Last Week’s Markets in Review: Economic Growth Slows in the First Quarter

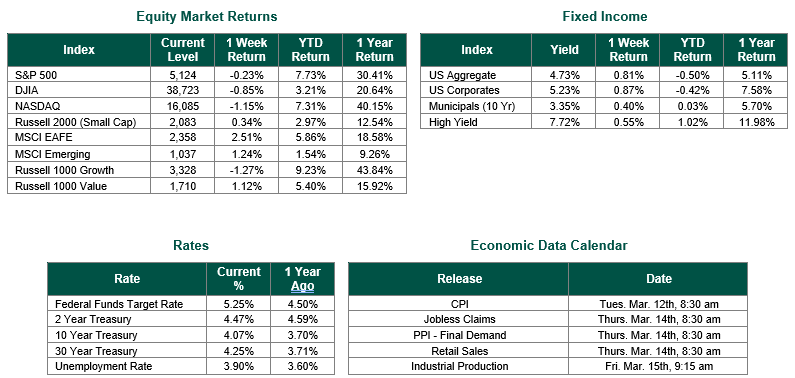

Global equity markets finished higher for the week. In the U.S., the S&P 500 Index closed the Week at a level of 5,100, representing an increase of 2.68%, while the Russell Midcap Index moved 1.97% last Week. Meanwhile, the Russell 2000 Index, a measure of the Nation’s smallest publicly traded firms, returned 2.80% over the Week. As developed international equity performance and emerging markets were higher, returning 1.98% and 3.77%, respectively. Finally, the 10-year U.S. Treasury yield moved higher, closing the Week at 4.66%.

Markets experienced a fairly volatile week as both equities and bonds reacted to economic data that included New Home Sales and Durable Goods Orders for March on Wednesday, Gross Domestic Product (GDP) for the first quarter, and Weekly Jobless Claims on Thursday, and Personal Income and Outlays for March on Friday.

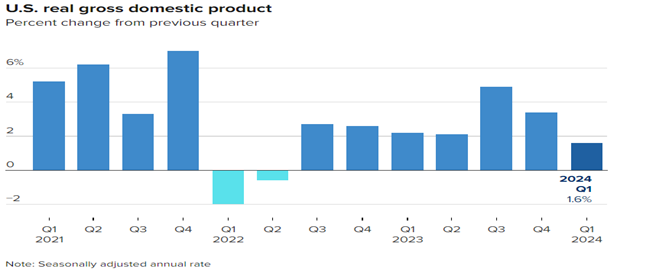

The release of the First Quarter 2024 GDP results was the major disrupter for the week. The report from the Bureau of Economic Analysis (BEA) on GDP, which is a broad measure of good and services produced during the January through March period, Increased at a 1.6% annualized rate. This reading showed a substantial decline from the prior quarter’s 3.4% growth and was also below the consensus of 2.4%.

The release also showed that the Personal Consumption Expenditures Price Index rose at a 3.4% annual rate, representing the largest gain in a year, and was up from 1.8% in the fourth quarter.

The market reacted to slower-than-expected economic growth and higher-than-expected inflation; equities sold off, and interest rates moved higher throughout the trading session on Thursday. There was a great deal of media commentary suggesting that the Federal Reserve may be forced to keep rates higher for longer as a result of Thursday’s results.

On Friday, the Commerce Department released the PCE Price Index, the Federal Reserve’s preferred gauge of inflation, for March. Core PCE, excluding food and energy, increased by 2.8% from a year ago and was unchanged from the February reading. The results were slightly higher than the 2.7% consensus estimate.

Despite all of the volatility and uncertainty of the week, the S&P 500 Index had its best week since November of 2023, breaking a three-week losing streak. The technology-laden Nasdaq Composite Index also experienced its best weekly performance since November 2023 and registered its first winning week in the last five weeks.

This week, investors will be focused on more earnings reports, jobs data, and Chairman Powell’s press conference this upcoming Wednesday to try to determine how slower economic growth and sticky inflation will affect the timing of the first interest rate cut and future Monetary Policy.

Best wishes for the week ahead!

GDP data is sourced from the U. S. Bureau of Labor Statistics. PCE data is sourced from the Commerce Department. Economic Calendar Data from Econoday as of 4/26/24. International developed markets are measured by the MSCI EAFE Index, emerging markets are measured by the MSCI EM Index, and U.S. Large Caps are defined by the S&P 500 Index. Sector performance is measured using the GICS methodology.

Disclosures: Past performance does not guarantee future results. We have taken this information from sources that we believe to be reliable and accurate. Hennion and Walsh cannot guarantee the accuracy of said information and cannot be held liable. You cannot invest directly in an index. Diversification can help mitigate the risk and volatility in your portfolio but does not ensure a profit or guarantee against a loss.