Last Week’s Markets in Review: Fed Chair’s Comments Rattle the Markets

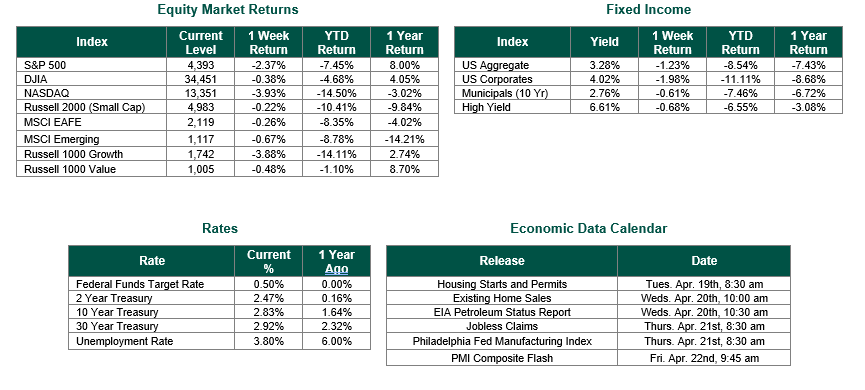

Global equity markets finished lower for the week. In the U.S., the S&P 500 Index closed the week at a level of 4,272, representing a decline of 2.74%, while the Russell Midcap Index moved -2.48% lower last week. Meanwhile, the Russell 2000 Index, a measure of the Nation’s smallest publicly traded firms, returned -3.20% over the week. International equity performance was lower as developed, and emerging markets returned -1.53% and -3.33%, respectively. Finally, the 10-year U.S. Treasury yield moved higher, closing the week at 2.90%.

On Thursday, Federal Reserve Chairman Powell participated in a panel discussion at the International Monetary Fund. His comments concerning future potential Federal Open Market Committee (FOMC) policy actions had a negative impact on financial markets. Before Powell’s remarks, financial markets warmly received a generally positive week of corporate earnings for the first quarter of 2022. We will discuss both topics in greater detail through the remainder of this update.

The headline from Chairman Powell’s comments, “It’s absolutely essential to restore price stability. Economies don’t work without price stability.” moved financial markets. All the major equity indices immediately gave back the gains they had established through the first three days of the week. The selloff continued through Friday with a daily decline of over 2.5% in each of the major equity indices. The U.S. Treasuries yield curve also reacted to this news, as the yield curve inverted between the 5 and 10-year maturities. However, it should be noted that this inversion differed from the widely discussed brief inversion of 2 and 10-year maturities a couple of weeks back.

Powell also supported the idea that the FOMC will pass a 50 basis points (0.50%) hike at their upcoming May meeting by stating, “I also think there is something to be said for front-end loading any accommodation one thinks is appropriate. I would say 50 basis points will be on the table for the May meeting.” According to the CME Group’s Fed Watch Tool, 97.6% of market participants believe the May 4th rate increase will be 50 basis points.

1st quarter corporate earnings season is ongoing and looking generally positive thus far. FactSet reports that as of April 22, 2022, 20% of companies in the S&P 500 have reported results with 79% reporting a positive EPS surprise and 69% reporting a positive revenue surprise for Q1 2022. FactSet also noted that the Q1 2022 blended earnings growth rate for the S&P 500 Index is 6.6%. If 6.6% proves to be the actual growth rate for the quarter, it will mark the lowest earnings growth rate reported by the index since Q4 2020 – consistent with our “Still Growing, but yet Slowing” macro theme for 2022.

We will continue to monitor and report on corporate earnings, as earnings momentum can be one of many important determinants of future Fed policy. Continued strong earnings have typically been an indication that the domestic economy is robust enough to withstand higher interest rates, allowing the Fed to be more aggressive in the hopes of taming prevailing record-setting levels of inflation. On the other hand, weak earnings and a dramatically slowing economy may lead to the Fed being less aggressive.

Investors should consider all the information and data discussed within this market update. However, with so much data and so little time to digest it all, we encourage investors to work with experienced financial professionals to help process all of this information in order to build and manage the asset allocations within their portfolios consistent with their objectives, timeframe, and tolerance for risk.

Best wishes for the week ahead!

Equity Market and Fixed Income returns are from JP Morgan as of 4/22/22. Rates and Economic Calendar Data from Bloomberg as of 4/22/22. International developed markets measured by the MSCI EAFE Index, emerging markets measured by the MSCI EM Index, U.S. Large Cap defined by the S&P 500. Sector performance is measured using the GICS methodology.

Disclosures: Past performance does not guarantee future results. We have taken this information from sources that we believe to be reliable and accurate. Hennion and Walsh cannot guarantee the accuracy of said information and cannot be held liable. You cannot invest directly in an index. Diversification can help mitigate the risk and volatility in your portfolio but does not ensure a profit or guarantee against a loss.

Diversification can help mitigate the risk and volatility in your portfolio but does not ensure a profit or guarantee against loss.

Investing in commodities is not suitable for all investors. Exposure to the commodities markets may subject an investment to greater share price volatility than an investment in traditional equity or debt securities. Investments in commodities may be affected by changes in overall market movements, commodity index volatility, changes in interest rates or factors affecting a particular industry or commodity.

Products that invest in commodities may employ more complex strategies which may expose investors to additional risks.

Investing in fixed income securities involves certain risks such as market risk if sold prior to maturity and credit risk, especially if investing in high yield bonds, which have lower ratings and are subject to greater volatility. All fixed income investments may be worth less than the original cost upon redemption or maturity. Bond Prices fluctuate inversely to changes in interest rates. Therefore, a general rise in interest rates can result in the decline of the value of your investment.

Definitions

MSCI- EAFE: The Morgan Stanley Capital International Europe, Australasia and Far East Index, a free float-adjusted market capitalization index that is designed to measure developed-market equity performance, excluding the United States and Canada.

MSCI-Emerging Markets: The Morgan Stanley Capital International Emerging Market Index, is a free float-adjusted market capitalization index that is designed to measure the performance of global emerging markets of about 25 emerging economies.

Russell 3000: The Russell 3000 measures the performance of the 3000 largest US companies based on total market capitalization and represents about 98% of the investible US Equity market.

ML BOFA US Corp Mstr [Merill Lynch US Corporate Master]: The Merrill Lynch Corporate Master Market Index is a statistical composite tracking the performance of the entire US corporate bond market over time.

ML Muni Master [Merill Lynch US Corporate Master]: The Merrill Lynch Municipal Bond Master Index is a broad measure of the municipal fixed income market.

Investors cannot directly purchase any index.

LIBOR, London Interbank Offered Rate, is the rate of interest at which banks offer to lend money to one another in the wholesale money markets in London.

The Dow Jones Industrial Average is an unweighted index of 30 “blue-chip” industrial U.S. stocks.

The S&P Midcap 400 Index is a capitalization-weighted index measuring the performance of the mid-range sector of the U.S. stock market and represents approximately 7% of the total market value of U.S. equities. Companies in the Index fall between S&P 500 Index and the S&P SmallCap 600 Index in size: between $1-4 billion.

DJ Equity REIT Index represents all publicly traded real estate investment trusts in the Dow Jones U.S. stock universe classified as Equity REITs according to the S&P Dow Jones Indices REIT Industry Classification Hierarchy. These companies are REITs that primarily own and operate income-producing real estate.