Last Week’s Markets in Review: Don’t Keep Your Eggs in One Basket

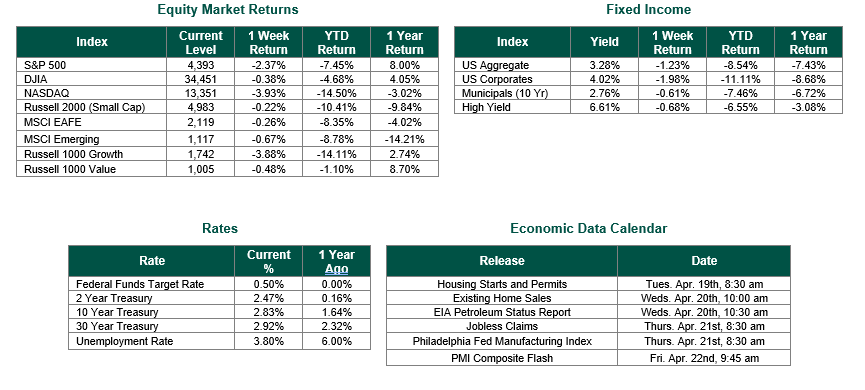

Global equity markets finished lower for the week. In the U.S., the S&P 500 Index closed the week at a level of 4,393, representing a loss of 2.37%, while the Russell Midcap Index moved 0.48% lower last week. Meanwhile, the Russell 2000 Index, a measure of the Nation’s smallest publicly traded firms, returned -0.22% over the week. International equity performance was slightly lower as developed and emerging markets returned -0.26% and -0.67%, respectively. Finally, the 10-year U.S. Treasury yield moved higher, closing the week at 2.83%.

We hope that our readers enjoyed the holiday weekend! The beginning of 2022 has already been a wild ride. We have experienced record inflation levels, interest rates being hiked, geopolitical tensions overseas, and the continued concern over new COVID variants. With all that has been happening in the macro landscape, what advice can we provide to investors to help them weather such events? One of the most important actions that can be taken, in our view, is ensuring that an appropriate amount of diversification is in place in each investor’s portfolio.

The Easter Bunny knows that he shouldn’t keep all his eggs in one basket, even the most colorful of the bunch. The same should be true of investors with respect to the holdings within their portfolios. However, diversification within a portfolio is not solely limited to exposure to a single asset class (i.e., stocks or bonds) but should be reviewed in significantly greater detail.

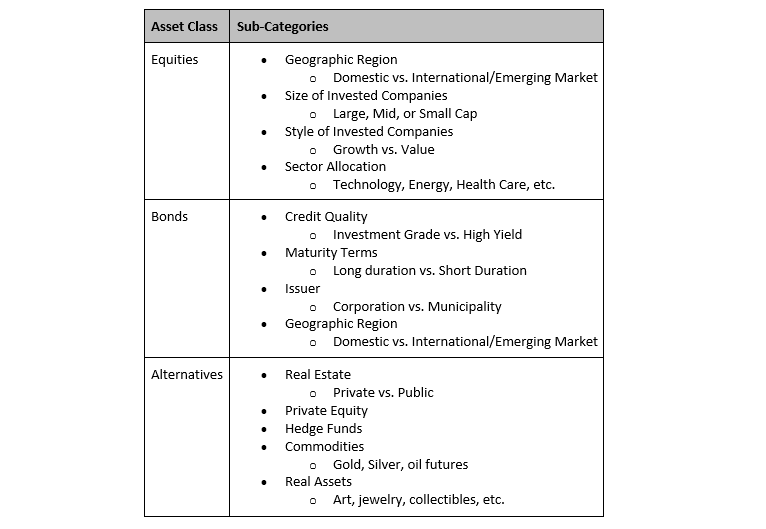

Let’s start by looking at diversification at the asset level. This form of diversification is a view from the highest degree of the portfolio and typically will involve exposure to major asset classes such as equity, fixed income, alternatives, and cash. Because these asset classes are not perfectly correlated, they have historically provided hedging attributes when invested within the same portfolio.

Digging deeper, diversification can, and should, be further pursued within certain asset classes. The following chart can help sub-categorize these areas.

The asset classes and sub-diversifying categories above are some common examples and are not necessarily limited to only those shown. Individual investors have different goals and objectives for their portfolios, so understanding these various forms of diversification is important.

