Last Week’s Markets in Review: Economy Shows Signs of Slowing

Global equity markets finished higher for the week. In the U.S., the S&P 500 Index closed the week at a level of 4,071, representing an increase of 2.48%, while the Russell Midcap Index moved 2.44% higher last week. Meanwhile, the Russell 2000 Index, a measure of the Nation’s smallest publicly traded firms, returned 2.37% over the week. As developed, international equity performance and emerging markets were higher returning 1.40% and 1.44%, respectively. Finally, the 10-year U.S. Treasury yield moved higher, closing the week at 3.50%.

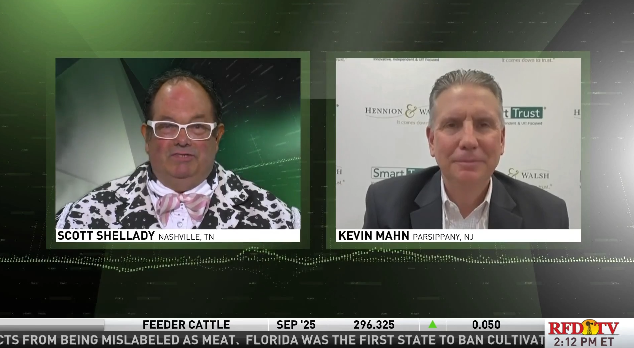

This week’s update will review Gross Domestic Product (GDP) for the fourth quarter 0f 2022, personal consumption expenditures (PCE) for December, and 4th quarter corporate earnings. Our review of each of these economic data points will help us better understand the current state of the economy and how it may perform through the remainder of 2023. These economic data points are also being reviewed and analyzed by the Federal Reserve as it determines its future monetary policy for 2023 and beyond.

On Thursday, the Commerce Department released its first reading of GDP for the 4th quarter. The sum of all goods and services produced for the October to December period was a positive 2.9%, annualized. This result was slightly above the consensus estimate of 2.8%, although the growth rate for the 4th quarter was slower than the 3.2% advance recorded during the 3rd quarter of 2022.

Within the overall GDP results, consumer spending, which accounts for nearly 70% of total GDP, increased 2.1% for the quarter, slightly lower than the 2.3% recorded in the 3rd quarter. GDP was restrained by a sharp decline in residential fixed investment (housing). For the quarter, housing declined by 26.7%. This plunge in housing subtracted approximately 1.3% from the overall GDP total.

The Commerce Department also released Personal Consumption Expenditures results for December on Friday. The results showed that the Fed’s aggressive rate hiking agenda during 2022 is having the desired effect. Personal consumption expenditures, excluding food and energy, increased 4.4% from a year ago, down from a 4.7% increase in November and in line with the consensus estimate. This reading represented the slowest annual rate of growth since October 2021.

Turning towards corporate earnings, as of January 27, FactSet reports that 29% of the S&P 500 companies have reported 4th quarter earnings results. Of the reporting companies, 69% have reported positive earnings per share (EPS) surprises. The percentage of companies reporting EPS above the mean EPS estimate is below the 1-year average (75%), below the 5-year average (77%), and the 10-year average (73%). 60% of the reporting S&P companies have reported revenues above estimates. With a large percentage of corporations still to report, we will continue to analyze the progress of corporations in this challenging environment. Market participants viewed the results of the reporting companies as generally favorable.

Market participants seemed to be pleased with all of these economic results on a cumulative basis, pushing equities higher for the week. A slowing economy, showing the lagging effects of the Fed’s aggressive rate hikes of 2022, was welcomed by investors as market participants are increasingly talking about a Fed that is likely to decrease the pace of interest rate hikes and ultimately pause hiking during the first half of 2023.

Investors should consider all the information discussed within this market update and many other factors when managing their investment portfolios. However, with so much data and so little time to digest, we encourage investors to work with experienced financial professionals to help process all this information to build and manage the asset allocations within their portfolios consistent with their objectives, timeframe, and tolerance for risk.

Best wishes for the week ahead!

Both GDP and PCE data are sourced from the Commerce Department. t4th quarter corporate earnings information is sourced from FactSet. Equity Market and Fixed Income returns are from JP Morgan as of 1/27/23. Rates and Economic Calendar Data from Bloomberg as of 1/27/23. International developed markets are measured by the MSCI EAFE Index, emerging markets are measured by the MSCI EM Index, and U.S. Large Caps are defined by the S&P 500 Index. Sector performance is measured using the GICS methodology.

Disclosures: Past performance does not guarantee future results. We have taken this information from sources that we believe to be reliable and accurate. Hennion and Walsh cannot guarantee the accuracy of said information and cannot be held liable. You cannot invest directly in an index. Diversification can help mitigate the risk and volatility in your portfolio but does not ensure a profit or guarantee against a loss.