Employment Data Moves Stocks Higher

Global equity markets finished higher for the week. In the U.S., the S&P 500 Index closed the Week at a level of 5567, representing an increase of 1.57%, while the Russell Midcap Index moved-0.82% last Week. Meanwhile, the Russell 2000 Index, a measure of the Nation’s smallest publicly traded firms, returned -0.50% over the Week. As developed international equity performance and emerging markets were higher, returning 2.18% and 1.95%, respectively. Finally, the 10-year U.S. Treasury yield moved lower, closing the Week at 4.28%.

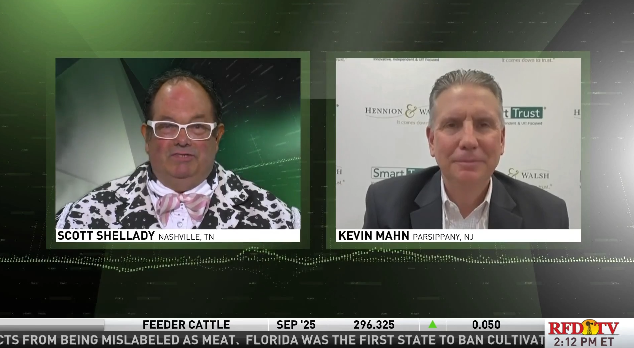

During the shortened trading week when our Nation celebrated Independence Day, there was a bountiful amount of employment data and comments from Federal Reserve Chairman Powell.

The employment data began with the release of the JOLTS (Job Openings and Labor Turnover Summary) for May by the Labor Department on Tuesday. The report disclosed that there were 8.14 million domestic job openings. The consensus estimate was 7.9 million. The May results follow outsized declines in the prior two months, but the trend remained consistent with an easing in labor market conditions that could pave the way for the softening of monetary policy later this year.

Due to the observance of the Independence Day holiday, weekly jobless claims (normally released on Thursday) were published on Wednesday. For the week ending on June 29th, jobless claims increased to 238,000, slightly higher than the consensus estimate of 233,000. Like the JOLTS for May, the trend in claims seems to support a weakening labor market environment.

On Friday, the Bureau of Labor Statistics (BLS) released the Employment Situation Summary for June. Nonfarm payrolls increased by 206,000 for the month, better than the 200,000 consensus estimate. June results were less than the downwardly revised gain of 218,000 in May, which itself was cut sharply from the initial estimate of 272,000 jobs. In addition, the unemployment rate unexpectedly climbed to 4.1%, tied for the highest level since October 2021. The increase in the unemployment rate came as the labor force participation rate rose to 62.6%.

As the labor data pointed to a slowing economy that the Fed is trying to engineer, and equities moved higher as a result, with both the S&P 500 and NASDAQ indexes achieving new all-time highs on Friday. Fed Chairman Powell tried to maintain the Fed’s ongoing position that they were steadfast in their commitment to try and push inflation down closer to their 2% target. In this regard, Powell said that the Fed “has made quite a bit of progress” in getting back to price stability and FOMC’s inflation objective of 2%. Powell added, “We want that progress to continue”. Powell maintained that the Fed policymakers “want to be more confident” before loosening monetary policy by cutting interest rates.

We will continue to monitor both the economic data and the Federal Reserve throughout the summer and report our analysis to our readers. B

est wishes for the week ahead!

Employment Data is sourced from both the Labor Department and the Bureau of Labor Statistics. Economic Calendar Data from Econoday as of 7/5/24. International developed markets are measured by the MSCI EAFE Index, emerging markets are measured by the MSCI EM Index, and U.S. Large Caps are defined by the S&P 500 Index. Sector performance is measured using the GICS methodology.

Disclosures: Past performance does not guarantee future results. We have taken this information from sources that we believe to be reliable and accurate. Hennion and Walsh cannot guarantee the accuracy of said information and cannot be held liable. You cannot invest directly in an index. Diversification can help mitigate the risk and volatility in your portfolio but does not ensure a profit or guarantee against a loss.