Economic Optimism Outweighs Trade Tensions

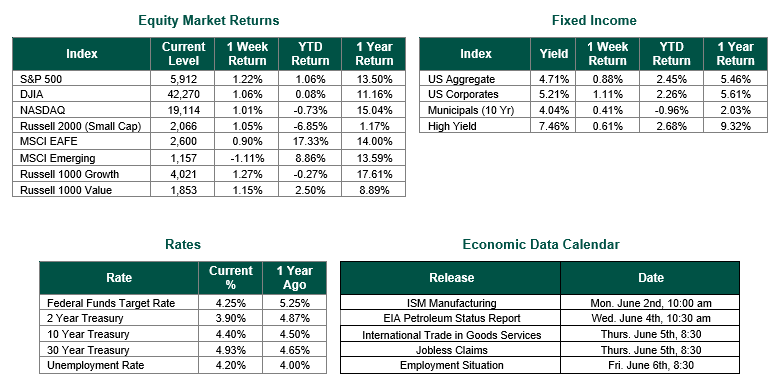

Global equity markets finished higher for the week. In the U.S., the S&P 500 Index closed the week at a level of 5,912, representing a gain of 1.22%. Notably, the S&P 500 had its best May performance since 1990. The Russell Midcap Index increased by 1.06% last week. Meanwhile, the Russell 2000 Index, a measure of the Nation’s smallest publicly traded firms, returned 1.05% over the week. Developed international equity performance and emerging markets were mixed, returning 0.90% and -1.11%, respectively. Finally, the 10-year U.S. Treasury yield declined slightly, closing the week at 4.40%

The U.S. stock market experienced a volatile yet generally positive holiday-shortened trading week, driven by a mix of trade policy developments and economic data releases. Markets reacted to shifting trade dynamics, particularly around U.S. tariff policies, which created both optimism and uncertainty. Early in the week, investor sentiment was buoyed by a temporary pause in escalating trade tensions with the European Union, fostering a risk-on environment. However, renewed concerns over U.S.-China trade relations, sparked by comments from the Trump administration about potential violations of trade agreements, introduced late-week turbulence.

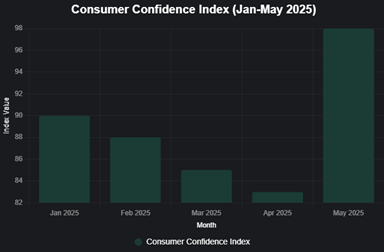

Economic data provided a mixed but largely positive backdrop. The Personal Consumption Expenditures (PCE) price index, the Federal Reserve’s preferred inflation gauge, rose by just 0.1% in April, indicating cooling inflation while also aligning with consensus expectations. This inflation reading fueled speculation about potential Federal Reserve rate cuts, with market expectations for 2025 rate reductions slightly increasing. Consumer confidence also improved, with The Conference Board’s Consumer Confidence Index rising to 98 in May, surpassing forecasts and signaling much-improved optimism despite lingering trade policy concerns.

Investors are now focused on upcoming economic indicators, including the May jobs report, ISM Manufacturing PMI, and Federal Reserve commentary, which could provide further clarity on economic growth and monetary policy. Trade policy developments, particularly U.S.-China relations and ongoing tariff disputes, will likely continue to influence market dynamics in the near term.

Best wishes for the week ahead!

Equity and Fixed Income Index returns sourced from Bloomberg on 5/30/25. Consumer Confidence Data sourced from The Conference Board on 5/27/25. PCE data sourced from The Bureau of Economic Analysis on 5/30/25. International developed markets are measured by the MSCI EAFE Index, emerging markets are measured by the MSCI EM Index, and U.S. Large Caps are defined by the S&P 500 Index. Sector performance is measured using the GICS methodology.

Disclosures: Past performance does not guarantee future results. We have taken this information from sources that we believe to be reliable and accurate. Hennion and Walsh cannot guarantee the accuracy of said information and cannot be held liable. You cannot invest directly in an index. Diversification can help mitigate the risk and volatility in your portfolio but does not ensure a profit or guarantee against a loss.