Last Week’s Markets in Review: Fed’s Plans Uncertain as Powell Signals Caution

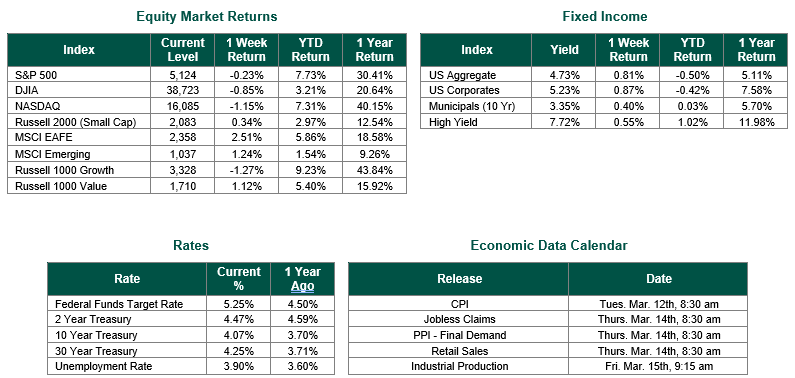

Global equity markets finished lower for the Week. In the U.S., the S&P 500 Index closed the Week at a level of 4,967, representing a loss of 3.04%, while the Russell Midcap Index moved -3.06 last Week. Meanwhile, the Russell 2000 Index, a measure of the Nation’s smallest publicly traded firms, returned -2.76% over the Week. As developed international equity performance and emerging markets were also lower, returning -2.28% and -3.58%, respectively. Finally, the 10-year U.S. Treasury yield moved higher, closing the Week at 4.62%.

Federal Reserve Chair Jerome Powell stated on Tuesday that firm inflation in the first quarter raises doubts about the possibility of lowering interest rates this year without signs of an unexpected economic slowdown. This shift in the Fed’s outlook follows stronger-than-anticipated inflation readings for the third consecutive month, potentially dashing hopes for pre-emptive rate cuts this summer. Powell’s remarks signal a delay in rate cuts until greater confidence in inflation’s return to target is achieved. He emphasized that recent data have not increased their confidence and suggested it may take longer than expected to reach that point.

The response to Powell’s comments was evident in the market, with the S&P 500 experiencing a slight decline and investors selling Treasurys, leading to increased yields. Powell clarified that the Fed isn’t considering rate increases but is prepared to maintain rates at current levels for as long as necessary if inflation persists. In other words, “higher for longer.” However, if the economy shows signs of a sharp slowdown, the Fed stands ready to implement rate cuts. Despite initial optimism at the beginning of the year for multiple rate cuts, the Fed now appears inclined to wait for further inflation data before making any decisions.

Powell’s remarks reflect a departure from earlier expectations of multiple rate cuts, aligning more closely with a cautious approach. The Fed’s preferred gauge of core inflation (i.e., core PCE) is expected to remain at 2.8% in March, indicating persistent inflationary pressures. Most analysts now anticipate rate cuts in July, September, or December, with only one or two cuts expected this year

.

While the Fed previously raised rates aggressively to combat high inflation, signs of easing labor market imbalances offer some reassurance. Powell emphasized the importance of continued moderation in wage growth for maintaining confidence in inflation improvement over time. However, it should be noted that the Fed’s most recent Dot Plot chart, which was released recently on March 20, showed three rate cuts this year, three rate cuts next year, and three rate cuts (all of 0.25% each) in 2026. While no one has a crystal ball that will show whether or not this path forward will happen, it is still possible that it will occur, recognizing, of course, that the Fed will remain data-dependent and more sticky inflation reports will likely keep them “higher for longer.”

In summary, Powell’s comments underscore the Fed’s cautious stance regarding interest rates in response to persistent inflationary pressures and the need for further data to guide future policy decisions.

Best wishes for the week ahead!

Employment data from the Bureau of Labor Statistics Equity Market, Fixed Income returns, and rates are from Bloomberg as of 4/19/24. Economic Calendar Data from Econoday as of 4/22/24. International developed markets are measured by the MSCI EAFE Index, emerging markets are measured by the MSCI EM Index, and U.S. Large Caps are defined by the S&P 500 Index. Sector performance is measured using the GICS methodology.

Disclosures: Past performance does not guarantee future results. We have taken this information from sources that we believe to be reliable and accurate. Hennion and Walsh cannot guarantee the accuracy of said information and cannot be held liable. You cannot invest directly in an index. Diversification can help mitigate the risk and volatility in your portfolio but does not ensure a profit or guarantee against a loss.