Last Week’s Markets in Review: Dividend-paying Stocks Offer Growth and Income Potential

Global equity markets were lower across the board last week as interest rates continued their move higher. In the U.S., the S&P 500 Index fell to a level of 3,811, representing a loss of 2.41%, while the Russell Midcap Index moved 2.68% lower last week. Meanwhile, the Russell 2000 Index, a measure of the Nation’s smallest publicly traded firms, returned -2.87% over the week. International equities were not immune to the declines as developed and emerging markets returned -2.79% and -6.33%, respectively. Finally, the 10-year U.S. Treasury yield climbed to 1.44%, which is an increase of 51 bass points for the year.

It’s no secret that investors remain challenged to find attractive sources of income, a trend that will likely persist in the months, and perhaps years, ahead. As you can see in the data tables above, current yields within traditional fixed-income investments are at levels that, on their own, may not completely satisfy the needs of income-oriented investors. In this week’s update, we’ll review equities as another potential source of income, why they may make sense in today’s market environment, and factors we believe investors should review when considering income-producing stocks.

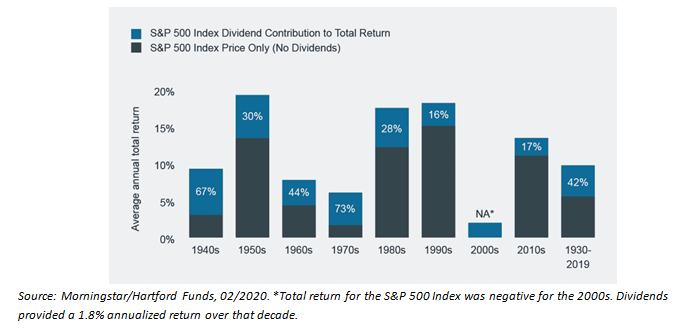

Investors who follow equity research firms or financial media outlets are familiar with commonly cited statistics on stock indexes or individual companies, such as historical price performance or 12-month price targets. Of course, past or expected future price movements fail to capture the total return picture. It may surprise many to realize how much of a given stock’s, or index’s, total return is attributable to dividends. The table below shows the historical contributions of dividends to the total return of stocks. Stocks are certainly an asset class that can be used in a portfolio for growth potential, however, those that pay dividends can also be used for income potential.

Source: Morningstar/Hartford Funds, 02/2020. *Total return for the S&P 500 Index was negative for the 2000s. Dividends provided a 1.8% annualized return over that decade.

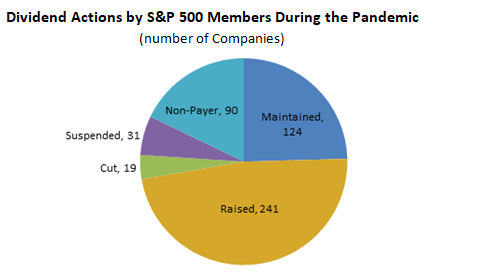

We know that income sustainability is often as important as the yield for income-oriented investors. Often, the tricky part of dividend investing is finding financially stable companies that can sustain, or potentially grow, their dividends over time. This task became increasingly important and yet more difficult during the COVID-19 pandemic. The chart below from JP Morgan shows that over 10% of S&P 500 dividend-paying companies either cut or suspended dividends during the COVID-19 pandemic.

One factor to consider when investing in companies that pay dividends is those with a strong track record of growing their dividends. While dividend growers don’t typically fall into the top tiers in terms of dividend yield, above-average dividend growth rates are often associated with companies that have strong balance sheets which are supportive of their dividend payout policies. Changes to dividend policy, such as a cut or suspension, are not taken lightly by the management teams of these companies as they may send a negative signal to shareholders. Therefore, we contend that dividend growth is a sign of strength and worthy of consideration.

