Last Week’s Markets in Review: Elections and the Markets

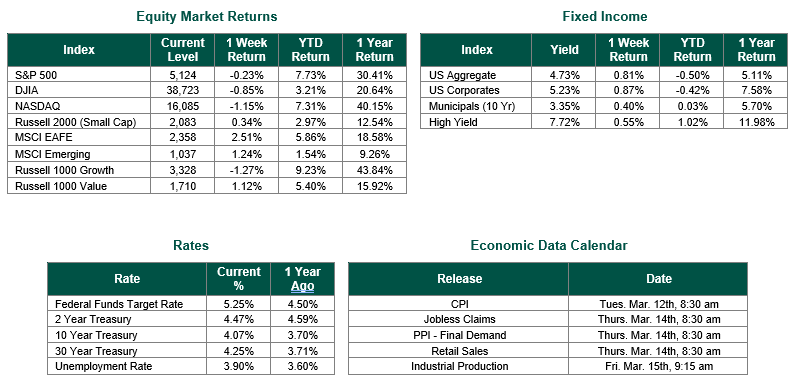

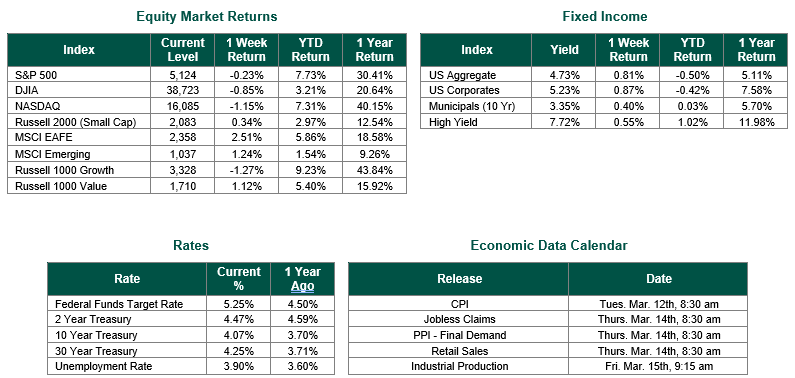

Global equity markets finished mixed for the week. In the U.S., the S&P 500 Index closed the week at a level of 5,124, representing an decrease of 0.23%, while the Russell Midcap Index moved 0.69% last week. Meanwhile, the Russell 2000 Index, a measure of the Nation’s smallest publicly traded firms, returned 0.34% over the week. Developed international equity performance and emerging markets were positive, returning 2.51% and 1.24%, respectively. Finally, the 10-year U.S. Treasury yield moved lower, closing the week at 4.07%.

One of the primary focuses for 2024 is the outcome of the November presidential election in the United States. The fiscal policy differences that the Democrat and Republican parties favor will significantly affect potential corporate tax rates and the individual tax rate sunset that will occur in 2025 from the Tax Cuts and Jobs Act coming to an end. It has been argued that this year’s general election will be one of the most impactful elections in history, and market participants have already begun raising concerns nearly eight months out. Last Tuesday’s “Super Tuesday” primary voting has officially set the stage for a rematch election between former President Donald Trump and current President Joe Biden. With the field seemingly now in place, global investors have brought greater focus on how the outcome may affect their portfolios.

Despite its significance, this will not be the first election in history with economic and market implications. However, in our view, investors should not rely solely on election results or political party preferences to guide their investment decisions. Since 1928 (the S&P 500 index’s inception), there have been 23 presidential election years. In 19 of those 23 years, or 83% of the time, the index provided positive performance. Further, the average return for those election years was 11.58% for the S&P 500 vs. the average return of 9.81% overall for the index. This outperformance is why we believe that trying to time the market by moving to cash during or after election years is often an exercise in futility and could be detrimental to meeting longer-term investment goals.

Although just one part of the equation, political risk is an important variable when constructing and managing portfolios. This risk may be even more significant this year as 64 countries, plus the European Union, have elections scheduled in 2024. Furthermore, according to the International Foundation for Electoral Systems, these elections represent approximately 49% of the global population. Due to the magnitude of these elections, we suggest that investors work with their financial advisors to ensure that their portfolios are positioned according to their goals, risk appetites, and investment timeframes with a gameplan for navigating the various possible outcomes.

Best wishes for the week ahead!

Equity Market, Fixed Income returns, and rates are from Bloomberg as of 3/8/24. Economic Calendar Data from Econoday as of 3/8/24. International developed markets are measured by the MSCI EAFE Index, emerging markets are measured by the MSCI EM Index, and U.S. Large Caps are defined by the S&P 500 Index. Sector performance is measured using the GICS methodology.

Disclosures: Past performance does not guarantee future results. We have taken this information from sources that we believe to be reliable and accurate. Hennion and Walsh cannot guarantee the accuracy of said information and cannot be held liable. You cannot invest directly in an index. Diversification can help mitigate the risk and volatility in your portfolio but does not ensure a profit or guarantee against a loss.