Fed Cuts Rates, Now What?

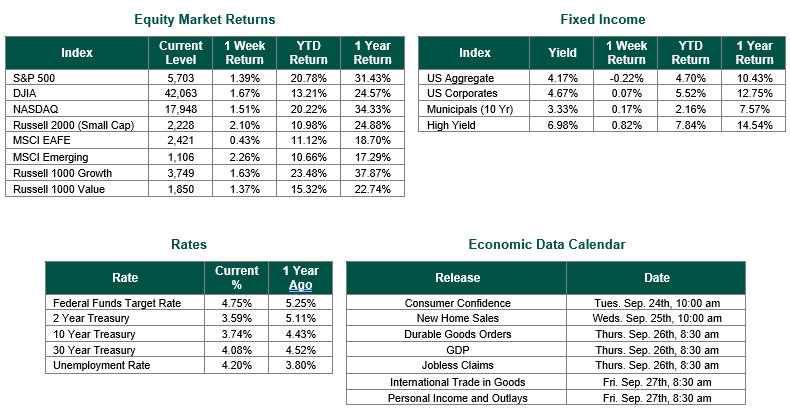

Global equity markets finished higher for the week. In the U.S., the S&P 500 Index closed the week at a level of 5,703, representing an increase of 1.39%, while the Russell Midcap Index moved 0.99% last week. Meanwhile, the Russell 2000 Index, a measure of the Nation’s smallest publicly traded firms, returned 2.10% over the week. As developed international equity performance and emerging markets were higher, returning 0.43% and 2.26%, respectively. Finally, the 10-year U.S. Treasury yield moved higher, closing the week at 3.74%.

Last week, the Federal Reserve cut interest rates for the first time since the start of quantitative tightening in 2022. The futures markets were accurate in their expectations ahead of the rate decision, predicting a 50 basis points reduction. The actions by the Federal Reserve to cut interest rates were never in doubt heading into last week, but the magnitude of said cut was. Traders had suggested that perhaps the Fed may be more aggressive in their decision-making to “catch up” from not cutting during their last meeting in July, only to watch the jobs market become stressed. At the same time, however, history would tell us that it would be uncharacteristic for monetary policy to shift by more than a single 25 basis point cut, given that there was no recession or major economic downturn taking place. All in all, the Fed weighed the cooling jobs market as a greater threat to the economy than inflation and decided to be more aggressive in their initial rate cut decision.

According to their updated Dot Plot chart, the Fed is currently forecasting 50 Bp in additional rate cuts in 2024, perhaps equating to a 25 Bp cut following each of their two remaining meetings of the year. The updated Dot Plot chart also shows another full percentage point (i.e., 100 Bp) in rate cuts by the end of 2025 and a half-point (i.e., 50 Bp) in rate cuts in 2026. These cuts align with their long-run neutral rate expectation of around 2.9%.

Now that the Fed has cut rates, what does it mean for the rest of the market? The recent interest rate decrease should provide a boost to both consumers and small businesses, although more rate cuts will be necessary in order to provide a significant boost. For individuals struggling with credit card debt, lower interest rates will directly reduce their monthly payments and help them pay off their balances more quickly. Small businesses that have variable-rate loans will also benefit from lower interest costs, freeing up more cash flow that can be used for growth or to weather economic downturns.

In anticipation of the interest rate cuts, long-term borrowing costs, such as those associated with mortgages and corporate debt, have already begun to decline. This trend was further solidified by Powell’s recent statements ahead of the cut that indicated that rate reductions were on the horizon. The combination of these factors suggests that consumers and businesses can expect to see a noticeable improvement in their financial situations in the coming months and years, which should, in turn, be beneficial to the economy and markets.

Best wishes for the week ahead!

Equity and Fixed Income Index returns sourced from Bloomberg on 9/20/24. Economic Calendar Data from Econoday as of 9/20/24. International developed markets are measured by the MSCI EAFE Index, emerging markets are measured by the MSCI EM Index, and U.S. Large Caps are defined by the S&P 500 Index. Sector performance is measured using the GICS methodology.

Disclosures: Past performance does not guarantee future results. We have taken this information from sources that we believe to be reliable and accurate. Hennion and Walsh cannot guarantee the accuracy of said information and cannot be held liable. You cannot invest directly in an index. Diversification can help mitigate the risk and volatility in your portfolio but does not ensure a profit or guarantee against a loss.