Europe Likely to Cut Interest Rates Before U.S.

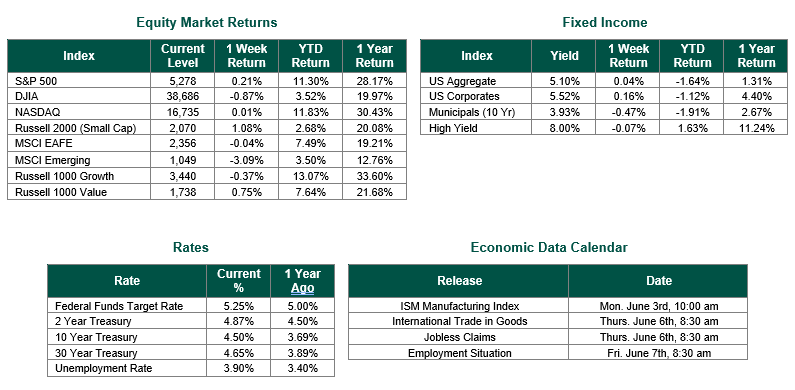

Global equity markets finished mixed for the week. In the U.S., the S&P 500 Index closed the Week at a level of 5,278, representing an increase of 0.21%, while the Russell Midcap Index moved -0.76% last Week. Meanwhile, the Russell 2000 Index, a measure of the Nation’s smallest publicly traded firms, returned 1.08% over the Week. As developed international equity performance and emerging markets were lower, returning -0.04% and -3.09%, respectively. Finally, the 10-year U.S. Treasury yield moved higher, closing the Week at 4.50.

Eurozone inflation accelerated in May due to a rise in service prices, but this rise isn’t expected to deter the European Central Bank (ECB) from cutting interest rates next week as planned. For the month, inflation rose to 2.6% from 2.4%, slightly exceeding economists’ expectations. The ECB is confident that inflation will stabilize around their 2% target by mid-next year, supported by falling energy and food prices. However, policymakers are wary of sustained wage increases leading to higher service costs and inflation. The ECB is closely monitoring service price pressures and will adjust interest rates accordingly. Despite a stronger-than-expected Eurozone economy, the ECB remains focused on its inflation mandate.

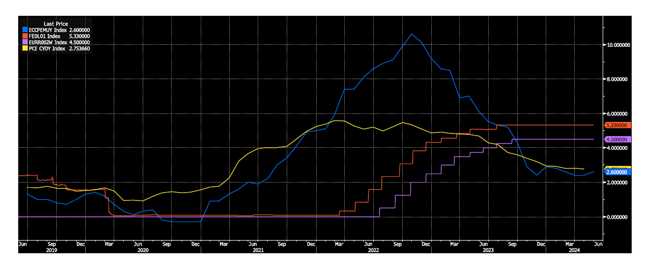

As we can see in the chart below, the ECB policy rate (purple) has lagged and not been as drastic as the Federal Reserve’s rate policies (red). Yet, at the same time, eurozone inflation (blue) has come down at a significantly stronger pace than U.S. inflation, as measured by PCE (yellow). These policies and the direction of prices are likely to provide the ECB with the confidence to cut rates well ahead of the U.S.

Source:Bloomberg as of 5/31/24

Meanwhile, in the United States, the picture is not necessarily glum despite its relative picture to the Eurozone. The Federal Reserve’s preferred inflation gauge, the personal consumption expenditures price index (PCE), increased by 2.7% in April compared to a year ago, aligning with economists’ expectations. The core index, excluding volatile food and energy prices, rose slightly higher than anticipated, at 2.8% over the past 12 months. It is important to remember that the Summary of Economic Projections released by the Federal Reserve following their March meeting showed that their forecast for core PCE in 2024 is 2.6%. This data comes amid expectations for potential interest-rate cuts due to recent economic indicators. Initially, investors anticipated rate cuts earlier in the year, but firmer-than-expected inflation data tempered such expectations. However, more recent indicators, including a slight easing in the consumer price index (CPI) inflation gauge for April, have revived optimism for rate cuts. This sentiment is reinforced by revised gross domestic product (GDP) data showing slower growth (i.e., 1.3%) in the first quarter of 2024. The Fed’s upcoming policy meeting, scheduled for June 12, will be closely watched as they will update their infamous “Dot Plot” chart, which will provide a new potential path forward for interest rates in the U.S.

Best wishes for the week ahead!

Inflation and rate chart acquired from Bloomberg on 5/31/24. Equity Market, Fixed Income returns, and rates are from Bloomberg as of 5/31/24. Economic Calendar Data from Econoday as of 5/31/24. International developed markets are measured by the MSCI EAFE Index, emerging markets are measured by the MSCI EM Index, and U.S. Large Caps are defined by the S&P 500 Index. Sector performance is measured using the GICS methodology.

Disclosures: Past performance does not guarantee future results. We have taken this information from sources that we believe to be reliable and accurate. Hennion and Walsh cannot guarantee the accuracy of said information and cannot be held liable. You cannot invest directly in an index. Diversification can help mitigate the risk and volatility in your portfolio but does not ensure a profit or guarantee against a loss.