Last Week’s Markets in Review: Evaluating this Bear Market

Market Overview

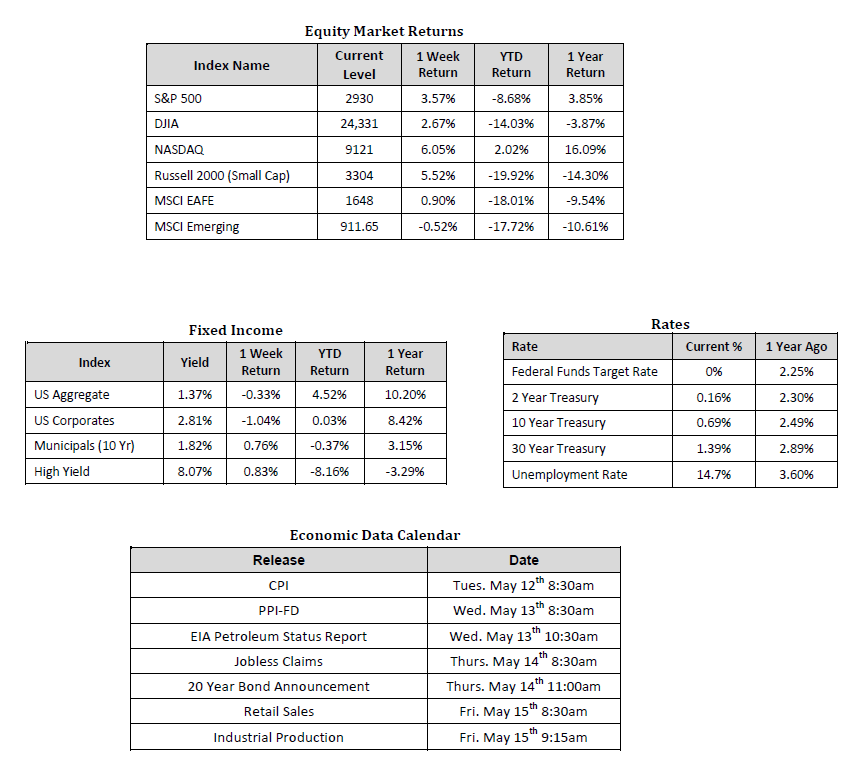

Sources: Sources for data in tables: Equity Market and Fixed Income returns are from JP Morgan as of 05/08/2020. Rates and Economic Calendar Data from Bloomberg as of 05/08/2020. International developed markets measured by the MSCI EAFE Index, emerging markets measured by the MSCI EM Index. Sector performance is measured using GICS methodology.

Happening Now

Global equity markets shrugged off the worst news on the employment front since World War 2, as nearly all equity indexes moved higher. According to Wells Fargo, “Friday’s jobs report showed roughly 20.5 million jobs were lost in April, below expectations of a 22 million decline. Meanwhile, the unemployment rate more than tripled from the prior month to 14.7%, breaking the post-World War Two record of 10.8%, but still below the Great Depression high of almost 25.0%”. In the U.S., the S&P 500 Index propelled to a level of 2,930, representing a gain of 3.57%, while the Russell Midcap Index pushed 4.83% higher last week. Meanwhile, the Russell 2000 Index, a measure of the Nation’s smallest publicly traded firms, returned 5.52% over the week. Moreover, developed and emerging international markets returned 0.90% and -0.52%, respectively. Finally, the yield on the 10-year U.S. Treasury rose modestly, finishing the week at 0.69%.

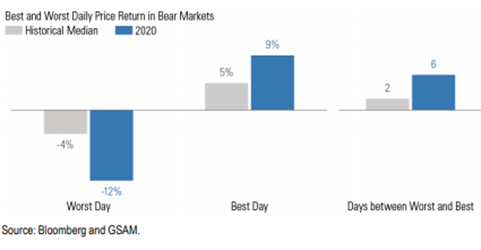

With the worst of the damage starting to look like it might be behind us, we thought it might be interesting to evaluate how this bear market has stacked up to past bear markets thus far. We’ve written repeatedly about the difficulty of trying to time the market successfully, which is due in large part to the proximity of the best and worst-performing days. Comparing this bear market to all bear markets since 1948 shows that certain market mechanics, such as the nearness of the best and worst-performing days, just might be timeless. The chart below illustrates the timelessness of this relationship, as we can see that the best and worst-performing days have historically occurred within two days of each other. With a six-day interval, the 2020 bear market has been no exception.

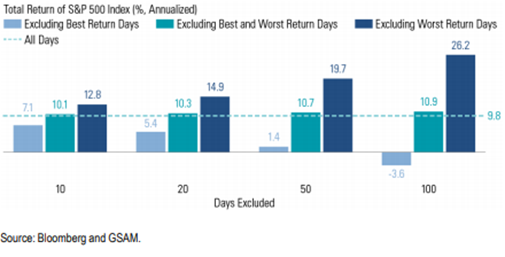

Given the immediacy of the strongest and weakest days, it’s only natural to assume that those attempting to market time will likely miss out on at least one of the best days, even if there are lucky enough to avoid one of the worst days. Markets can be wildly unpredictable. For evidence, look no further than the performance of U.S. large cap stocks, which have essentially erased many of the earlier losses for the year, all while roughly 15% of the U.S. labor force is unemployed. Turning to the chart below, we can see that since 1989 those that missed ten of the worst and best days went on to average 10.1% per year, which is in line with the 9.8% return generated by a typical buy-and-hold strategy.

