Last Week’s Markets in Review: Contagion Concerns put Fed in the Spotlight

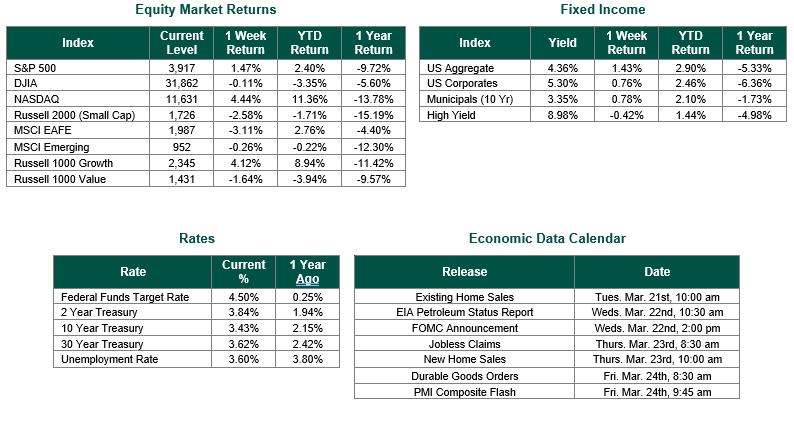

Global equity markets finished higher for the week. In the U.S., the S&P 500 Index closed the week at a level of 3,917, representing a gain of 1.47%, while the Russell Midcap Index moved 1.55% higher last week. Meanwhile, the Russell 2000 Index, a measure of the Nation’s smallest publicly traded firms, returned -2.58% over the week. As developed, international equity performance and emerging markets were lower, returning -3.11% and -0.26%, respectively. Finally, the 10-year U.S. Treasury yield moved lower, closing the week at 3.43%.

The recent collapse of Silicon Valley Bank, the 16th largest bank in the country with approximately $209 billion in assets, has spooked investors and sent shockwaves through the market. The sudden collapse has led many investors to ask what happened. During the pandemic, tech companies saw a surge in business, leading to a host of new hopeful tech companies popping up, each flush with Venture Capital funds. As a result, banks specializing in serving these types of companies enjoyed their surge in deposits, including Silicon Valley Bank.

Like most banks, Silicon Valley Bank only keeps a fraction of its deposits in-house at any given time. The rest is lent out or invested. In this case, the bank purchased tens of billions of dollars in U.S. Treasury bonds, presumably believing that it was being prudent with customers’ money. However, while U.S. Treasuries don’t usually see the volatility that stocks or other securities do, they are vulnerable to a very specific kind of risk – the risk of rising interest rates.

Over the course of 2021 and 2022, the economy started changing. Inflation skyrocketed, and interest rates, in turn, rose to the highest levels in decades. That meant all those Treasuries purchased when interest rates were low were suddenly far less valuable and experienced price declines, as newer government bonds paid far more interest than those purchased before the rate hikes began. At the same time, those tech companies that profited during the pandemic saw their businesses – and their stock prices. Suddenly, Silicon Valley Bank faced a nightmare scenario: a lack of liquidity and new funds via new deposits.

When a bank makes risky financial decisions at the exact wrong time and crumbles, the situation typically makes investors wonder if other banks out there might soon experience the same problem. This time is no different, as shares of banks with similar business models have fallen sharply over the last week.

To calm the concerns over financial sector contagion, the Federal Reserve and a handful of large institutions stepped in last week. The Fed made its first move by creating a separate “backstop” facility to provide loans to banks that have been affected by failures to help avoid the liquidity crunching trap that was outlined early in the case of Silicon Valley. Additionally, the Federal Reserve eased the terms of banks’ access to its discount window, allowing banks to turn assets that have lost value into liquid cash without experiencing an immediate loss. Later in the week, large banks like JP Morgan and Wells Fargo also intervened to lend a hand by providing $30 billion of deposits into First Republic Bank, another regional bank affected by the recent events.

Concerns have grown that additional financial stress could be caused as a result of aggressive quantitative tightening by the Federal Reserve. There has been a growing conviction that the latest events could put a speed bump in the Fed’s recent rate hike plans. In fact, according to CME Group, the probability of the Fed raising 50 bps at their next meeting this upcoming week fell from over 78% to 0% since the news of Silicon Valley Bank hit the headlines. Additionally, the probability of no rate hike at this week’s meeting went from 0% to just over 25% as of the time of this writing.

Whether the Fed decides to continue to raise interest rates or if the downfall of a handful of banks is the tip of the iceberg remains to be seen. However, investors should keep their perspective and work with investment professionals to determine how their portfolios may be exposed to any of the risks mentioned. As always, investors should also consider all the information discussed within this market update and many other factors when managing their investment portfolios in accordance with their objectives, risk tolerance, and investment timeframe.

Best wishes for the week ahead!

Equity Market, Fixed Income returns, and rates are from Bloomberg as of 3/17/23. Economic Calendar Data from Econoday as of 3/20/23. International developed markets are measured by the MSCI EAFE Index, emerging markets are measured by the MSCI EM Index, and U.S. Large Caps are defined by the S&P 500 Index. Sector performance is measured using the GICS methodology.

Disclosures: Past performance does not guarantee future results. We have taken this information from sources that we believe to be reliable and accurate. Hennion and Walsh cannot guarantee the accuracy of said information and cannot be held liable. You cannot invest directly in an index. Diversification can help mitigate the risk and volatility in your portfolio but does not ensure a profit or guarantee against a loss.