Last Week’s Markets in Review: Fed likely to Slow Future Interest Rate Hikes

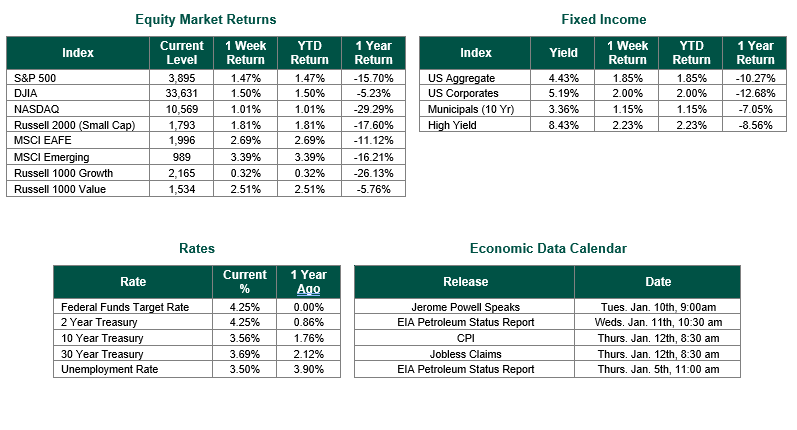

Global equity markets finished higher for the week. In the U.S., the S&P 500 Index closed the week at a level of 3,999, representing an increase of 2.71%, while the Russell Midcap Index moved 3.04% higher last week. Meanwhile, the Russell 2000 Index, a measure of the Nation’s smallest publicly traded firms, returned 5.27% over the week. As developed, international equity performance and emerging markets were higher returning 2.50% and 1.74%, respectively. Finally, the 10-year U.S. Treasury yield moved lower, closing the week at 3.50%.

The positive move in the stock market last week was based primarily on three events that took place during the week. On Tuesday, Federal Reserve Chairman Powell made his first public statement for the new year in a speech delivered to Sweden’s Riksbank. The second event was the release of December’s Consumer Price Index (CPI) data on Thursday morning. The third event occurred on Friday, with four major banks announcing their earnings and revenue results for the fourth quarter of 2022.

Chairman Powell’s speech gave little insight into the future course of Fed policy for 2023. His comments did emphasize, however, the need for the central bank to be free of political influence while it continues its fight to lower inflation. Powel stated, “Price stability is the bedrock of a healthy economy and provides the public with immeasurable benefits over time. But restoring price stability when inflation is high can require measures that are not popular in the short term as we raise interest rates to slow the economy.” Many market participants perceived the remarks, and the questions and answer session that followed, to be somewhat dovish concerning upcoming policy decisions.

The Labor Department reported last Thursday that the December Consumer Price Index (CPI) had declined by 0.1% for the month. This result was exactly in line with the consensus estimate. On an annual basis, CPI rose by 6.5%, highlighting the persistent strain of the rising cost of living.

The markets are hyper-focused on monthly changes in CPI, attempting to predict the Fed’s upcoming actions at their next meeting on February 1st. In this regard, the CPI results affected market sentiment as measured by the CME FedWatch Tool from the CME Group as follows:

• There is a 91.2% probability that the Fed Funds Target Rate will be between 4.50% – 4.75% after the February 1st meeting.

If this forecast holds, the resulting 25 Basis Point (0.25%) increase would signal a meaningful change to a more dovish monetary policy from the Fed.

Finally, the Fourth Quarter 2022 earnings season officially began last Friday, with four major Banks: JPMorgan Chase & Co., Citigroup Inc., Bank of America Corp, and Wells Fargo & Co. reporting results. All four beat their consensus earnings estimates, and their share prices rallied to finish the day of trading. Fourth quarter profits were aided by higher interest rates boosting income from loans. Each of the four overcame weaker capital market revenues within the fourth quarter. Corporate earnings will continue to be reported for the next few weeks. We will continue monitoring and reporting on the earnings season results in our future weekly updates.

Investors should consider all the information discussed within this market update and many other factors when managing their investment portfolios. However, with so much data and so little time to digest, we encourage investors to work with experienced financial professionals to help process all this information to build and manage the asset allocations within their portfolios consistent with their objectives, timeframe, and tolerance for risk.

Best wishes for the week ahead!

Consumer Price Index data is sourced from the Department of Labor. Corporate earnings information is sourced from Bloomberg. Equity Market and Fixed Income returns are from JP Morgan as of 1/13/23. Rates and Economic Calendar Data from Bloomberg as of 1/13/23. International developed markets are measured by the MSCI EAFE Index, emerging markets are measured by the MSCI EM Index, and U.S. Large Caps are defined by the S&P 500 Index. Sector performance is measured using the GICS methodology.

Disclosures: Past performance does not guarantee future results. We have taken this information from sources that we believe to be reliable and accurate. Hennion and Walsh cannot guarantee the accuracy of said information and cannot be held liable. You cannot invest directly in an index. Diversification can help mitigate the risk and volatility in your portfolio but does not ensure a profit or guarantee against a loss.