Jobs Data and Tariff Negotiations Shape Market Sentiment

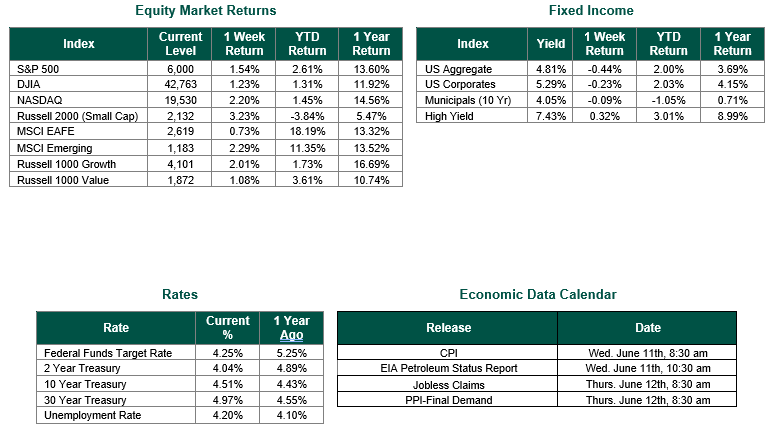

Global equity markets finished higher for the week. In the U.S., the S&P 500 Index closed the week at a level of 6,000, representing a gain of 1.54%, while the Russell Midcap Index moved approximately 1.50% last week Meanwhile, the Russell 2000 Index, a measure of the Nation’s smallest publicly traded firms, returned 3.23% over the week. Developed international equity performance and emerging markets were positive, returning 0.73% and 2.29%, respectively. Finally, the 10-year U.S. Treasury yield moved higher, closing the week at 4.51%.

The latest economic data and policy developments paint a complex picture of the U.S. labor market and trade environment. Employment reports released last week provided new insights into hiring trends, job openings, and workforce participation, highlighting both areas of growth and ongoing challenges. Meanwhile, the Trump administration remained active in negotiating international trade tariffs, pushing forward with significant policy shifts despite facing legal hurdles. These developments underscore the broader economic landscape, where labor market fluctuations and trade disputes continue to shape the outlook for businesses, consumers, and investors alike.

Throughout last week, several key employment indicators were released, providing insight into the state of the U.S. labor market. The Employment Situation Report for May revealed that total non-farm payroll employment increased by 139,000 jobs, while the unemployment rate remained unchanged at 4.2%. Job gains were concentrated in health care, leisure and hospitality, and social assistance, whereas the federal government continued to shed jobs. The Job Openings and Labor Turnover Summary (JOLTS), released on June 3, indicated that the number of job openings remained steady at 7.4 million – roughly matching the number of unemployed individuals. Additionally, the labor force participation rate declined slightly to 62.4%, while the employment-population ratio fell to 59.7%. The mixed signals from the Household Survey, which recorded a loss of 696,000 jobs, contrasted with the Establishment Survey’s reported job gains, highlighting ongoing discrepancies in labor market measurements. Overall, the employment data suggested a moderate, though slowing, pace of job growth, with some sectors continuing to expand while others sectors declined.

As eluded to earlier, the current administration has been actively engaged in negotiations and legal battles surrounding international tariffs and trade policies. Recently, President Trump announced a significant increase in tariffs on aluminum and steel imports, raising them to 50%, as part of his broader trade strategy. The administration has also been pressing trading partners to accelerate negotiations, setting deadlines for updates on trade discussions. However, these efforts have faced multiple legal challenges, with several court rulings blocking the enforcement of certain tariffs. Despite these setbacks, the Trump administration remains committed to its tariff policies, with appeals underway to overturn the rulings.

Meanwhile, the White House has indicated that three trade deals are close to being finalized and are awaiting the president’s approval. The ongoing tariff disputes have led to economic uncertainty, with concerns about rising costs for American consumers and potential retaliatory measures from affected countries. This will be a critical week for the tariffs and trade as delegates from the U.S. and China are scheduled to meet in London to further their trade discussion and tariff negotiations.

The interplay between labor market dynamics and international trade policies remains a key factor influencing investor sentiment. As uncertainties persist, analysts and policymakers will closely monitor upcoming data releases to gauge the strength of economic recovery and potential adjustments in fiscal and monetary strategies. It is important to remember that the Federal Reserve is scheduled to meet next week. While we do not expect a rate cut to be announced at this meeting, the Federal Reserve will release any updated Dot Plot Chart and Summary of Economic Projections, both of which should provide an updated path forward for interest rates, according to the data-dependent Federal Reserve, of course.

Best wishes for the week ahead!

Equity and Fixed Income Index returns sourced from Bloomberg on 6/6/25. The May Employment Situation Summary and the JOLTS data were sourced from the U.S. Bureau of Labor Statistics. Weekly jobless claims data sourced from the U. S. Department of Labor. Economic Calendar Data from Econoday as of 5/23/25. International developed markets are measured by the MSCI EAFE Index, emerging markets are measured by the MSCI EM Index, and U.S. Large Caps are defined by the S&P 500 Index. Sector performance is measured using the GICS methodology.

Disclosures: Past performance does not guarantee future results. We have taken this information from sources that we believe to be reliable and accurate. Hennion and Walsh cannot guarantee the accuracy of said information and cannot be held liable. You cannot invest directly in an index. Diversification can help mitigate the risk and volatility in your portfolio but does not ensure a profit or guarantee against a loss.