Last Week’s Markets in Review: Fed Watching and the State of Inflation

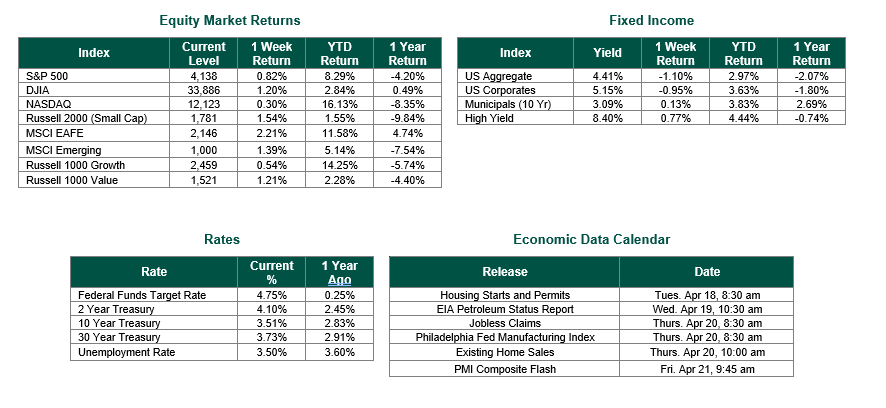

Global equity markets finished higher for the week. In the U.S., the S&P 500 Index closed the week at a level of 4,138, representing an increase of 0.82%, while the Russell Midcap Index moved 1.72% higher last week. Meanwhile, the Russell 2000 Index, a measure of the Nation’s smallest publicly traded firms, returned 1.52% over the week. As developed, international equity performance and emerging markets were higher returning 2.21% and 1.39%, respectively. Finally, the 10-year U.S. Treasury yield moved higher, closing the week at 3.51%.

During this intense “Fed Watching” period, every release of economic data is instantly evaluated as either inflationary or non-inflationary. Once the effect of inflation is determined, the data is factored into predicting future monetary policy. This past week’s economic data was subject to this analysis. The economic data included:

• Consumer Price Index (CPI) for March on Wednesday

• FOMC March meeting minutes on Wednesday

• Jobless claims and the Producer Price Index (PPI) for March on Thursday

• Retail sales and the beginning of first-quarter corporate earnings reports on Friday

The U.S. Bureau of Labor Statistics reported that the Consumer Price Index (CPI) for March rose 0.1% for the month and 5.0% on an annual basis. These results were lower than both the prior periods (0.4% for February and 6.0% for the trailing 12 months ending in February) and consensus estimates (0.3% monthly and 5.2% annually). Market participants viewed the CPI numbers as non-inflationary.

The FOMC minutes from March revealed that the dramatic developments of the failure of Silicon Valley Bank (SVB) ultimately did little to derail the Fed’s rate-hiking campaign. Fed officials believe they can continue to battle inflation with one set of tools and stabilize financial markets with others.

Initial jobless claims for the week ending April 8 were 239,000, an increase of 11,000 from the previous week exceeding the consensus estimate of 233,000. The Producer Price Index for March surprised the market with a -0.5% reading, which was well below both the prior months (-0.1%) and the average estimate (0.0%). These results were also viewed as non-inflationary.

Friday brought another report that was interpreted as signs of a slowing economy. Advance retail sales in March showed consumer spending fell twice as much as expected. Retail sales declined by 1% last month, more than the 0.5% fall expected by the market.

Finally, the beginning of 1st quarter corporate earnings reports kicked off last week with investors interested in reviewing the status of the Financials sector given the events surrounding Silicon Valley Bank and Signature Bank. Since the largest financial institutions are some of the earliest earnings reports released, investors will be focused on these reports as they become available. Interestingly, bigger banks such as JPMorgan Chase & Co., Citigroup, Wells Fargo & Co., and PNC Financial Services Group Inc. reported results exceeding Wall Street’s estimates.

We will continue to update our readers concerning 1st quarter corporate earnings in the coming weeks.

Investors should consider all the information discussed within this market update and many other factors when managing their investment portfolios. However, with so much data and so little time to digest, we encourage investors to work with experienced financial professionals to help process all this information to build and manage the asset allocations within their portfolios consistent with their objectives, timeframe, and tolerance for risk.

Best wishes for the week ahead!

The Consumer Price Index, continuing claims data, and the Producer Price Index are sourced from the Labor Department. FOMC Meeting Minutes are sourced from the Federal Reserve. Corporate Earnings, Equity Market, Fixed Income returns, and rates are from Bloomberg as of 4/14/23. Economic Calendar Data from Econoday as of 4/14/23. International developed markets are measured by the MSCI EAFE Index, emerging markets are measured by the MSCI EM Index, and U.S. Large Caps are defined by the S&P 500 Index. Sector performance is measured using the GICS methodology.

Disclosures: Past performance does not guarantee future results. We have taken this information from sources that we believe to be reliable and accurate. Hennion and Walsh cannot guarantee the accuracy of said information and cannot be held liable. You cannot invest directly in an index. Diversification can help mitigate the risk and volatility in your portfolio but does not ensure a profit or guarantee against a loss.