Entering and exiting the market adds multiple layers of transaction costs, not to mention the added uncertainty and stress that a volatile market presents. Uncertainty and stress can cloud judgment, and clouded judgment can lead to suboptimal decisions, and suboptimal decisions can lead potentially to decades of underperformance. Now, this isn’t to say that a buy-and-hold strategy is the most ideal option for all investors because it likely is not for most investors who desire portfolio strategies that are adjusted in accordance with changing market environments. This is why we continue to encourage investors to stay disciplined and work with experienced financial professionals to help manage their portfolios through various market cycles within an appropriately diversified framework that is consistent with their objectives, timeframe, and tolerance for risk.

Best wishes for continued health and safety to all.

Important Information and Disclaimers

Disclosures: Past performance does not guarantee future results. We have taken this information from sources that we believe to be reliable and accurate. Hennion and Walsh cannot guarantee the accuracy of said information and cannot be held liable. You cannot invest directly in an index. Diversification can help mitigate the risk and volatility in your portfolio but does not ensure a profit or guarantee against loss. Hennion & Walsh is the sponsor of SmartTrust® Unit Investment Trusts (UITs). For more information on SmartTrust® UITs, please visit www.smarttrustuit.com. The overview above is for informational purposes and is not an offer to sell or a solicitation of an offer to buy any SmartTrust® UITs. Investors should consider the Trust’s investment objective, risks, charges and expenses carefully before investing. The prospectus contains this and other information relevant to an investment in the Trust and investors should read the prospectus carefully before they invest.

Investing in foreign securities presents certain risks not associated with domestic investments, such as currency fluctuation, political and economic instability, and different accounting standards. This may result in greater share price volatility. These risks are heightened in emerging markets.

There are special risks associated with an investment in real estate, including credit risk, interest rate fluctuations and the impact of varied economic conditions. Distributions from REIT investments are taxed at the owner’s tax bracket.

The prices of small company and mid cap stocks are generally more volatile than large company stocks. They often involve higher risks because smaller companies may lack the management expertise, financial resources, product diversification and competitive strengths to endure adverse economic conditions.

Investing in commodities is not suitable for all investors. Exposure to the commodities markets may subject an investment to greater share price volatility than an investment in traditional equity or debt securities. Investments in commodities may be affected by changes in overall market movements, commodity index volatility, changes in interest rates or factors affecting a particular industry or commodity.

Products that invest in commodities may employ more complex strategies which may expose investors to additional risks.

Investing in fixed income securities involves certain risks such as market risk if sold prior to maturity and credit risk especially if investing in high yield bonds, which have lower ratings and are subject to greater volatility. All fixed income investments may be worth less than original cost upon redemption or maturity. Bond Prices fluctuate inversely to changes in interest rates. Therefore, a general rise in interest rates can result in the decline of the value of your investment.

Definitions

MSCI- EAFE: The Morgan Stanley Capital International Europe, Australasia and Far East Index, a free float-adjusted market capitalization index that is designed to measure developed-market equity performance, excluding the United States and Canada.

MSCI-Emerging Markets: The Morgan Stanley Capital International Emerging Market Index, is a free float-adjusted market capitalization index that is designed to measure the performance of global emerging markets of about 25 emerging economies.

Russell 3000: The Russell 3000 measures the performance of the 3000 largest US companies based on total market capitalization and represents about 98% of the investible US Equity market.

ML BOFA US Corp Mstr [Merill Lynch US Corporate Master]: The Merrill Lynch Corporate Master Market Index is a statistical composite tracking the performance of the entire US corporate bond market over time.

ML Muni Master [Merill Lynch US Corporate Master]: The Merrill Lynch Municipal Bond Master Index is a broad measure of the municipal fixed income market.

Investors cannot directly purchase any index.

LIBOR, London Interbank Offered Rate, is the rate of interest at which banks offer to lend money to one another in the wholesale money markets in London.

The Dow Jones Industrial Average is an unweighted index of 30 “blue-chip” industrial U.S. stocks.

The S&P Midcap 400 Index is a capitalization-weighted index measuring the performance of the mid-range sector of the U.S. stock market, and represents approximately 7% of the total market value of U.S. equities. Companies in the Index fall between S&P 500 Index and the S&P SmallCap 600 Index in size: between $1-4 billion.

DJ Equity REIT Index represents all publicly traded real estate investment trusts in the Dow Jones U.S. stock universe classified as Equity REITs according to the S&P Dow Jones Indices REIT Industry Classification Hierarchy. These companies are REITs that primarily own and operate income-producing real estate.