Last Week’s Markets in Review: Economy Grew while Inflation Cooled in 2023

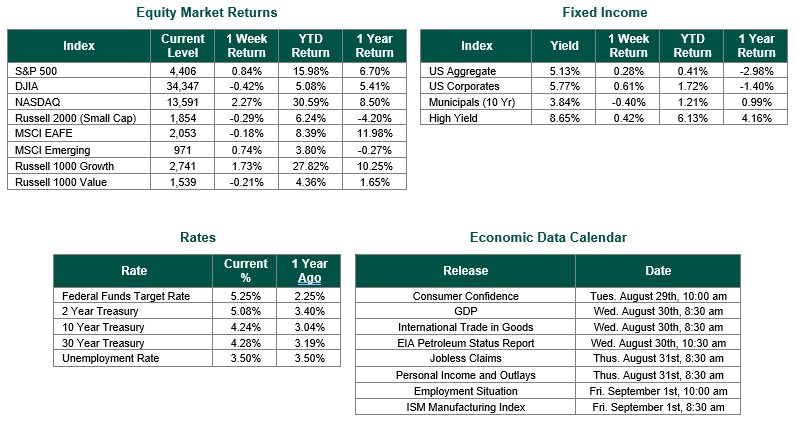

Global equity markets finished higher for the week. In the U.S., the S&P 500 Index closed the week at a level of 4,891, representing an increase of 1.07%, while the Russell Midcap Index moved 0.84% last week. Meanwhile, the Russell 2000 Index, a measure of the Nation’s smallest publicly traded firms, returned 1.75% over the week. Developed international equity performance and emerging markets were also positive, returning 2.01% and 1.47%, respectively. Finally, the 10-year U.S. Treasury yield moved higher, closing the week at 4.14%.

Resilience in the labor markets and strong consumer spending pushed near-term recession fears aside as the U.S. economy expanded 3.1% over the past year, according to the Commerce Department this past week. Entering 2023, economists had widely projected a recession, which would have resulted from a contraction in economic growth for the world’s largest economy. Instead, the economy defied the odds and significantly outpaced the projected 0.2% growth rate that the Wall Street Journal economist surveys had anticipated a year ago. In the fourth quarter alone, the economy expanded at a 3.3% pace, thanks largely to household and government spending. However, it is important to note that this figure will be revised three more times before being finalized, and revisions that have taken place in previous quarters have had varying differences from the initial reading. In addition, gross domestic product (GDP) growth slowed in the 4th quarter from 5.3% in the 3rd quarter of 2023. In the short term, though, the GDP print is seen as a strong positive for markets.

Despite the stronger-than-expected growth in 2023, the Federal Reserve forecasts real GDP growth to slow to 1.4% in 2024 and stay below 2.0% through 2026, according to their Summary of Economic Projections released on December 13, 2023. If the data shifts in their forecasted direction and inflation continues to moderate towards their 2% target, the Federal Reserve could loosen monetary policy (i.e., cut interest rates) to help stimulate growth and prevent a recessionary period.

In what will be the final inflation reading before the Federal Reserve’s first policy meeting of 2024, the PCE Price Index rose at just a 0.2% pace in December and 2.9% for the year. Remarkably, the Fed’s preferred measure of inflation would be only 0.90% away from their long-term target rate. While we do not believe last Friday’s report is significant enough to warrant a rate cut next week, prices do appear to be moving in the right direction for cuts to occur in 2024, likely during the second half of 2024. Perhaps a relatively soft landing for the U.S. economy can be achieved.

Best wishes for the week ahead!

Equity Market, Fixed Income returns, and rates are from Bloomberg as of 1/26/24. Economic Calendar Data from Econoday as of 1/29/24. PCE Inflation data from the Bureau of Economic Analysis on 1/26/24. International developed markets are measured by the MSCI EAFE Index, emerging markets are measured by the MSCI EM Index, and U.S. Large Caps are defined by the S&P 500 Index. Sector performance is measured using the GICS methodology.

Disclosures: Past performance does not guarantee future results. We have taken this information from sources that we believe to be reliable and accurate. Hennion and Walsh cannot guarantee the accuracy of said information and cannot be held liable. You cannot invest directly in an index. Diversification can help mitigate the risk and volatility in your portfolio but does not ensure a profit or guarantee against a loss.