Consider a scenario with a young individual with a high-risk tolerance and a longer-term investment horizon. Given these parameters, this investor may have more of an aggressive portfolio with a higher allocation to equities. However, this investor can, and should, still look to diversify within the Equities asset class to ensure that they are not taking on undue risk in one specific area of the market. For example, assume that this equities portfolio held only one position in Apple (Ticker: AAPL). By keeping this lone position, the portfolio would have a relatively high level of volatility, as measured by standard deviation, of 29.9%. Rather than holding a single position, an investment could be made in the technology sector, lets’ say, through an exchange-traded fund (ETF) tracking the NASDAQ Composite Index to help add some diversification. Completing this action would help reduce the portfolio risk, as measured again by standard deviation, from 29.9% to 19.8%. However, given the additional sector-specific risk that this new investment has added, an additional allocation could be made across different U.S. sectors by investing in an ETF that tracks the S&P 500 Index, resulting in an even lower level of his overall portfolio risk of 17.8%. Finally, to help add geographic diversification to the existing all-US equities portfolio, an investment could be made in an ETF that tracks the MSCI All Country World index, bringing the portfolio’s standard deviation down to 17.2%.

As one can see from the above example, as the investor spread their capital throughout the sub-diversifying categories of the Equities asset class, they were able to reduce the portfolio risk from 29.9% to 17.2% risk – a near 74% reduction!

This past week, we saw the consumer price index (CPI) increase at an annualized rate of 8.5% in the U.S., the producer price index (PPI) rose by an annualized rate of 11.2%, extended lockdowns abroad due to new COVID-19 variant outbreaks, and the kick-off of Q1 corporate earnings season. With the incoming data being a likely catalyst for market volatility, our point of diversification within portfolios cannot be stressed enough. As always, we suggest working with financial professionals to ensure that your portfolio is sufficiently diversified and allocated towards the appropriate asset classes associated with specific objectives, risk tolerance, investment horizon, and liquidity needs.

Best wishes for the week ahead!

AAPL, NASDAQ Index, S&P500 Index, and MSCI ACWI Index Risk data from Morningstar as of 4/14/22. Equity Market and Fixed Income returns are from JP Morgan as of 4/14/22. Rates and Economic Calendar Data from Bloomberg as of 4/14/22. International developed markets measured by the MSCI EAFE Index, emerging markets measured by the MSCI EM Index, U.S. Large Cap defined by the S&P 500. Sector performance is measured using the GICS methodology.

Disclosures: Past performance does not guarantee future results. We have taken this information from sources that we believe to be reliable and accurate. Hennion and Walsh cannot guarantee the accuracy of said information and cannot be held liable. You cannot invest directly in an index. Diversification can help mitigate the risk and volatility in your portfolio but does not ensure a profit or guarantee against a loss.

Diversification can help mitigate the risk and volatility in your portfolio but does not ensure a profit or guarantee against loss.

Investing in commodities is not suitable for all investors. Exposure to the commodities markets may subject an investment to greater share price volatility than an investment in traditional equity or debt securities. Investments in commodities may be affected by changes in overall market movements, commodity index volatility, changes in interest rates or factors affecting a particular industry or commodity.

Products that invest in commodities may employ more complex strategies which may expose investors to additional risks.

Investing in fixed income securities involves certain risks such as market risk if sold prior to maturity and credit risk, especially if investing in high yield bonds, which have lower ratings and are subject to greater volatility. All fixed income investments may be worth less than the original cost upon redemption or maturity. Bond Prices fluctuate inversely to changes in interest rates. Therefore, a general rise in interest rates can result in the decline of the value of your investment.

Definitions

MSCI- EAFE: The Morgan Stanley Capital International Europe, Australasia and Far East Index, a free float-adjusted market capitalization index that is designed to measure developed-market equity performance, excluding the United States and Canada.

MSCI-Emerging Markets: The Morgan Stanley Capital International Emerging Market Index, is a free float-adjusted market capitalization index that is designed to measure the performance of global emerging markets of about 25 emerging economies.

Russell 3000: The Russell 3000 measures the performance of the 3000 largest US companies based on total market capitalization and represents about 98% of the investible US Equity market.

ML BOFA US Corp Mstr [Merill Lynch US Corporate Master]: The Merrill Lynch Corporate Master Market Index is a statistical composite tracking the performance of the entire US corporate bond market over time.

ML Muni Master [Merill Lynch US Corporate Master]: The Merrill Lynch Municipal Bond Master Index is a broad measure of the municipal fixed income market.

Investors cannot directly purchase any index.

LIBOR, London Interbank Offered Rate, is the rate of interest at which banks offer to lend money to one another in the wholesale money markets in London.

The Dow Jones Industrial Average is an unweighted index of 30 “blue-chip” industrial U.S. stocks.

The S&P Midcap 400 Index is a capitalization-weighted index measuring the performance of the mid-range sector of the U.S. stock market and represents approximately 7% of the total market value of U.S. equities. Companies in the Index fall between S&P 500 Index and the S&P SmallCap 600 Index in size: between $1-4 billion.

DJ Equity REIT Index represents all publicly traded real estate investment trusts in the Dow Jones U.S. stock universe classified as Equity REITs according to the S&P Dow Jones Indices REIT Industry Classification Hierarchy. These companies are REITs that primarily own and operate income-producing real estate.