Last Week’s Markets in Review: Earth Day and Impact Investing

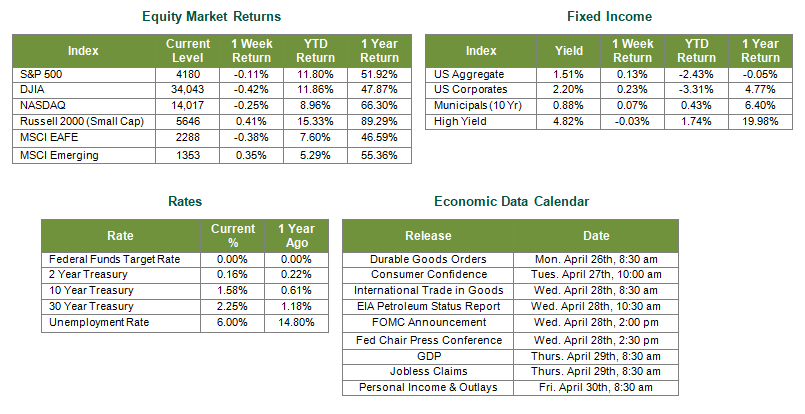

Global equity markets finished mixed for the week. In the U.S., the S&P 500 Index (S&P 500) fell to a level of 4,180, representing a loss of 0.11%, while the Russell Midcap Index moved 0.69% higher last week. Meanwhile, the Russell 2000 Index, a measure of the Nation’s smallest publicly traded firms, returned 0.41% over the week. International equity performance also varied as developed and emerging markets returned -0.38% and 0.35%, respectively. Finally, the 10-year U.S. Treasury yield was little changed, closing the week at 1.58%.

Earth Day often acts as a reminder of the environmental challenges we face across the globe. This year, during a virtual climate summit, President Biden set ambitious targets to help combat climate change, a top priority during his 2020 campaign. The goal is to cut greenhouse gas emissions in half by 2030 and become a net-zero emissions economy by 2050. Climate change has become an increasingly important subject for many. Studies have shown that workers and job seekers are more likely to stay with a company with a strong environmental reputation. Even consumers are increasingly likely to pay a premium for goods that are sourced sustainably. What may come as a surprise to some is that this ideology continues to make its way into how investors approach their portfolio positioning. In a survey released last week by the IBM Institute for Business Value, 59% of individual investors expect to buy or sell holdings in the next 12 months based on environmental sustainability factors. This is significant, especially considering that retail investors made up about 20% of the U.S. equity trading volume in 2020, nearly double the amount from just 10 years ago.

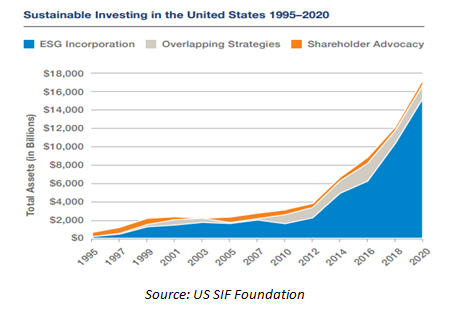

Corporate America is also taking notice of the overall importance of sustainable business practices. Last year during the World Economic Forum, industry behemoths BlackRock and Microsoft made pledges to tackle climate change. These environmental sustainability factors are part of the “E” in Environmental, Social, and Governance (ESG) ratings, and ESG investing continues to gain in popularity. Financial assets across the board are flowing into funds that consider a company’s ESG ratings, as you can see in the chart below.

We tend to favor this broader lens of ESG, often referred to as Sustainable Impact Investing, as a company’s reach and ability to influence extends to more than just environmental stakeholders. Take, for example, a company such as JUST Capital*. JUST Capital is a not-for-profit 501(c)(3) registered organization whose mission is to help work towards an economy that works for all Americans by helping companies improve how they serve all their stakeholders. Americans are surveyed on what matters most to them across five stakeholder categories – Workers, Customers, Communities, Environment, and Shareholders. Through in-depth research resulting in a unique rankings system, they can help investors direct capital to companies who are leaders in areas such as climate change, workplace diversity, fair pay, and community engagement. From an investment standpoint, it’s important to be aware of a changing marketplace and distinguish between short-term trends and lasting impacts, and we feel that the incorporation of ESG research and ratings in portfolio management is likely here to stay.

