Fed Minutes Cause Market Volatility

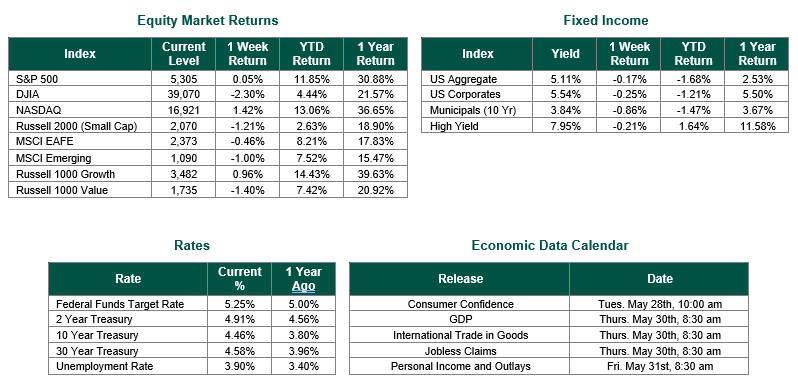

Global equity markets finished mixed for the week. In the U.S., the S&P 500 Index closed the Week at a level of 5305, representing an increase of 0.05%, while the Russell Midcap Index moved -1.07% last Week. Meanwhile, the Russell 2000 Index, a measure of the Nation’s smallest publicly traded firms, returned -1.21% over the Week. As developed international equity performance and emerging markets were lower, returning -0.46% and -1.00%, respectively. Finally, the 10-year U.S. Treasury yield moved higher, closing the Week at 4.46%.

We hope you enjoyed this long Memorial Day weekend with your families and friends. We also hope that you took a moment to remember those who have given their lives to provide us the freedom to make our way of life possible.

Equity markets experienced a fair amount of volatility in the week leading up to Memorial Day. This volatility was primarily caused by the release of the minutes from the Federal Reserve’s April 30 – May 1 policy meeting and numerous comments from a wide range of Federal Reserve voting members.

These minutes were released last Wednesday and indicated a good deal of apprehension from policymakers about when the appropriate time would be to start cutting interest rates. “Participants observed that while inflation had eased over the past year, in recent months, there had been a lack of further progress toward the Committee’s 2% objective,” the summary said. “The recent monthly data had showed significant increases in components of both goods and services price inflation.”

The minutes also revealed that “various participants mentioned a willingness to tighten policy further should the risks to inflation materialize in a way that such an action became appropriate.” The mention of further policy restrictions alarmed market participants. It should be noted that several Fed officials, including Chair Powell and Governor Waller, have said since the meeting that they doubt that their next move would involve an interest rate hike.

The other headline-grabbing announcement was the quarterly earnings release from Nvidia. Nvidia’s fiscal 1st quarter earnings beat expectations for both sales and earnings. Beyond their chips results, Nvidia also highlighted that their data center business grew by 400% from a year earlier. Nvidia’s earnings have become a measure for investors to gauge the strength of the artificial intelligence (AI) boom that has dominated equity markets for the past several quarters. Nvidia provided leadership for the NASDAQ Composite Index, the only major equity index that showed a gain for the week.

Best wishes for the week ahead!

Federal Reserve data and commentary is sourced from the Federal Reserve. Information concerning Nvidia’s earnings are sourced from the company’s website. Economic Calendar Data from Econoday as of 5/24/24. International developed markets are measured by the MSCI EAFE Index, emerging markets are measured by the MSCI EM Index, and U.S. Large Caps are defined by the S&P 500 Index. Sector performance is measured using the GICS methodology.

Disclosures: Past performance does not guarantee future results. We have taken this information from sources that we believe to be reliable and accurate. Hennion and Walsh cannot guarantee the accuracy of said information and cannot be held liable. You cannot invest directly in an index. Diversification can help mitigate the risk and volatility in your portfolio but does not ensure a profit or guarantee against a loss.