Last Week’s Markets in Review: Factoring in Quality to Equity Portfolios

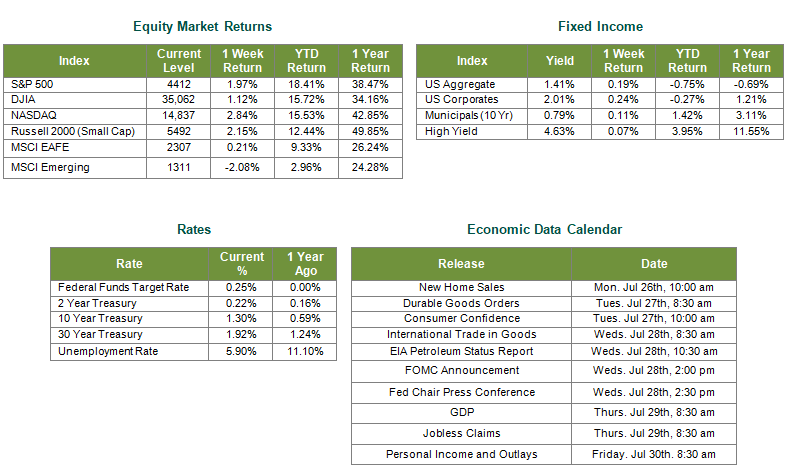

Major U.S. indexes reclaimed record highs last week after an inauspicious start. In the U.S., the S&P 500 Index closed the week at a level of 4,412, representing a gain of 1.97%, while the Russell Midcap Index moved 2.54% higher. Meanwhile, the Russell 2000 Index, a measure of the Nation’s smallest publicly traded firms, returned 2.15% over the week. International equity performance was mixed as developed and emerging markets returned 0.21% and -2.08%, respectively. Finally, the 10-year U.S. Treasury yield was unchanged over the week, closing at 1.30% on Friday.

Last week started on a heavy risk-off tone. On Monday, the S&P 500 fell 1.6%, the CBOE Volatility Index spiked, and Treasuries rallied over concerns of the COVID-19 delta variant posing a risk to global growth. The glass half-empty crowd wasn’t around for very long as investors appeared to buy the dip and markets rallied once again. Last week was a microcosm of what we have experienced recently and we will likely encounter a balancing act between headwinds and tailwinds for the remainder of the year. Robust corporate profits and strong global growth prospects are met with public health concerns, debatable translations on economic indicators, and uncertainty on how numerous policy decisions will unfold.

While investor and media discussions regarding equity positioning have primarily revolved around Value vs. Growth or Large Cap vs. Small Cap, another factor that investors should consider is quality. We view quality companies as those with robust balance sheets, strong fundamentals, reliable and sustainable earnings, and relatively low levels of leverage. Quality stocks tend to experience less volatility and may be helpful in the management of risk within equity allocations. While quality stocks are usually given stronger consideration during economic slowdowns and contractions, we see three distinct benefits for adding, or maintaining, allocations in the current environment.

Our first supporting argument relates to valuations and the business cycle. For much of the past 12 months, particularly the fourth quarter of 2020 and the first quarter of 2021, quality stocks were an afterthought giving way to early cycle beneficiaries like small-cap and value stocks. As a result, valuations soared and started to catch up with the already “expensive” growth names on a relative basis. While we acknowledge our projections for continued strong economic growth, we are no doubt moving through the early stages of the cycle at a historically quick rate due to the driver of this particular recession and subsequent bounce-back. In addition, markets may have already priced in this ascent, as evidenced by the frequent market high milestones. So as the pace of reopenings normalizes, we would expect growth to slow and a more gradual, choppy climb in the markets ahead, with Quality stocks drawing more attention.

Second, as previously mentioned, quality stocks can help mitigate risk. Companies with strong and stable balance sheets are better suited to weather economic headwinds or market gyrations. This balance sheet stability, paired with low debt to equity ratios provides companies with the financial flexibility to endure adverse economic conditions. The result will typically lead to more stable earnings and in return, lower volatility for equity investors. In our view, financially sound companies with growing profits should be able to withstand potential margin compression from the inflationary forces we face today and may also better endure potential tax rate increases.

