Last Week’s Markets in Review: Fed Can’t Spook Markets

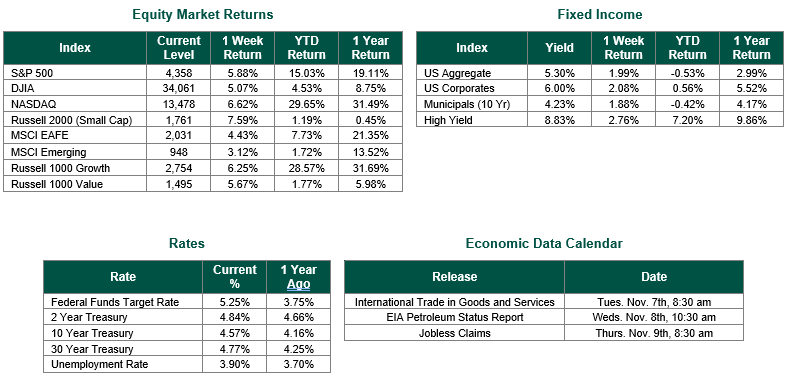

Global equity markets finished higher for the week. In the U.S., the S&P 500 Index closed the week at a level of 4,358, representing a increase of 5.88%, while the Russell Midcap Index moved 5.94% last week. Meanwhile, the Russell 2000 Index, a measure of the Nation’s smallest publicly traded firms, returned 7.59% over the week. As developed international equity performance and emerging markets were higher, returning 4.43% and 3.12%, respectively. Finally, the 10-year U.S. Treasury yield moved lower, closing the week at 4.57%.

As widely expected, the Federal Reserve “paused again” for the second consecutive meeting and the third time in 2023, keeping the Fed Funds Target Rate within its current range of 5.25%-5.50%. Also, as expected, the Federal Reserve confirmed its commitment to bringing inflation closer to its target rate of 2% and its data dependency on potential future rate hikes. Markets reacted positively to the Fed’s announcement and the prospect of a true ending to monetary tightening. For the first time in Fed Chair Jerome Powell’s press conference, he openly suggested that “We are close to the end of the cycle” but still fell short of admitting that there won’t be any more future rate hikes.

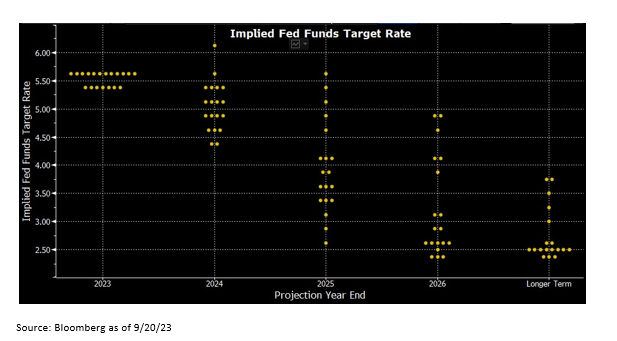

The reaction of the market last week was overwhelmingly positive, as the comments by Federal Reserve Chair Jay Powell during Halloween week did not spook investors. In fact, the Dow Jones Industrial Average experienced its best week of performance since October 2022, while the S&P 500 delivered five consecutive gains of at least 65 bps, mostly fueled by Fed commentary and weakening jobs reports that saw non-farm payrolls rise by just 150,000 vs 170,000 expected, and an unemployment rate of 3.9% vs 3.8% expected. Despite the recent data suggesting that monetary policies are being effective, the Fed still fell short of suggesting that future rate cuts are in our near future. However, it is important to remember that through its most recent Dot Plot Chart, the Fed is 50 Bp in rate cuts in 2024, another potential 120 Bp in rate cuts in 2025, and yet another 100 Bp in potential rate cuts in 2026 – this equates to 270 Bp in possible rate cuts over the next three years.

According to the CME Group’s Fed Watch tool, the market is not pricing the likelihood of an interest rate cut until the May or June meetings, at the earliest. Overall, the outlook for lower rates, yields, and inflation over the next two to three years remains intact.

In these rapidly changing times, it is becoming evermore important to review your current investment portfolio to determine how these actions by the Fed are affecting your portfolio. We suggest working with financial professionals to help ensure you are properly invested strategically for your goals, risk tolerance, and investment horizon and tactically positioned for the current economic landscape.

Best wishes for the week ahead!

Employment data was sourced from the Bureau of Labor Statistics on 11/3/2023. Equity Market, Fixed Income returns, and rates are from Bloomberg as of 11/3/23. Economic Calendar Data from Econoday as of 11/3/23. International developed markets are measured by the MSCI EAFE Index, emerging markets are measured by the MSCI EM Index, and U.S. Large Caps are defined by the S&P 500 Index. Sector performance is measured using the GICS methodology.

Disclosures: Past performance does not guarantee future results. We have taken this information from sources that we believe to be reliable and accurate. Hennion and Walsh cannot guarantee the accuracy of said information and cannot be held liable. You cannot invest directly in an index. Diversification can help mitigate the risk and volatility in your portfolio but does not ensure a profit or guarantee against a loss.