Last Week’s Markets in Review: Earthquakes, Eclipses, and… Jobs

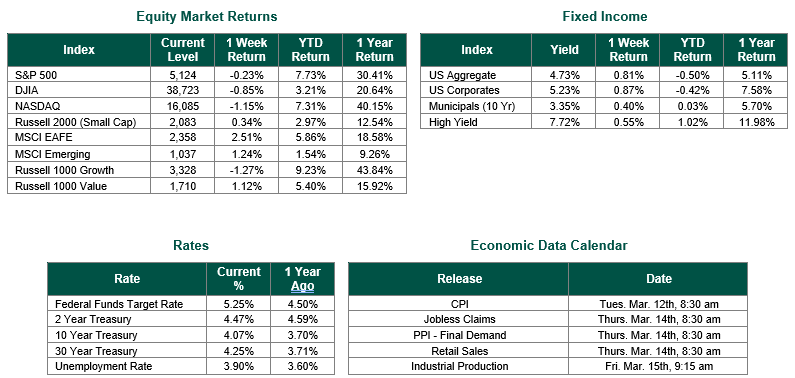

Global equity markets finished mixed for the week. In the U.S., the S&P 500 Index closed the Week at a level of 5,204, representing aloss of 0.93%, while the Russell Midcap Index moved -1.63% last Week. Meanwhile, the Russell 2000 Index, a measure of the Nation’s smallest publicly traded firms, returned -2.86% over the Week. As developed international equity performance and emerging markets were mixed, returning -1.34% and 0.28%, respectively. Finally, the 10-year U.S. Treasury yield moved lower, closing the Week at 4.40%.

While the world was focused on major earth-moving quakes on the East Coast of the United States and the anticipation of a rare solar eclipse, markets were busy digesting a robust U.S. jobs market. In March, U.S. job growth exceeded expectations, with 303,000 jobs added and the unemployment rate falling to 3.8%, while wages rose by 0.3%, the smallest increase since June 2021. This robust labor market has caused concerns among investors about potential delays in Federal Reserve interest-rate cuts, as a strong job market could fuel inflation, complicating the Fed’s mandate of maintaining employment and controlling inflation.

Despite sustained job creation over the past year, wage gains have cooled, and the unemployment rate has slightly risen, challenging the conventional belief that slowing job creation is necessary to curb inflation. Increased availability of workers, possibly due to immigration, has contributed to sustained job growth alongside high labor demand, evidenced by low layoff rates and many unfilled job openings. Key contributors to job growth include private education, healthcare, and leisure and hospitality sectors, which have collectively added 1.5 million jobs in the past year. Challenges remain, however, especially in vulnerable sectors like restaurants and hospitality, which the pandemic has heavily impacted. It should also be noted that part-time job growth over the past year has outpaced full-time job growth over the past year for the fourth consecutive month.

The job news comes just days after Fed Chair Jerome Powell confirmed that recent inflation data wouldn’t be material enough to influence the Fed’s stance on keeping interest rates unchanged. Despite high interest rates, the continued relative strength of the U.S. economy and jobs market has given the Fed the necessary confidence to be patient with their policies. However, the potential for their forecast of three interest rate cuts of 25 Bp (0.25%) each by the end of the year still exists.

Best wishes for the week ahead!

Employment data from the Bureau of Labor Statistics Equity Market, Fixed Income returns, and rates are from Bloomberg as of 4/5/24. Economic Calendar Data from Econoday as of 4/5/24. International developed markets are measured by the MSCI EAFE Index, emerging markets are measured by the MSCI EM Index, and U.S. Large Caps are defined by the S&P 500 Index. Sector performance is measured using the GICS methodology.

Disclosures: Past performance does not guarantee future results. We have taken this information from sources that we believe to be reliable and accurate. Hennion and Walsh cannot guarantee the accuracy of said information and cannot be held liable. You cannot invest directly in an index. Diversification can help mitigate the risk and volatility in your portfolio but does not ensure a profit or guarantee against a loss.