While a higher level of yield may be attainable in companies that don’t necessarily grow dividends at a high rate, one of the mistakes investors can make in this low interest rate environment is by chasing yield alone. Remember, investments offering exceedingly high yields generally also carry higher relative risk and typically warrants additional questions. Is the company paying more than it’s potentially able to service in the future? Is the yield high due to a precipitous drop in the stock’s price? We believe that high-quality companies that are well-positioned to generate sustainable cash flows in a variety of market conditions are more likely to maintain a consistent dividend policy.

We continue to encourage income-oriented and growth-oriented investors to work with experienced financial professionals to help manage their portfolios through various market cycles within an appropriately diversified framework that is consistent with their investment objectives, time-frame, and risk tolerance. Best wishes for the week ahead!

Sources for data in tables: Equity Market and Fixed Income returns are from JP Morgan as of 2/26/21. Rates and Economic Calendar Data from Bloomberg as of 2/26/21. International developed markets measured by the MSCI EAFE Index, emerging markets measured by the MSCI EM Index, U.S. Large Cap defined by the S&P 500. Sector performance is measured using the GICS methodology.

Disclosures: Past performance does not guarantee future results. We have taken this information from sources that we believe to be reliable and accurate. Hennion and Walsh cannot guarantee the accuracy of said information and cannot be held liable. You cannot invest directly in an index. Diversification can help mitigate the risk and volatility in your portfolio but does not ensure a profit or guarantee against a loss.

Diversification can help mitigate the risk and volatility in your portfolio but does not ensure a profit or guarantee against loss.

Investing in commodities is not suitable for all investors. Exposure to the commodities markets may subject an investment to greater share price volatility than an investment in traditional equity or debt securities. Investments in commodities may be affected by changes in overall market movements, commodity index volatility, changes in interest rates or factors affecting a particular industry or commodity.

Products that invest in commodities may employ more complex strategies which may expose investors to additional risks.

Investing in fixed income securities involves certain risks such as market risk if sold prior to maturity and credit risk especially if investing in high yield bonds, which have lower ratings and are subject to greater volatility. All fixed income investments may be worth less than the original cost upon redemption or maturity. Bond Prices fluctuate inversely to changes in interest rates. Therefore, a general rise in interest rates can result in the decline of the value of your investment.

Definitions

MSCI- EAFE: The Morgan Stanley Capital International Europe, Australasia and Far East Index, a free float-adjusted market capitalization index that is designed to measure developed-market equity performance, excluding the United States and Canada.

MSCI-Emerging Markets: The Morgan Stanley Capital International Emerging Market Index, is a free float-adjusted market capitalization index that is designed to measure the performance of global emerging markets of about 25 emerging economies.

Russell 3000: The Russell 3000 measures the performance of the 3000 largest US companies based on total market capitalization and represents about 98% of the investible US Equity market.

ML BOFA US Corp Mstr [Merill Lynch US Corporate Master]: The Merrill Lynch Corporate Master Market Index is a statistical composite tracking the performance of the entire US corporate bond market over time.

ML Muni Master [Merill Lynch US Corporate Master]: The Merrill Lynch Municipal Bond Master Index is a broad measure of the municipal fixed income market.

Investors cannot directly purchase any index.

LIBOR, London Interbank Offered Rate, is the rate of interest at which banks offer to lend money to one another in the wholesale money markets in London.

The Dow Jones Industrial Average is an unweighted index of 30 “blue-chip” industrial U.S. stocks.

The S&P Midcap 400 Index is a capitalization-weighted index measuring the performance of the mid-range sector of the U.S. stock market and represents approximately 7% of the total market value of U.S. equities. Companies in the Index fall between S&P 500 Index and the S&P SmallCap 600 Index in size: between $1-4 billion.

DJ Equity REIT Index represents all publicly traded real estate investment trusts in the Dow Jones U.S. stock universe classified as Equity REITs according to the S&P Dow Jones Indices REIT Industry Classification Hierarchy. These companies are REITs that primarily own and operate income-producing real estate.