be better than expected, with a 0.1% decline for the April reading, and increased by just 0.3% when excluding food and energy. And on an annual basis the PCE index was revised down to 3.8% in April, from 4.4% and increased by 4.6% in May.These data points give the Federal Reserve the necessary conviction to potentially deliver at least one more rate hike in 2023. However, we still do not believe that any additional rate hikes are necessary as the U.S. economy still has not felt the full impact of the 5% in rate hikes that have taken place since March 2022, and inflation continues to moderate, albeit at a much slower pace than the Fed would prefer. It should be noted that only four Federal Open Market Committee (FOMC) meetings remain in 2023, with no meeting scheduled in August.

Investors should consider all the information discussed within this market update and many other factors when managing their investment portfolios. However, with so much data and so little time to digest, we encourage investors to work with experienced financial professionals to help process all this information to build and manage the asset allocations within their portfolios consistent with their objectives, timeframe, and tolerance for risk.

Best wishes for the week ahead!

Consumer Confidence data from the Conference Board on 6/27/23. GDP data from the Bureau of Economic Analysis on 6/29/23. PCE inflation data from the Commerce Department on 6/30/2023. Equity Market, Fixed Income returns, and rates are from Bloomberg as of 6/30/23. Economic Calendar Data from Econoday as of 6/30/23. International developed markets are measured by the MSCI EAFE Index, emerging markets are measured by the MSCI EM Index, and U.S. Large Caps are defined by the S&P 500 Index. Sector performance is measured using the GICS methodology.

Disclosures: Past performance does not guarantee future results. We have taken this information from sources that we believe to be reliable and accurate. Hennion and Walsh cannot guarantee the accuracy of said information and cannot be held liable. You cannot invest directly in an index. Diversification can help mitigate the risk and volatility in your portfolio but does not ensure a profit or guarantee against a loss.