Last Week’s Markets in Review: Fed Raises Rates by 75 Bp Again

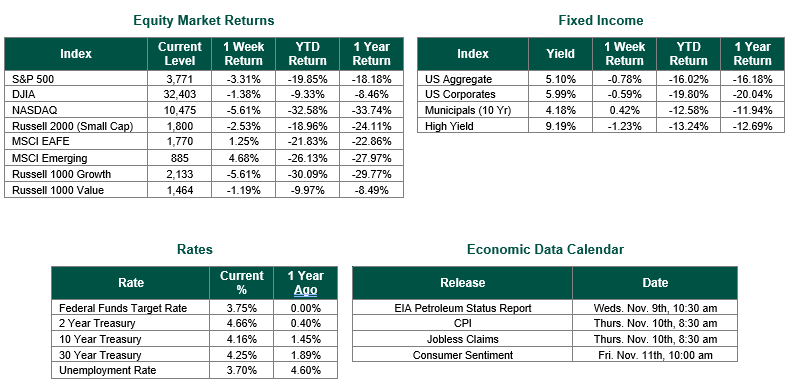

Global equity markets finished mixed for the week. In the U.S., the S&P 500 Index closed the week at a level of 3,771, representing a decline of 3.31%, while the Russell Midcap Index moved -1.57% lower last week. Meanwhile, the Russell 2000 Index, a measure of the Nation’s smallest publicly traded firms, returned -2.53% over the week. As developed, international equity performance and emerging markets were higher returning 1.25% and 4.68%, respectively. Finally, the 10-year U.S. Treasury yield moved higher, closing the week at 4.16%.

Last week’s financial markets were focused on two events that affected performance for the past week and future weeks to come which involved the Federal Reserve’s November meeting that concluded on Wednesday with a Press Conference from Chairman Powell and the release of The Employment Situation for October on Friday Morning by the Bureau of Labor Statistics, U.S. Department of Labor. The events surrounding the Federal Reserve’s November meeting were highly anticipated and did not surprise. Alternatively, the October Jobs data was a big shock to the market.

Below are a few notes regarding the Fed meeting.

• The Federal Reserve raised the Fed Funds Target Rate by 75 Bp (0.75%), (with a unanimous vote among FOMC voting members), marking the 4th consecutive rate hike of 75 Bp.

• The Fed Funds Target Rate is now within a range of 3.75% – 4.00%, the highest it has been since January 2008.

• At his press conference following the announcement, Chair Powell indicated that they are less focused on the speed of raising interest rates and now more focused on how high to raise interest rates overall for this rate hike cycle and how long to keep interest rates at that level once they stop raising rates.

• Chair Powell also indicated at the press conference that the slowdown in the increments of their interest rate hikes may take place after either their next meeting or the following meeting.

We contend that the Fed may pause raising interest rates sometime by the end of the 1st half of 2023. To put this into context, following the rate hike of 75 Bp, if the Fed were to raise rates by 50 Bp in December, and then by 25 Bp following each of their first three meetings of 2023, the Fed Funds Target Rate would then be in a range of 5.00% – 5.25%. When the Fed scales down the increments of their interest rate hikes (i.e., less than 75 Bp), it will signal to the market that peak hawkishness and, by extension, peak inflation have likely been reached.

As we briefly mentioned above, on Friday, market participants were surprised by labor market data that continues to be robust despite rising interest rates caused by Fed’s unprecedented interest rate hikes. The October report showed that nonfarm payrolls grew by 261,000 for the month while the unemployment rate moved higher to 3.7%. The payroll numbers were better than the Dow Jones estimate of 205,000 jobs but worse than the 3.5% estimate for the unemployment rate. Although the increase in unemployment would suggest that the Fed’s policies may be affecting the economy, the October jobs numbers appeared to be contradictory.

Investors should consider all the information discussed within this market update and many other factors when managing their investment portfolios. However, with so much data and so little time to digest, we encourage investors to work with experienced financial professionals to help process all this information to build and manage the asset allocations within their portfolios consistent with their objectives, timeframe, and tolerance for risk.

Best wishes for the week ahead!

The October Employment Situation Report were sourced from the U.S Bureau of Labor Statistics. Equity Market and Fixed Income returns are from JP Morgan as of 11/4/22. Rates and Economic Calendar Data from Bloomberg as of 11/4/22. International developed markets are measured by the MSCI EAFE Index, emerging markets are measured by the MSCI EM Index, and U.S. Large Caps are defined by the S&P 500 Index. Sector performance is measured using the GICS methodology.

Disclosures: Past performance does not guarantee future results. We have taken this information from sources that we believe to be reliable and accurate. Hennion and Walsh cannot guarantee the accuracy of said information and cannot be held liable. You cannot invest directly in an index. Diversification can help mitigate the risk and volatility in your portfolio but does not ensure a profit or guarantee against a loss.