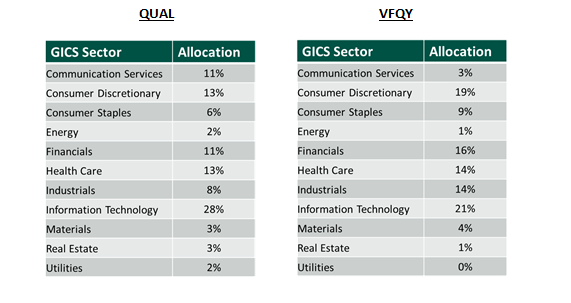

Finally, quality doesn’t necessarily mean defensive. Investing in quality stocks or funds is not going into full risk-off mode. Consider the sector breakdown of the two largest quality factor exchange-traded funds (ETFs), the iShares MSCI Quality USA Quality Factor ETF (Ticker: QUAL) and the Vanguard U.S. Quality Factor ETF (Ticker: VFQY). Quality can be found in all sectors below. The style falls into the Core category for each fund, which is also consistent with our recent market update discussing the potential benefits of a Growth and Value barbell strategy.

For these reasons, we believe a quality equity allocation may be appropriate for certain investors to consider. As always, we encourage investors to work with experienced financial professionals to help build and manage the asset allocations within their portfolios consistent with their objectives, timeframe, and tolerance for risk.

Best wishes for the week ahead!

Sources for data in tables: Equity Market and Fixed Income returns are from JP Morgan as of 7/23/21. Rates and Economic Calendar Data from Bloomberg as of 7/23/21. International developed markets measured by the MSCI EAFE Index, emerging markets measured by the MSCI EM Index, U.S. Large Cap defined by the S&P 500. Sector performance is measured using the GICS methodology.

Disclosures: Past performance does not guarantee future results. We have taken this information from sources that we believe to be reliable and accurate. Hennion and Walsh cannot guarantee the accuracy of said information and cannot be held liable. You cannot invest directly in an index. Diversification can help mitigate the risk and volatility in your portfolio but does not ensure a profit or guarantee against a loss.

Diversification can help mitigate the risk and volatility in your portfolio but does not ensure a profit or guarantee against loss.

Investing in commodities is not suitable for all investors. Exposure to the commodities markets may subject an investment to greater share price volatility than an investment in traditional equity or debt securities. Investments in commodities may be affected by changes in overall market movements, commodity index volatility, changes in interest rates or factors affecting a particular industry or commodity.

Products that invest in commodities may employ more complex strategies which may expose investors to additional risks.

Investing in fixed income securities involves certain risks such as market risk if sold prior to maturity and credit risk especially if investing in high yield bonds, which have lower ratings and are subject to greater volatility. All fixed income investments may be worth less than the original cost upon redemption or maturity. Bond Prices fluctuate inversely to changes in interest rates. Therefore, a general rise in interest rates can result in the decline of the value of your investment.

Definitions

MSCI- EAFE: The Morgan Stanley Capital International Europe, Australasia and Far East Index, a free float-adjusted market capitalization index that is designed to measure developed-market equity performance, excluding the United States and Canada.

MSCI-Emerging Markets: The Morgan Stanley Capital International Emerging Market Index, is a free float-adjusted market capitalization index that is designed to measure the performance of global emerging markets of about 25 emerging economies.

Russell 3000: The Russell 3000 measures the performance of the 3000 largest US companies based on total market capitalization and represents about 98% of the investible US Equity market.

ML BOFA US Corp Mstr [Merill Lynch US Corporate Master]: The Merrill Lynch Corporate Master Market Index is a statistical composite tracking the performance of the entire US corporate bond market over time.

ML Muni Master [Merill Lynch US Corporate Master]: The Merrill Lynch Municipal Bond Master Index is a broad measure of the municipal fixed income market.

Investors cannot directly purchase any index.

LIBOR, London Interbank Offered Rate, is the rate of interest at which banks offer to lend money to one another in the wholesale money markets in London.

The Dow Jones Industrial Average is an unweighted index of 30 “blue-chip” industrial U.S. stocks.

The S&P Midcap 400 Index is a capitalization-weighted index measuring the performance of the mid-range sector of the U.S. stock market, and represents approximately 7% of the total market value of U.S. equities. Companies in the Index fall between S&P 500 Index and the S&P SmallCap 600 Index in size: between $1-4 billion.

DJ Equity REIT Index represents all publicly traded real estate investment trusts in the Dow Jones U.S. stock universe classified as Equity REITs according to the S&P Dow Jones Indices REIT Industry Classification Hierarchy. These companies are REITs that primarily own and operate income-producing real estate.