We continue to encourage investors to stay disciplined and work with experienced financial professionals to help manage their portfolios through various market cycles within an appropriately diversified framework that is consistent with their growth and/or income objectives time-frame, and risk tolerance.

Best wishes for the week ahead!

*JUST Capital is a research provider to SmartTrust® Unit Investment Trusts, whose sponsor is Hennion & Walsh, Inc.

Sources for data in tables: Equity Market and Fixed Income returns are from JP Morgan as of 4/23/21. Rates and Economic Calendar Data from Bloomberg as of 4/23/21. International developed markets measured by the MSCI EAFE Index, emerging markets measured by the MSCI EM Index, U.S. Large Cap defined by the S&P 500. Sector performance is measured using the GICS methodology.

Disclosures: Past performance does not guarantee future results. We have taken this information from sources that we believe to be reliable and accurate. Hennion and Walsh cannot guarantee the accuracy of said information and cannot be held liable. You cannot invest directly in an index. Diversification can help mitigate the risk and volatility in your portfolio but does not ensure a profit or guarantee against a loss.

Diversification can help mitigate the risk and volatility in your portfolio but does not ensure a profit or guarantee against loss.

Investing in commodities is not suitable for all investors. Exposure to the commodities markets may subject an investment to greater share price volatility than an investment in traditional equity or debt securities. Investments in commodities may be affected by changes in overall market movements, commodity index volatility, changes in interest rates or factors affecting a particular industry or commodity.

Products that invest in commodities may employ more complex strategies which may expose investors to additional risks.

Investing in fixed income securities involves certain risks such as market risk if sold prior to maturity and credit risk especially if investing in high yield bonds, which have lower ratings and are subject to greater volatility. All fixed income investments may be worth less than the original cost upon redemption or maturity. Bond Prices fluctuate inversely to changes in interest rates. Therefore, a general rise in interest rates can result in the decline of the value of your investment.

Definitions

MSCI- EAFE: The Morgan Stanley Capital International Europe, Australasia and Far East Index, a free float-adjusted market capitalization index that is designed to measure developed-market equity performance, excluding the United States and Canada.

MSCI-Emerging Markets: The Morgan Stanley Capital International Emerging Market Index, is a free float-adjusted market capitalization index that is designed to measure the performance of global emerging markets of about 25 emerging economies.

Russell 3000: The Russell 3000 measures the performance of the 3000 largest US companies based on total market capitalization and represents about 98% of the investible US Equity market.

ML BOFA US Corp Mstr [Merill Lynch US Corporate Master]: The Merrill Lynch Corporate Master Market Index is a statistical composite tracking the performance of the entire US corporate bond market over time.

ML Muni Master [Merill Lynch US Corporate Master]: The Merrill Lynch Municipal Bond Master Index is a broad measure of the municipal fixed income market.

Investors cannot directly purchase any index.

LIBOR, London Interbank Offered Rate, is the rate of interest at which banks offer to lend money to one another in the wholesale money markets in London.

The Dow Jones Industrial Average is an unweighted index of 30 “blue-chip” industrial U.S. stocks.

The S&P Midcap 400 Index is a capitalization-weighted index measuring the performance of the mid-range sector of the U.S. stock market and represents approximately 7% of the total market value of U.S. equities. Companies in the Index fall between S&P 500 Index and the S&P SmallCap 600 Index in size: between $1-4 billion.

DJ Equity REIT Index represents all publicly traded real estate investment trusts in the Dow Jones U.S. stock universe classified as Equity REITs according to the S&P Dow Jones Indices REIT Industry Classification Hierarchy. These companies are REITs that primarily own and operate income-producing real estate.